Regulator Concern at Online Investor Vulnerability

Both the European Commission and the SEC have expressed concern over the rise of “gamification” of retail investing and indications are that enhanced investor protection regulation is inevitable.

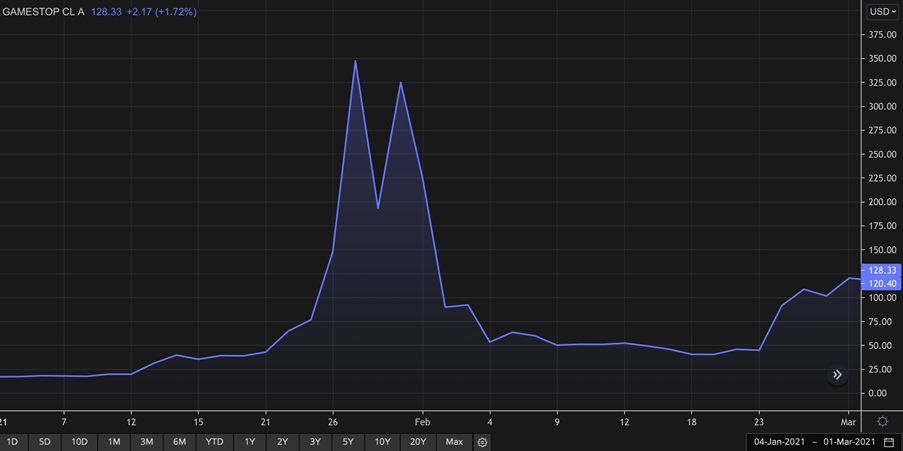

It was just over a year ago that the global stock markets witnessed one of the most unusual phenomena of recent decades.

With so many in the developed world locked down at that time due to covid restrictions, appetites for stock market speculation through online platforms spiked dramatically. Among that population of amateur retail investors were a determined group who, organized through social media, attempted (and succeeded) in frustrating the “shorting” of the GameStop stock by a number of hedge funds (“short selling” is an investment strategy that speculates that a stock will fall in value).

The Rise and Fall of Gamestop. Source: Refinitiv

The activities of the GameStop cohort may have been driven as much by political considerations as profit motivations, but the incident served to concentrate minds on the role of a number of innovative and aggressive online trading platforms, notably Robinhood. Concerns over inexperienced investors have been compounded by the massive growth in cryptocurrency trading with all of its extreme volatility.

The surge of retail interest in the stock market has abated somewhat, but questions over investor protection remain. Hence, in the United States the Securities and Exchange Commission (SEC) last August requested from the public “Information and Comment on Broker-Dealer and Investment Adviser Digital Engagement Practices, Related Tools and Methods, and Regulatory Considerations and Potential Approaches; Information and Comments on Investment Adviser Use of Technology.”

The “digital engagement practices” (DEP) referred to by the SEC include tools such as “behavioral prompts, differential marketing, game-like features (commonly referred to as gamification), and other design elements or features designed to engage with retail investors on digital platforms.” The overall objective of the SEC’s request is to “facilitate the Commission’s assessment of existing regulations and consideration of whether regulatory action may be needed to further the Commission’s mission.”

The impact of ‘gamification’ of investment has not been lost on European authorities either.

Similar concerns prompted the European Securities and Markets Authority (ESMA) to issue a statement that warned against making investment decisions based on information shared on social media. This drew even greater attention to the increasing role of digital platforms in the investment sphere – something recognized by the European Commission when it published its digital finance strategy in September 2020.

Capital markets and investor risks

Ironically, the role of technology is considered by the EU as fundamental to increased retail investor participation in financial markets. This deficiency is reflected in (although not the direct cause of) serious underperformance of European stocks relative to their US counterparts.

S&P 500 v Eurostoxx 600 – Rebased 20yrs. Source: Refinitiv

In support, the European Commission cites easier access to investment products and capital markets, easier comparability, and lower costs. At the same time, it also recognizes that new technology “can also carry risks for consumers (e.g. easier access to potentially riskier products)” and render investment protection rules “no longer fit for purpose”.

In its attempts to develop its notoriously thin capital markets, the EU is adopting an integrated approach from the ground up. In January, it announced its Financial Competence Framework for Adults in the European Union, hailing it as a “key milestone” in its 2020 Capital Markets Union (CMU) Action Plan. Last August, it engaged in a public consultation in its efforts to “build retail investors’ trust in capital markets” and a comprehensive study based on its findings is expected later this year.

A new retail investment culture?

GameStop and crypto are just the most visible evidence of the impact a new wave of digital investment platforms is having on the retail investment market, with a host of new entrants looking to bring a US-style retail investment culture to Europe.

While in principle the arrival of these new entrants would seem to be aligned with the goal to broaden and deepen EU capital markets, their offerings and delivery are likely to come under keen scrutiny at regulatory level. This is on the grounds that very many would-be investors possess inadequate knowledge or understanding of investment principles. Online investment discussion groups – as identified by ESMA in their warning – overwhelmingly center on speculative, short term stock tips rather than considered, long term investment principles.

The EU and the SEC’s intervention comes at a time of nervousness over perceived elevated levels of the major indexes. Stock markets are dealing also with a low level of IPOs, the rise of private equity, and heavy concentration, particularly in the technology sector.

Intuition Know-How has a number of tutorials that are relevant to this article:

- Equity Markets – An Introduction

- Equity Markets – Issuing

- Equity Trading – An Introduction

- Equity Indices

- US Equity Market

- European Equity Market

- Hedge Funds – An Introduction

- Hedge Funds – Strategies

- Crypto Assets