“Trump 2” – beyond deregulation, who can say?

The election of Donald Trump to a second term as US President has been cheered by financial markets and beneficiaries of Trump’s policy pronouncements. However, with plenty of uncertainty looming around policy implementation, the only things we can be reasonably certain of are deregulation and uncertainty itself.

The buoyancy of financial markets in the wake of Trump’s victory is no great surprise. The climate of uncertainty that prevailed in the run-up to the election has been lifted. Despite the unpredictability associated with Trump himself, he is not the unknown quantity he was ahead of his first term. Further, he’s widely perceived in the investor community as “market friendly.”

What does Trump’s second term as president have in store? Image: Spiegel

Market set-up vs. Trump 1

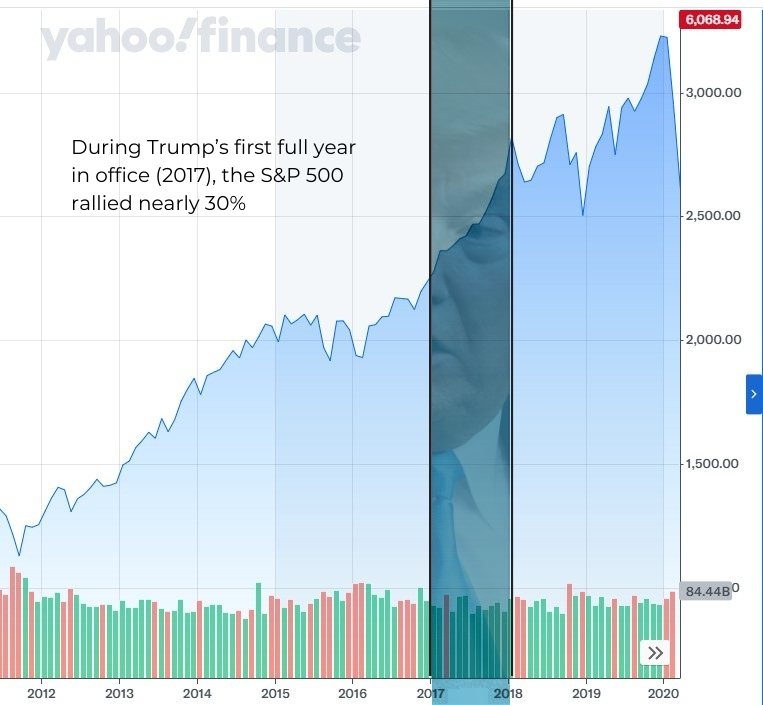

That perception – formed largely during Trump’s first full year in office (in 2017), in which the S&P 500 rallied nearly 30% – seems to be shaping what looks like a classic “echo rally,” with similar assets, such as small-caps and cyclical stocks leading. However, the market backdrop now is nothing like the one that prevailed when Trump first came to office.

In late 2016, US equities had been flat for two years, following an earnings recession in 2015 that had hit cyclical sectors particularly hard. Valuations were undemanding – the S&P 500 forward P/E ratio hovering in the mid-teens – and investor sentiment was deeply skeptical. The consensus was that a Trump win would be overwhelmingly bearish for markets. Reflecting this pessimism, investor positioning was heavily underweight equities. The stage was therefore set for a powerful rebound should those fears prove unfounded, which is exactly what happened.

Fast forward to today, and investors are ebullient. Major US stock indexes are at all-time highs, having rallied hard since the inflation-driven slump of 2022. The S&P 500 finds itself three times higher than where it was at the beginning of Trump’s first term in late 2016. Reflecting this bullish sentiment, valuations are close to historic highs, with the S&P 500 trading at just below 25 times next year’s estimated earnings and investors overweight US equities. While nobody knows what’s in store, this marked difference in “initial conditions” suggests that a repeat of 2017 is unlikely, with plenty of room for disappointment.

Memories of 2017 aside, there is another important factor shaping today’s market environment and the relative performance across different sectors and regions – namely Trump’s policy pronouncements, particularly on tariffs, (de)regulation, and digital assets.

During Trump’s first full year in office (2017), the S&P 500 rallied nearly 30%. Image: Yahoo Finance

Tariffs – tool or tactic?

Of all Trump’s economic proposals, his sweeping tariff plans have perhaps sparked the most controversy. Promising a 10% tariff on all imports – with rates as high as 60% for China and 25% for Canada and Mexico – the policy has clear populist appeal, resonating with those frustrated by the erosion of the US industrial base.

Yet, the economic realities of such measures are far from straightforward. Canada and Mexico are the US’ largest trading partners, with deeply integrated supply chains spanning decades. Imposing tariffs on the proposed scale would severely disrupt production, inflate prices, and lead to significant job losses in affected industries. Any retaliatory tariffs from trade partners would likely further exacerbate the US trade deficit.

Predictably, belying the overall positive mood, those areas sensitive to tariffs have reacted negatively to Trump’s rhetoric. This means, at the regional level, some emerging markets (notably China and Mexico), while at the sector level, shares of US auto manufacturers such as Ford and General Motors – tied to cross-border supply chains – have come under pressure.

But should the tough tariff talk be taken at face value? Some observers think not.

For example, Anthony Scaramucci – briefly Trump’s communications director and one of the first of many to fall out with Trump during Trump 1 – recently speculated on the US version of the podcast The Rest is Politics that it may be a calculated bluff to drive markets lower ahead of Trump’s January 20 inauguration, positioning him to benefit from a recovery. If that’s the plan, the buoyancy of the broader US market suggests it may be faltering.

A more pragmatic view – that draws on history – suggests that tariffs tend to evolve into tools for negotiation. Broad measures narrow over time, with carve-outs and exemptions reducing their impact. For instance, the threat of tariffs has been known to stimulate trade in the short term, as seen with Canadian steel and aluminum. Whether Trump’s aggressive proposals are genuine or simply a bargaining tactic remains unclear, adding another layer of uncertainty to the outlook.

Anthony Scaramucci has been vocal on Trump’s potential tariff tactics. Image: NBC News

Regulatory changes to drive wider policy divergence

Even without Trump, a notable divergence in the regulatory paths of different jurisdictions has been observed of late, particularly on climate-related matters, with the general pattern being one of regulatory loosening in the US relative to other jurisdictions. For all the unknowns surrounding Trump 2, deregulation is a safe assumption, and this will lead to a further widening of the divergence. Barring some cataclysm that upends the deregulation push, the only question is how much deregulation we will see.

A key sign of forthcoming change is the expected departure of Gary Gensler, chair of the Securities and Exchange Commission (SEC), in January, whom Trump pledged to fire on “day one” of his presidency. Known for his strict regulatory approach, Gensler has been a lightning rod for criticism from the banking and investment industries. His exit has fueled hopes in some corners that a new SEC leadership might loosen restrictions, particularly around alternative assets such as private credit, private equity, and crypto, making them more accessible to retail investors.

More profound regulatory shifts could occur in banking. Trump’s first term saw an easing of reporting rules for midsized regional banks in 2018 – a move that some blame for contributing to the regional banking crisis of early 2023. In response, the Fed then implemented stricter requirements under the so-called “Basel III endgame,” aimed at safeguarding the financial system against another 2008-style meltdown.

With Michael Barr, the Fed’s head of supervision, set to depart and a more deregulatory stance likely, US banks may find themselves with significant latitude to roll back compliance measures. Some analysts argue this marks the effective death of Basel III in the US, widening the gap between American and international financial regulation.

An area where we may see even starker regulatory divergence is climate finance. Trump’s well-known skepticism regarding climate change aligns with US banks’ lobbying to dilute Basel III’s Pillar 3 provisions, which mandate the disclosure of environmental, social, and governance (ESG) risks. This contrasts sharply with the EU’s ambitious ESG agenda, including the Corporate Sustainability Reporting Directive (CSRD) and the EU Taxonomy.

Basel III, Basel IV, Basel III Endgame, & Basel 3.1: Terminology Explained

As with tariffs, the scope and scale of Trump’s regulatory approach remain uncertain. Investors are left navigating a fluid landscape, where policy surprises could swing markets in unexpected directions. While markets may cheer moves toward deregulation, it brings significant risks. Regulatory frameworks are, after all, often born out of major crises and designed to address the risks such crises expose, the likelihood of which only grows if those safeguards are removed. For example, today’s banking and market rules emerged in response to the financial crisis, with the aim of mitigating systemic threats.

Crypto promoters welcome Trump victory

Trump’s second victory has sent ripples of excitement through the cryptocurrency world. Unlike in 2016, when crypto was still a niche asset class, Trump’s latest campaign included explicit overtures to the crypto community. His promise to create a “strategic bitcoin stockpile” and transform the US into the global hub of bitcoin mining has boosted optimism among crypto enthusiasts, with his pledge to fire SEC Chair Gary Gensler – a known critic of the industry – an additional boon.

Trump’s embrace of crypto adds more complexity to an already charged regulatory environment. Over the past several years, global and US regulators have sought to bring the crypto sector under stricter oversight, focusing on issues such as investor protection, systemic risk, and anti-money laundering. A more pro-crypto administration could either slow these efforts or inject new uncertainties. Meanwhile, the prevailing euphoria – coupled with eye-catchingly high inflows into the asset class – is sparking concerns among regulators and other observers who believe crypto is now large enough and sufficiently intertwined with traditional asset markets to pose a systemic threat.

At the same time, a shift in – or even reversal of – Trump’s stance cannot be ruled out. First, his current position marks a significant departure from his earlier stance. In 2021, he famously dismissed crypto as a “scam.” Second, while his current rhetoric aligns with crypto purists who champion “freedom money” as an alternative to fiat currencies, Trump has also been a staunch defender of the US dollar. This sets up a potential conflict with crypto ideologues who envision Bitcoin’s success as tied to the dollar’s eventual decline. Trump’s crypto/digital assets agenda, like much else in his presidency, will likely keep markets guessing.

Trump is a supporter of crypto, but also the US dollar. Image: NBC News

US dollar – an uncertain trajectory

Even in “normal” times, predicting the trajectory of the US dollar may be considered a fool’s errand, given the confluence of unpredictable factors, including macroeconomic policy, trade dynamics, as well as the global market sentiment and positioning that drive it. Under a second Trump administration, it is fraught with even more uncertainty, given the lack of clarity on key policy details, such as the scale and scope of tariffs.

The views of market participants remain sharply divided. For some, tariffs and protectionist policies might fuel inflationary pressures and prompt higher interest rates, which historically support dollar strength. For others, any significant disruptions to global trade could undermine confidence in the US economy, potentially weakening the dollar.

How will Trump’s policies impact the dollar? Image: Amazon

Unsustainable fiscal path – a potential brake

Tying into broader macro concerns, the US fiscal situation may prevent Trump from honoring some of his pledges. The US fiscal outlook is already precarious, with debt at 10% of GDP and deficits projected to exceed 6% of GDP annually for the next decade. This trajectory is widely regarded as unsustainable.

According to the Committee for a Responsible Federal Budget, Trump’s proposed fiscal plans – if enacted – could add an additional USD 8 trillion to US debt over the coming decade, equivalent to 2.5% of GDP annually. This sits at odds with his intention to extend the sweeping tax cuts of 2017.

Sustaining deficits at these levels would likely lead to rising term premiums in bond markets, which could dampen economic growth. Compounding the challenge is the looming debt ceiling, a contentious issue during Trump’s first term that will require careful management in the new administration.

Amid these fiscal concerns, Trump’s nomination of Scott Bessent as Treasury secretary has generally been well received. While many of Trump’s other cabinet picks have raised alarm bells, Bessent is seen as a stabilizing figure. As Treasury Secretary, he will face the considerable challenge of balancing Trump’s ambitious economic plans – ranging from tax cuts to protectionist policies – with managing ballooning deficits and national debt, all while staying on the right side of Trump. Representing the US on economic and financial issues at forums like the G7, G20, and IMF will also be no easy task.

Conclusion – expect the unexpected

To sum up, as Trump 2 arrives, the only things we can be reasonably sure of are deregulation and uncertainty – on tariffs, crypto, the dollar, and fiscal matters. In financial markets, the unpredictability is likely to manifest itself in a higher frequency of sudden large market moves driven by unexpected announcements, which became a hallmark of Trump’s first presidency – “tape bombs” in trader jargon. While tape bombs are beyond the control of market participants, traders and risk managers will have taken steps to guard against their adverse effects on portfolios by adjusting risk management frameworks, reducing position sizing, and engaging in more hedging.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Equity Markets – An Introduction

- US Equity Market

- Equity Valuation – An Introduction

- Equity Trading – An Introduction

- Economic Indicators – An Introduction

- Trade Finance – An Introduction

- Trade Indicators

- Regulation – An Introduction

- Markets Regulation – An Introduction

- Banking Regulation – An Introduction

- Basel III – An Introduction

- Basel III – Pillar 3 & Risk Reporting

- ESG – An Introduction

- Corporate Sustainability Reporting Directive (CSRD)

- Fiscal Policy Analysis

- Digital Assets

- Crypto Assets – Financial Crime Risks

- Crypto Assets – Regulation

- Foreign Exchange (FX) Market – An Introduction

Learn more about Know-How

Fill in the form below to view all tutorials and courses offered within Know-How.