Regulatory capture on the rise

The notion that regulators hold absolute sway over the industries they cover is facing mounting challenges, as increasingly successful lobbying by big business to dilute regulations – ranging from bank capital requirements to climate change measures to artificial intelligence (AI) legislation – points to “regulatory capture”.

A recent scaling back by the Federal Reserve (the Fed) of proposals announced in July 2023 to shore up the US banking sector suggests that the Fed has succumbed to a campaign of sustained pressure from the banking industry and other vested interests. It’s not so much the campaign itself – characterized by intense lobbying and billboard advertising warning consumers and small businesses about the implications of the Fed’s proposals – that suggests regulatory capture may be at work, but its apparent success.

The initial proposals, which included a 19% increase in capital requirements, were introduced in response to the mini-banking crisis earlier that year. These events raised concerns about “systemic risk” and fostered a strong consensus among key regulatory and supervisory bodies, including the Fed, that capital requirements needed to be tightened.

However, the Fed has recently scaled back its proposed capital requirement increase from 19% to just 9%. Furthermore, an additional relaxation stipulates that the increase will now apply only to banks with assets over USD 250 billion, rather than those with assets of USD 100 billion or more.

Basel rules losing their influence?

The Fed’s actions put it on a potential collision course with the so-called Basel III Endgame, which refers to the final set of rules for banks devised by the Basel Committee on Banking Supervision (BCBS). The rules are designed to prevent the recurrence of major financial crises like the Global Financial Crisis (GFC) of 2008. Capital adequacy – the requirement that banks hold sufficient capital to cover potential losses, expressed as a ratio of capital to risk-weighted assets –

is central to the Basel rules, and forms Pillar 1.

Importantly, while the BCBS is recognized as the global standard-setter for banking regulation, it is not responsible for enforcement, which is up to regional and national regulators. The regulatory overhauls that followed the GFC had fostered a spirit of cooperation between national regulators and the BCBS.

The significance of the Fed’s retreat is that it may signal a break in this trend, potentially taking other regional supervisory bodies with it. Indeed, the Bank of England appears to be emulating the Fed, having indicated a desire to remain “competitive” internationally in terms of regulatory requirements. Some fear the setting in motion of a “race to the bottom” with the potential to undermine the stability of the global banking system.

Basel III, Basel IV, Basel III Endgame, & Basel 3.1: Terminology Explained

Pushback against climate regulation

Another example of regulatory capture in the banking sector can be seen in the efforts by banks and other companies to push back on regulations designed to counter climate change.

In December last year, a group of major US banks expressed concerns that new capital requirements linked to climate risk (also part of the Basel Endgame proposals) would inevitably reduce their lending capacity, thereby constraining economic growth.

Under the Basel III framework, Pillar 3 disclosure requirements on ESG risks will require some 150 European banks to publish extensive qualitative and quantitative information on transition and physical risks, exposures to at-risk sectors, and lending to green activities on a semiannual basis. This, according to European banks, will have significant costs and operational implications. The fear for European regulators is that the banks, emboldened by the success of their counterparts in the US, mount a similar challenge to their authority. Instances of regulatory capture is not restricted to the banking sector, as similar backlashes are unfolding in other regions and industries.

NGO dismay over Europe’s Green Claims Directive (GCD)

One such case centers around efforts in Europe to combat “greenwashing” – misleading claims made by companies to appear more environmentally friendly than they actually are.

The European Council’s first formal stance on the European Commission’s proposed Green Claims Directive (launched in 2023) has triggered dismay at environmental NGOs. They argue that the Council, no doubt caving to industry pressure, has watered down the European Parliament’s proposals to restrict companies’ use of carbon offsets in claiming carbon neutrality, while also alleging that the revised Directive permits companies to maintain or even increase emissions by purchasing offsets rather than making reductions. Additional objections target the reliance on self-assessment and the reduced disclosure requirements regarding evidence for green claims.

Regulators take aim at greenwashing

Large corporations vs. ETS

The broader backlash against climate regulations is also evident in the intense pressure being applied by large corporations to soften the requirements of the EU’s Emissions Trading System (ETS). The ETS, which places a cap on emissions and allows companies to trade carbon credits, has been targeted by powerful industry lobbies seeking to reduce the financial burden imposed by stricter emissions limits.

The pressure has resulted in delays and diluted enforcement of the ETS reforms, culminating in significant concessions to sectors like aviation and heavy industry. Another win, it seems, for big business, and further evidence of regulatory capture.

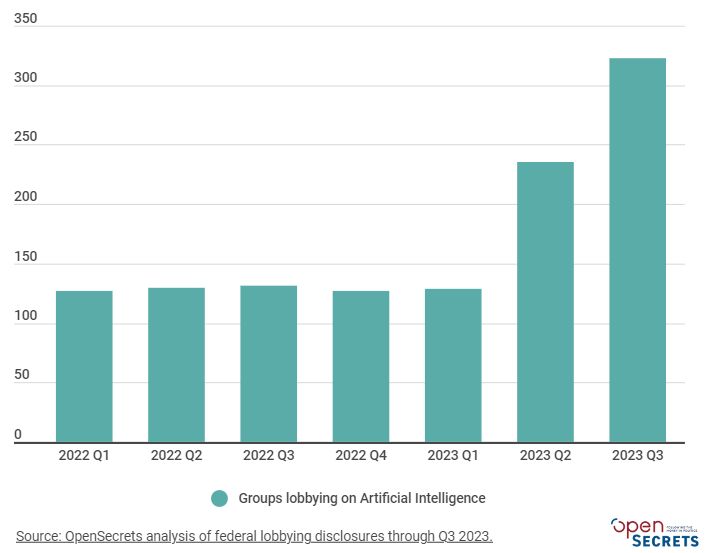

Efforts to soften AI legislation

Perhaps the hottest arena of all for lobbyists right now is AI, with the intensity of lobbyists’ efforts matching the general excitement surrounding AI itself. Data from OpenSecrets, a nonprofit organization that tracks and publishes data on campaign finance and lobbying, states that the number of groups lobbying the US federal government on AI nearly tripled between 2022 and 2023.

According to Time magazine, Big Tech companies have been leading efforts to influence forthcoming AI legislation. Their strategy appears to be one of support for AI regulation in public, while the reality in their private discussions with officials is a tendency to “push for light-touch and voluntary rules.”

Conclusion

The post-GFC regulatory overhauls ushered in a period of unprecedented regulatory power, particularly over the financial sector. The increasingly successful recent efforts of banks and other big business lobbies to exert influence and weaken or delay regulations – viewed as overly burdensome and damaging to their bottom lines – points to a potential shift in the balance of power.

While it is unclear how this evolving dynamic will unfold, history suggests that big corporations may well remain in the ascendancy and regulators on the backfoot – usually until a major crisis forces a reversal in the status quo.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Regulation – An Introduction

- Banking Regulation – An Introduction

- Financial Authorities (US) – Federal Reserve

- Basel III – An Introduction

- Basel III – Pillar 1 & Capital Adequacy

- Basel III – Pillar 3 & Risk Reporting

- Sustainable Finance Disclosure Regulation (SFDR)

- Greenwashing

- Climate Risk – An Introduction

- Climate Change – Physical Risks

- AI Ethics – An Introduction

- AI Ethics – Key Issues

- AI Ethics – Key Principles

Learn more about Know-How

Fill in the form below to view all tutorials and courses offered within Know-How.