Stage one of the trade lifecycle Pre-trade

Before any client trading can be done, a number of different activities must take place in the pre-trade environment.

A critical element is the client onboarding process, as this allows institutions to establish whether they should trade with a potential client.

Client onboarding often involves specialist teams and impacts many others involved in trade processing, including legal and compliance personnel and credit staff.

Well-implemented client onboarding can help an institution to develop strong client relationships, minimize risk, and satisfy regulatory requirements.

By contrast, poorly-implemented client onboarding can lead to client attrition, expose an institution to risk, and result in significant regulatory and compliance issues.

Other important aspects of pre-trade planning include client motivations for trading, transaction cost analysis, and pre-trade risk controls.

Clients are motivated to trade for a number of possible reasons, including cash needs, hedging, diversification, and view monetization.

Pre-trade transaction cost analysis can help clients to estimate the transaction costs associated with trades that have yet to be made.

Meanwhile, pre-trade risk controls are required to ensure that trades are deemed acceptable from a risk management perspective.

Client onboarding

Client onboarding refers to the process through which a bank, investment firm, or other trading institution establishes a relationship with a new client or customer.

Well-implemented client onboarding can be an effective tool through which an institution can develop strong client relationships, minimize its risks, and satisfy regulatory requirements.

Poorly-implemented client onboarding has the opposite effect as it can lead to client attrition, expose the institution to risk, and result in significant compliance issues.

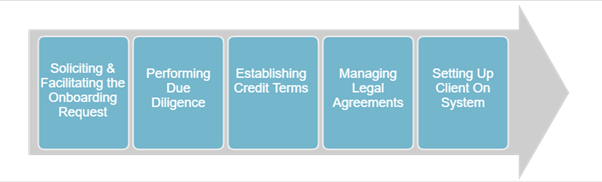

Onboarding process

The key elements of the onboarding process are:

Client onboarding impacts many teams involved in the lifecycle of a trade. Institutions typically have specialists, such as client onboarders and know your customer/client (KYC) teams, to manage the process. Any salesperson responsible for attracting a client must initiate a new client form and may be designated the “sponsor” of the relationship, adding a degree of accountability. Compliance, legal, and credit groups will also be involved.

Know your client/customer (kyc)

Know your client/customer, or KYC, is the name given to regulations that require financial institutions to engage in due diligence, recordkeeping, and reporting related to their customers.

KYC laws and regulations vary across jurisdictions. In the US, for instance, notable legislation includes the Bank Secrecy Act (1970) and the USA PATRIOT Act (2001), among others.

Pre-trade planning: the client's motivation

What motivates a client to engage in a trade?

Key client motivations can include:

- Cash needs

- Hedging

- Diversification

- View monetization

Cash needs

A client that requires cash may engage in a trade to turn a noncash asset into cash.

Before the trade takes place, the client must identify the cash needs and develop a plan to implement a trade that satisfies these needs.

Hedging

A client may hold a portfolio of assets that are vulnerable to losses and is concerned about this potential for losses.

While one way to remove these concerns is to sell the vulnerable assets, the client may be either unable to do so or prefer not to do so.

Instead, the client could enter into a hedging trade with exposures that offset the source of vulnerability.

Diversification

Many investors make decisions based on the belief that markets are "efficient." This means that they believe that any information is both immediately and accurately reflected in asset prices. Investors who believe markets are efficient do not try to form views on specific investment opportunities – their belief means they do not think such view formation is possible in the first place. Instead, they invest based on an approach known as "strategic asset allocation."

This involves:

- Determining the level of risk they are willing to tolerate

- Entering into a well-diversified portfolio that maximizes expected returns for the given level of risk

- Engaging in periodic rebalancing to ensure the portfolio remains diversified and at the desired risk level

View monetization

While many investors believe that markets are efficient, many others believe the opposite. These investors believe that information is not immediately and accurately reflected in asset prices, and hence information can be used to profit.

The investors engage in strategies through which they study information and use their research to form tactical views that drive trades that allow them to monetize views. For instance, through studying information an equity analyst may form a "buy," "sell" or "hold" view regarding a particular stock.