Regulators take aim at greenwashing

Greenwashing – a misleading or deceptive marketing practice used by companies and other organizations to portray themselves or their products and services as environmentally friendly or sustainable – has become so ubiquitous in recent times that regulators have been forced to act. The EU’s proposed “green claims” directive is the latest initiative designed to clarify the investment regime around sustainability and ESG with the aim of protecting consumers and investors from greenwashing. Once again, however, its progress promises to be somewhat fraught.

The momentum behind environmental, social, and governance (ESG) has slowed dramatically of late. One critical factor has been the absence of reliable, comparable, and verifiable categorization of investment products, preventing consumers from making fully informed decisions.

This lack of clarity undermines the environmental claims of investment product providers. A 2020 EU study found that over half of such claims were vague, misleading, or unfounded. The prevalence and potential impact of such claims worried regulators who are keen to protect consumers and investors alike by ensuring that “sustainable” products and services sold are accurately described.

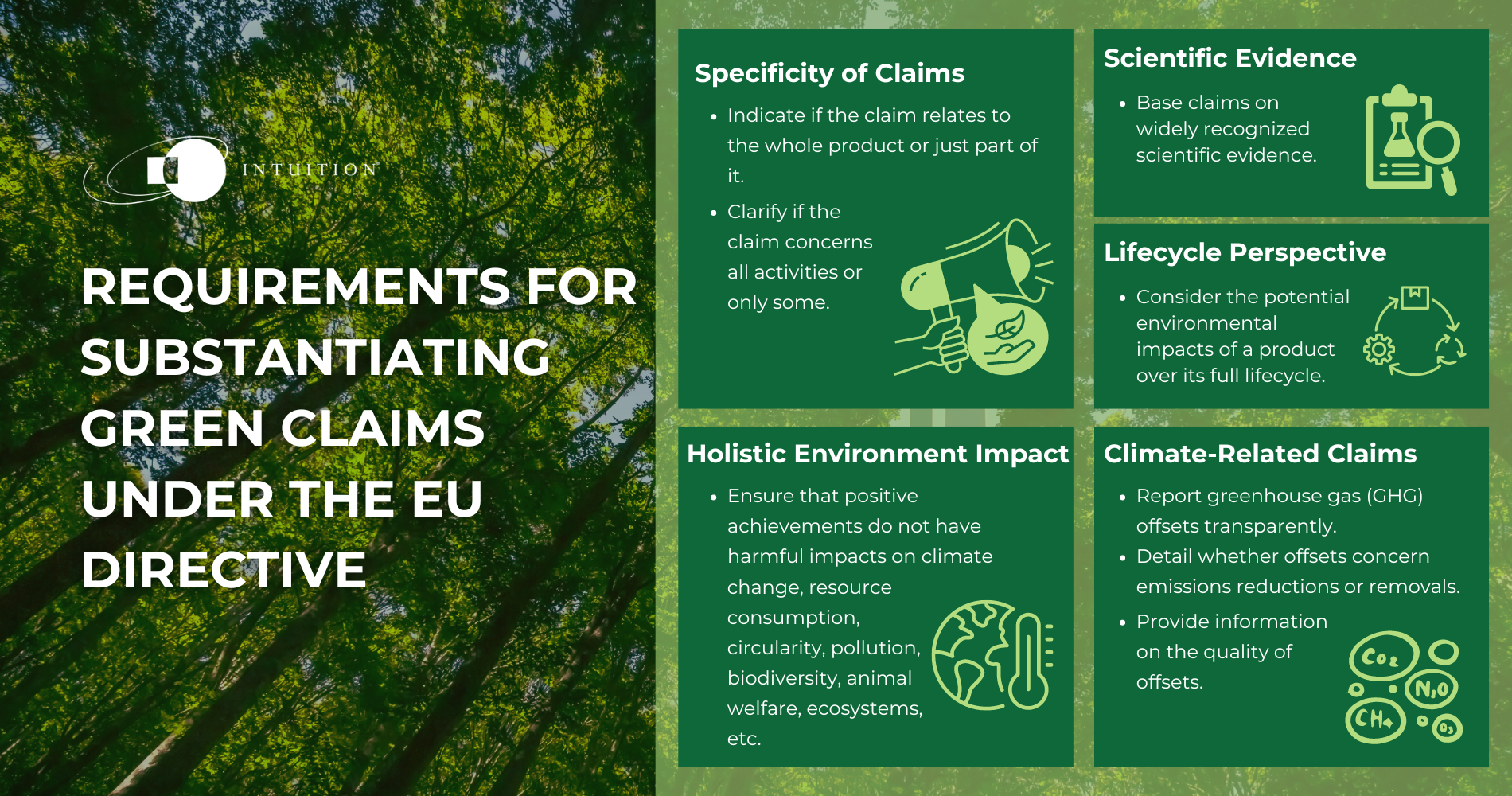

EU requirements for substantiating “green claims”

As has often been the case with ESG-related regulation, the EU was one of the first jurisdictions to act. Last year, the European Commission proposed a directive on green claims that requires companies to substantiate their voluntary green claims in business-to-consumer practices.

Among the many requirements related to claims, companies must specify if a claim relates to the whole product or just part of it, clarify if it concerns all activities or only some, and base it on widely recognized scientific evidence. They must also take a “lifecycle perspective” that considers the potential environmental impacts of a product over its full lifecycle, as well as ensure that positive achievements do not have harmful impacts on climate change, resource consumption, circularity, pollution, biodiversity, animal welfare, and ecosystems.

Additionally, the directive introduces important requirements in relation to proving climate-related claims, including those involving carbon credits. It obliges companies to report greenhouse gas (GHG) offsets transparently, detailing whether offsets concern emissions reductions or removals and providing information on offset quality.

***

Listen to this article and more on ‘The Intuition Finance Digest‘

Listen on Spotify | Listen on Amazon Music | Listen on Apple Podcasts

***

EU certification & labeling requirements

Companies, processes, or products wishing to certify compliance in the EU with an environmental label must provide transparent information on relevant ownership and decision-making bodies as well as objectives and procedures for monitoring compliance. The directive bans labels that present a rating or score for a product or company based on an aggregated indicator of cumulative environmental impacts unless awarded under environmental labeling schemes set up under EU law.

With the rise of ESG having led to a proliferation of labeling schemes, the directive prohibits the introduction of new publicly owned national or regional environmental labeling schemes (pre-existing schemes may continue if they meet the directive’s requirements). For labels from third-country schemes, awarding must be approved by the European Commission.

Concerns over green claims directive

The European Council has adopted its first formal position (“general approach”) on the proposed directive – and it has been greeted with some dismay by environmental NGOs. These groups are particularly concerned that the Council has watered down the European Parliament’s proposals to restrict how companies use carbon offsets to claim carbon neutrality. Critics argue that the revisions would allow companies to maintain or even increase emissions by purchasing offsets rather than making measurable reductions. Other objections focus on excessive self-assessment and reduced disclosure of evidence for green declarations.

The Council’s general approach will form the basis for negotiations with the European Parliament on the final shape of the directive.

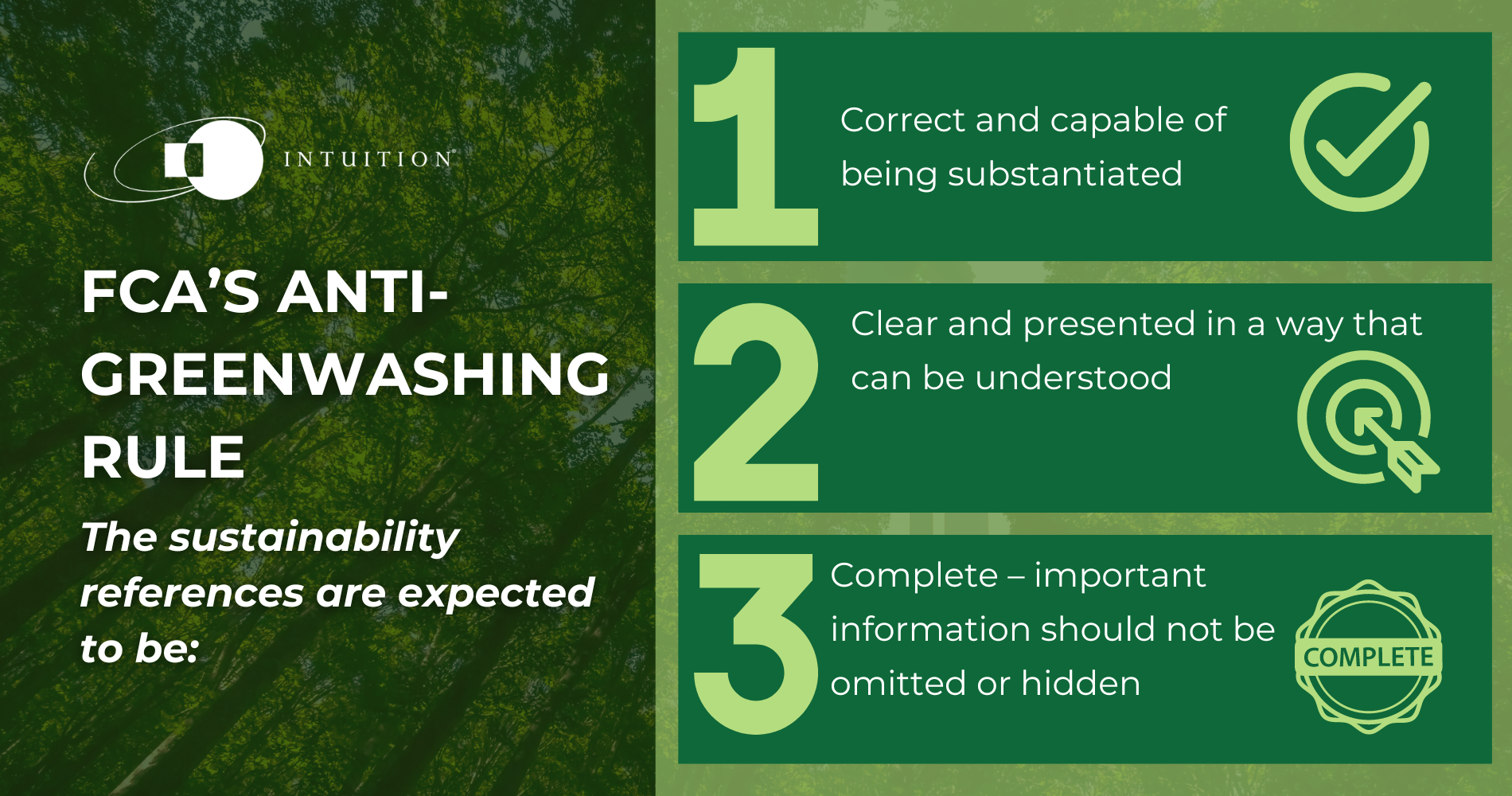

FCA’s anti-greenwashing rule

Apart from the EU’s efforts, the UK’s Financial Conduct Authority (FCA) has also introduced an anti-greenwashing rule (effective since end-May).

The rule is part of a package of measures on Sustainability Disclosure Requirements (SDR) and investment labels. It applies to financial products and services that FCA-authorized firms make available to UK clients, requiring such firms to ensure that “any reference to the sustainability characteristics of a product or service is consistent with the sustainability characteristics of the product or service, and is fair, clear and not misleading.”

The sustainability references are expected to be:

- Correct and capable of being substantiated – products and services should do what they say they do, with appropriate evidence to support any claims.

- Clear and presented in a way that can be understood – claims should be transparent and straightforward, with consideration given to whether all the terms used would be understood by the intended audience and also to any images, logos, and colors used.

- Complete – important information should not be omitted or hidden, and the full lifecycle of the product or service should be considered.

The anti-greenwashing rule is important as it gives the FCA an explicit regulatory framework to challenge firms if the regulator suspects they are making misleading sustainability claims about their products or services.

Conclusion

Greenwashing can have many consequences – misleading consumers and investors, undermining customer trust, and damaging the broader sustainability movement, to mention but a few. The EU’s Green Claims Directive and the FCA’s anti-greenwashing rule represent important steps toward greater transparency and accountability in the sustainability/ESG investment space.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Sustainability & Sustainable Development

- Greenwashing

- Net Zero

- ESG – Primer

- ESG – An Introduction

- ESG Factors

- Sustainable & Responsible Investing – An Introduction

- Sustainable & Responsible Investing – Strategies

- ESG Data & Ratings – An Introduction

- ESG Data & Ratings – Reporting Frameworks

- Commodities – Emissions