Introduction

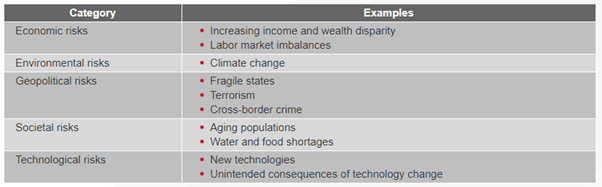

As the global financial landscape continues to shift, banks face a myriad of challenges in ensuring smooth operations and sustainable growth. In this volatile climate, operational risk management (ORM) faces several challenges and is subject to evolving trends. The World Economic Forum’s annual Global Risks Report sets out the current view on risks in five main categories. These categories and some examples of emerging risks that could impact banks are:

Top 5 operational risks to watch

1. Cybersecurity threats

In an increasingly digital world, banks are vulnerable to cyber attacks that can compromise customer data, disrupt operations, and erode trust. With the rapid advancement of hacking techniques – including ransomware attacks and data breaches – cybersecurity remains a top concern. To mitigate the risk of cyber incidents, banks must invest in robust cybersecurity measures, including advanced threat detection systems, employee training programs, and continuous monitoring.

2. Technological disruptions

The rapid pace of technological innovation introduces both opportunities and risks for banks. Embracing emerging technologies such as artificial intelligence, blockchain, and cloud computing can enhance efficiency and customer experience. However, banks must manage carefully the associated operational risks, including technological failures, system outages, and data integrity issues. By implementing robust IT governance frameworks, conducting thorough risk assessments, and ensuring adequate backup and recovery systems, banks can navigate the digital landscape more securely.

3. Regulatory compliance

Banks operate in a heavily regulated environment, and non-compliance can lead to severe financial penalties, reputational damage, and loss of customer trust. The evolving regulatory landscape, driven by factors such as changing geopolitical dynamics, technological advancements, and consumer protection, presents significant operational risks for banks. To address this challenge, banks should maintain a proactive approach to compliance by regularly monitoring regulatory changes, enhancing internal controls, and fostering a culture of compliance throughout the organization.

4. Talent management

In an era marked by technological disruption, banks require skilled professionals who can navigate the complexities of the digital age. However, attracting and retaining top talent remains a significant operational risk. Banks must adapt their talent management strategies to attract individuals with expertise in emerging technologies, data analytics, and cybersecurity. Furthermore, fostering a culture of continuous learning and providing opportunities for professional development can help banks build a robust talent pipeline and mitigate the risk of skill shortages.

5. Geopolitical and economic uncertainties

Political instability, trade disputes, and economic volatility have a profound impact on the banking sector. Banks are exposed to operational risks arising from global economic trends, policy changes, and geopolitical conflicts. By regularly monitoring and analyzing geopolitical risks, diversifying their portfolios, stress testing their balance sheets, and engaging in scenario planning exercises, banks can navigate uncertain environments more effectively and protect themselves from potential financial shocks.

Managing emerging risks

To be fully alert to emerging risks, banks can employ a variety of tools to assess the current operational risk landscape, including:

Horizon scanning

This tool is used to review and assess developments (such as those set out in the Global Risks Report) to determine which could have an impact in the future and collate a list that requires closer monitoring.

Risk assessment

For any developments identified, a risk assessment can be conducted covering aspects such as:

- Nature – what is the nature of the potential development and what opportunities/risks could it pose?

- Likelihood – can the likelihood of the development materializing in the near future or over the longer term be assessed?

- Impact – what are the likely impacts of the development and how material could they be?

- Speed of change – is the development likely to be gradual and therefore more manageable, or is it likely to be unpredictable?

- Lead indicators – are there any measures that could provide an indication of the stage of development or a change in it?

Reporting & Monitoring

A summary of the developments and their risk assessments can be prepared and updated on a regular basis, with significant risks highlighted/color-coded and commented on in reports.

Review & Discussion

Reports can be discussed at board-level and in risk committees on a regular basis. Quarterly rather than monthly discussions should suffice for risk committees and semi-annually at board-level.

When do emerging risks become current risks?

How will banks know when a risk moves from ‘emerging’ to ‘current’? The trigger is likely to be one or more of the following:

- Implementation stage has been reached – when a new technology, product, or process has moved to the implementation stage, it is deemed “current.”

- Likelihood has increased – when the probability of a risk event occurring as a result of some development has increased significantly, it needs to be on the current risk register.

- Risk events are already occurring – at this stage, the risk is current even if no losses have been incurred.

- Losses are being incurred – the risk is current if losses, of whatever size, are being experienced.

In a rapidly changing world, banks face a multitude of operational risks that require careful attention and proactive management. By focusing on cybersecurity, embracing emerging technologies, staying compliant with regulatory requirements, prioritizing talent management, and navigating geopolitical and economic uncertainties, banks can mitigate these operational risks and position themselves for long-term success.

>> Measurement and reporting basics for operational risk management

Test your knowledge of operational risk management

Navigation Menu

IntroductionTop 5 operational risks to watch

Managing emerging risks

When do emerging risks become current risks?

Test your knowledge of operational risk management

Learn more about our operational risk management course and resources