Key finance topics to understand: Q3 2024

At Intuition, we look to educate the finance industry on the most relevant topics. As we are now in Q3 2024, here are some of the main learning areas we have identified for the industry:

- Digital transformation in banking

- Crypto assets

- Model risk management

- Transaction banking

- APIs

- Trade finance

Click on one of the above to learn more about that section of finance, along with the key areas you should understand.

All of the below content is taken directly from Intuition Know-How, the world’s premier digital learning solution for finance.

Digital transformation in banking

Digitalization has been hugely disruptive and transformative in many industries. In banking and the broader financial sector, digital transformation is a multifaceted process that involves the adoption and integration of digital technologies and innovative strategies to revolutionize the way that financial products and services are delivered.

Digitalization: Foundational knowledge

Digitalization – developing processes and changing workflows to convert analog data and improve manual systems – has changed industries drastically, and banking is no exception. Today’s finance professional needs to understand how digitalization has evolved banking processes and how this has, in turn, influenced the development of new business models.

You should be able to:

- Identify how the emergence and growth of digitalization in banking led to the development of multichannel and omnichannel banking

- Recognize the business models that have emerged in banking as a result of digitalization and enabling legislation

- Identify the importance of cybersecurity and digital resilience in the implementation of digital banking processes

Digitalization: Open Banking and Open Finance

Open banking – the sharing of customer financial data with third parties with customer consent – is a transformative initiative in banking, finance, and potentially beyond. With roots in the EU’s second Payments Services Directive (PSD2), open banking has become something of a global phenomenon, promoting competition and innovation in the financial sector and disrupting legacy business models.

You should be able to:

- Identify how open banking works and how the model has evolved and developed in various jurisdictions around the world

- Recognize the key considerations relating to data privacy, data security, and the technology architecture used to facilitate open banking

- List how open banking presents banks with the opportunity to monetize their data and capabilities

- Recognize how open banking is evolving into open finance and how ultimately this could be expanded into a much broader open economy concept

Digitalization: Banking as a Service and Banking as a Product

The provision of financial services has traditionally been the exclusive domain of banks. However, the arrival of open banking and the general availability of customer data opened the door for new business models. This has led to banks collaborating with FinTech companies to offer products and services that an increasing number of customers desire. These collaborations take the form of Banking-as-a-Service (BaaS) or Banking-as-a-Platform (BaaP).

You should be able to:

- Recognize BaaS and explain how it works

- Identify the risks associated with Baas and the regulatory considerations

- Compare the characteristics of BaaS against those of embedded finance

- Recognize BaaP, explain how it works, and list the benefits for the different participants

Digitalization: Embedded finance

Embedded finance is an umbrella term that describes the integration of various financial products and services into the business, platforms, and applications of nonfinancial entities. It enables customers of these entities to access these products and services – such as payments, lending, insurance, and investing – without leaving the platform or app they are using, thus providing them with a more convenient and integrated experience where they can undertake their core activities and financial transactions in the same place.

You should be able to:

- Recognize embedded finance, how it evolved, and its drivers

- Identify the different business models for embedded finance and its applications

- Recall how embedded payments work and their benefits

- Identify embedded lending and its benefits

- List the other types of embedded finance

Intuition Know-How video: What is embedded finance?

Crypto assets

Crypto assets are a rapidly-growing asset class defined primarily by their use of cryptography and digital ledger technology (DLT), or blockchains. Initially seen as digital payment systems or “currencies,” blockchain technology is increasingly being deployed for other purposes as the crypto universe expands and new assets emerge. You should understand a range of crypto assets, including Bitcoin, Ethereum, stable coins, and non-fungible tokens (NFTs). You should also understand the key features of these assets and the functionality of the ecosystems they operate in, while also having a grasp of some of the key risks crypto assets pose and how regulation of the crypto universe is shaping up.

You should be able to:

- Recognize where crypto assets fit into the broader digital asset complex

- Identify different crypto ecosystems and their functions compared with both traditional finance and one another

- Identify key features of Bitcoin and recognize how a typical Bitcoin transaction works

- Identify key features that distinguish Ethereum from Bitcoin, recognize potential real-world use cases for Ethereum, and list enhancements associated with Ethereum 2.0

- Recognize other types of crypto assets, including non-fungible tokens (NFTs) and stablecoins, and their key features

- Identify key risks and challenges that crypto assets pose to their users and investors

Intuition Know-How excerpt: Ethereum 2.0

Ethereum 2.0 is an ongoing overhaul of the existing Ethereum infrastructure that is set to introduce fundamental changes to the Ethereum blockchain in the coming years. The first phase of the rollout, known as the “Beacon Chain Launch,” was implemented in December 2020. The transition to PoS that took place in September 2022 was also part of the rollout.

The Beacon Chain is to be the backbone of Ethereum 2.0, managing the PoS consensus mechanism, and facilitating the coordination and communication between various components of the network, including shard chains. Other planned enhancements (in addition to the beacon chain and the PoS transition) include:

Shard Chains/Sharding

Shard chains are parallel chains that operate alongside the beacon chain. Each shard chain processes a subset of transactions, allowing for greater scalability by distributing the network’s workload across multiple chains. This approach should enable Ethereum to handle a higher volume of transactions and improve overall network performance.

Sharding is the process of partitioning the network into shards or shard chains.

eWASM

The eWASM (short for Ethereum WebAssembly) is a virtual machine, which is expected to improve the efficiency and flexibility of smart contract execution on the Ethereum network.

Crosslinking

Crosslinking facilitates communication and data transfer between shard chains and the beacon chain, ensuring that the entire Ethereum 2.0 network remains synchronized and secure.

State Execution Layer

The state execution layer is conceptually similar to the Beacon Chain. The difference is that while the Beacon Chain manages the PoS consensus mechanism and overall network coordination, the state execution layer focuses specifically on processing transactions and executing smart contracts within individual shard chains.

Casper FFG

Casper FFG (Friendly Finality Gadget) is a hybrid consensus mechanism that combines elements of PoS and PoW to achieve finality and security in block validation.

Collectively, these enhancements aim to address Ethereum’s scalability, security, and sustainability challenges, paving the way for a more robust and efficient blockchain platform.

While there is no fixed timeline for the complete rollout of Ethereum 2.0, developers and the Ethereum community are actively working on bringing these upgrades to fruition.

Model risk management

Banks use models for a wide range of business, risk management, and financial purposes. As such, robust model risk management is crucial to ensuring the reliability and effectiveness of any models used throughout their business.

Model risk management: Foundational knowledge

Models produce outputs that can be used to inform decision making, as inputs for other models, or to calculate capital requirements.

A key issue with model outputs is that they are only estimates that may or may not be accurate. This is because the models are simplifications of the real world that are built using a limited set of data. Models are also based on assumptions that may no longer be correct if there have been significant changes in the external environment or in customer behavior.

It is important that model users understand how models work, the limitations of using model outputs, and take this into account when making decisions at both transactional and strategic levels.

You should be able to:

- Define a model and list the key stages of the model lifecycle

- Recognize why model risk is a concern for banks

- Identify the main regulatory requirements covering models

- Recognize the importance of model risk management

- Recall the role of AI and machine learning in model development

Model risk management

Banks use models for a wide range of business, risk management, and financial purposes, in addition to using them as inputs to regulatory capital calculations.

However, a key issue with this is that model outputs are only estimates that may or may not be accurate. This can give rise to model risk – the potential for adverse consequences from model errors or the inappropriate use of modelled outputs to inform business decisions.

You should understand how model risk can be managed – and kept within risk appetite – throughout its lifecycle by having a robust model risk management (MRM) framework in place, as well as robust governance to ensure any issues are promptly identified and addressed.

You should be able to:

- Identify regulatory approaches to model risk management (MRM)

- Recognize the importance of model identification, model risk rating, and model inventories

- Identify key model risk roles, responsibilities, policies, and procedures

- List the different stages of the model risk lifecycle and recall how risk is managed at each stage

- Recognize ongoing issues and challenges in model risk management

Intuition Know-How video: The model lifecycle

Transaction banking

Transaction banking, or global transaction banking (GTB), has long been a catch-all term for a range of disparate financial products and services provided by banks. But the landscape is changing significantly – driven by factors such as shifting global trade flows, geopolitics, digitalization, and sustainability – which in turn is disrupting traditional business models, both from a bank and customer perspective.

Transaction banking: Foundational knowledge

Transaction banking – the provision of payments, cash management, trade finance, and other services to (mostly) corporate customers – is a changing landscape. Factors such as shifting global trade flows, geopolitics, digitalization, and sustainability are disrupting traditional business models, both from a bank and customer perspective.

You should be able to:

- Recognize the importance of transaction banking to the modern, global economy

- Identify the crucial role played by transaction banks in facilitating global supply chains

- List the different products and services provided by transaction banks

Transaction banking: Payments services

Payments and payments systems play a crucial role in the global economy. While banks were exclusive suppliers of payments services for many years, this was regarded as a relatively unattractive part of the business.

However, payments act as the gateway to cash management services and consolidate the corporate customer relationship. You should understand how banks support their corporate customers by effecting different types of payment across a range of platforms and systems against the backdrop of an evolving global payments environment.

You should be able to:

- List the key features of payment processing systems and the main risks involved in payment processing

- Identify the key types of payment, namely credit/debit transfers, standing orders, cross-border-payments, and checks

- Recognize the key features and stages in the payments processing cycle, namely, payment type selection, payment initiation, and payment processing and execution

Transaction banking: Cash management services

Banks manage the timing of money flows for their corporate banking customers by providing essential cash management services.

You should be familiar with the bank client perspective on cash management and the typical tasks that go into the role of the person assigned with cash management responsibilities – the corporate treasurer. You should understand how the bank acts as support for the entire cash management cycle, from cash collection to cash sweeping, concentration, and investment.

You should be able to:

- Recognize the interconnection between cash management, the treasury function, and organizational structure, as well as regulatory initiatives in the cash management area

- Identify the key elements of bank account management, including managing banking relationships, virtual account management, cash sweeping, and notional pooling

- Recall the importance of effective liquidity management, especially working capital management, for a business

- Identify key elements of the cash conversion cycle, namely, days sales outstanding, days sales in inventory, and days payable outstanding

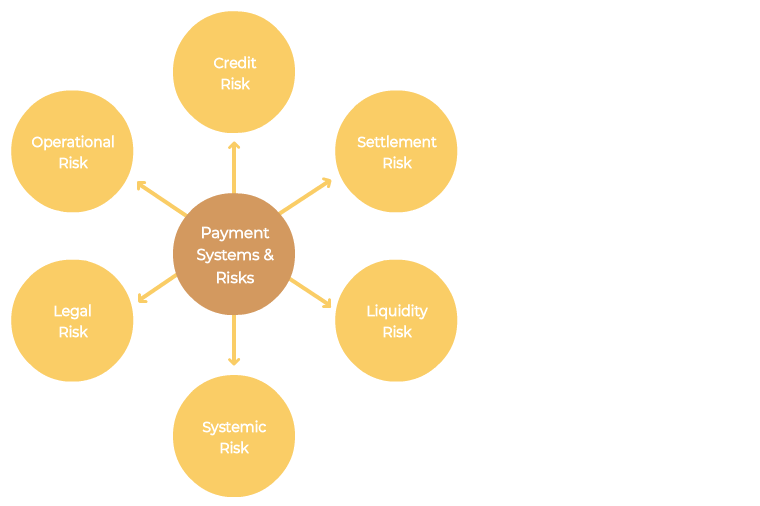

Intuition Know-How excerpt: Payments systems and risks

The nature of large-value payments systems is such that they are subject to multiple risks.

Credit Risk

In the interbank payments system, credit risk can occur between:

- Intermediaries (banks) who are participants in the interbank payments system

- Intermediaries and their clients (payer/payee)

- Direct participants and the settlement institution (a direct participant is one that can perform all activities permitted by the payments system without using an intermediary, including the direct inputting of orders and the performance of settlement operations)

A transaction that results in a payment usually relates to a contract where goods or services of value are exchanged. Settlement lag – the time between the provision of services (or transfer of ownership) and receipt of payment – generates credit risk for all participants involved (counterparties, their intermediary banks, and the settlement institution).

Settlement Risk

Settlement risk is the risk that one party will fail to deliver the terms of a contract with another party at the time of settlement. It can arise due to a default at settlement or a timing difference.

Liquidity Risk

This occurs where a participant has insufficient liquid funds with the settlement institution to meet its payment obligations. The funds available to a participant will vary at any given time during the day, depending on the pattern and value of payments made and received.

Systemic Risk

Large value payments systems are increasingly linked due to the globalization of trade. This gives rise to systemic risk where failure in one payments system can have implications for other payments systems. This could cause widespread liquidity or credit problems, threatening the stability of the financial system.

Legal Risk

Legal risk arises when there is uncertainty over the legal basis of a payments system. This relates to the rights and obligations of parties to the transaction and the enforceability of contracts.

Operational Risk

Operational risk is the risk that operational factors – such as technical malfunctions or operational mistakes – will cause or exacerbate credit or liquidity risks.

APIs

An API is a set of rules that lets software applications communicate with each other. APIs enable a secure and streamlined exchange of data and play a huge role in the digital economy and in our daily lives.

You should be able to:

- Explain what an API is

- List the four main types of API, namely public, private, partner, and composite

- Recognize how APIs are extending the range of companies that can provide financial services

- Describe embedded payments and Banking-as-a-Service (BaaS)

Intuition Know-How video: APIs in banking

Trade finance

Trade transactions have been taking place for centuries and a number of the practices that support the smooth execution of such transactions, such as the use of drafts and bills of lading, have been around for a long time.

In recent decades, however, transactions have grown in size and complexity and both the value and volume of overall trade has increased substantially. Further, new forms of transportation – such as containerization – have emerged and proliferated. Meanwhile, the use of electronic documentation has become more common and FinTech firms are starting to make inroads into what has traditionally been a heavily paper-based environment.

You should be able to understand:

- The need for trade finance products and the different types of product provider

- The main methods of payment used for trade transactions

- The use of open account terms in international trade

- The role of documentary collections in facilitating payment for trade transactions

- The various features of letters of credit (L/Cs), the lifecycle of a typical L/C, and the parties involved in that lifecycle

- The different types of bond/guarantee provided by banks and other guarantors to their customers

- The different forms of import and export finance available to buyers and sellers involved in international trade

- The role of export credit agencies (ECAs) in facilitating trade transactions

- The concept of structured trade finance and how it differs from traditional trade finance

- The importance of trade documentation and the role of the various rules/guidelines, such as UCP 600 and Incoterms, published by the International Chamber of Commerce (ICC)

Intuition Know-How video: Export and import finance

We equip over 1 million financial services professionals with the knowledge to deliver in the rapidly moving global marketplace. Our extensive Know-How content library is trusted by the world’s largest investment and commercial banks, leading asset managers, insurance firms, regulatory bodies, and professional services firms.

Click the button below to learn more about Intuition Know-How.