Gold’s resilience: Understanding its role in modern financial markets

Famously derided as a “barbarous relic” by none less than John Maynard Keynes, and nothing more than a shiny “pet rock” to its many detractors, the allure of gold can be hard to fathom, particularly for those who pride themselves on their rational outlook. After all, gold has limited industrial or commercial utility outside of jewelry – with just 6% of production going to industrial use – and yields no income to investors.

Yet gold has continually confounded the skeptics, proving itself to be a worthy store of value over time, which in gold’s case means not just years, decades, or even centuries, but millennia. Recent months have seen a surge in the value of the yellow metal, with the gold price recording new all-time highs in August, breaking above USD2,500 per troy ounce for the first time.

What explains the long-term durability of gold, what lies behind the recent wave of demand, and what are the factors that might influence prices from here?

Gold’s durability

Gold’s long-term durability can be largely attributed to its unique physical properties. Unlike other metals, gold is malleable and does not tarnish or corrode. Its malleability allows it to be shaped into coins, bars, and jewelry, making it a versatile medium of exchange and store of value.

Unlike fiat currencies issued by central banks and backed by governments, which can be manufactured out of thin air, the supply of gold is inherently limited, as it is a finite resource that cannot be manufactured or easily substituted. Gold, therefore, has particular appeal for those who are skeptical of governments and policymakers.

While the demise of the gold standard, solidified with the collapse of the Bretton Woods system in 1971, theoretically eroded gold’s role as a form of money by untethering currencies from it, this very shift may have perversely boosted gold’s appeal. With currencies no longer directly linked to gold, the metal came to be seen by some as a hedge against the potential devaluation of fiat currencies, as well as a symbol of financial security in an era of expanding money supply and growing national debts.

Another key factor could be gold’s track record itself, which may be self-perpetuating. Whatever the reason, gold has over millennia been trusted as a safe haven, preserving wealth through economic turmoil, wars, and the rise and fall of civilizations. Who wants to bet against thousands of years of history?

Interest rate easing

Among the factors driving the more recent surge in the gold price, perhaps the most significant has been the arrival of the Fed’s easing cycle. As interest rates decline, so too does the opportunity cost of owning gold.

Gold has a strong negative correlation to real interest rates, or interest rates adjusted for inflation. The Fed’s monetary tightening cycle that started in late 2021 culminated in real interest rates well into positive territory coming into this year, as inflation had begun to ease but nominal rates remained high, keeping a lid on the gold price. This dynamic reversed in July. Even though inflation continued to fall, interest rates declined at a faster pace, driving real rates lower and therefore boosting gold demand.

Dollar weakness

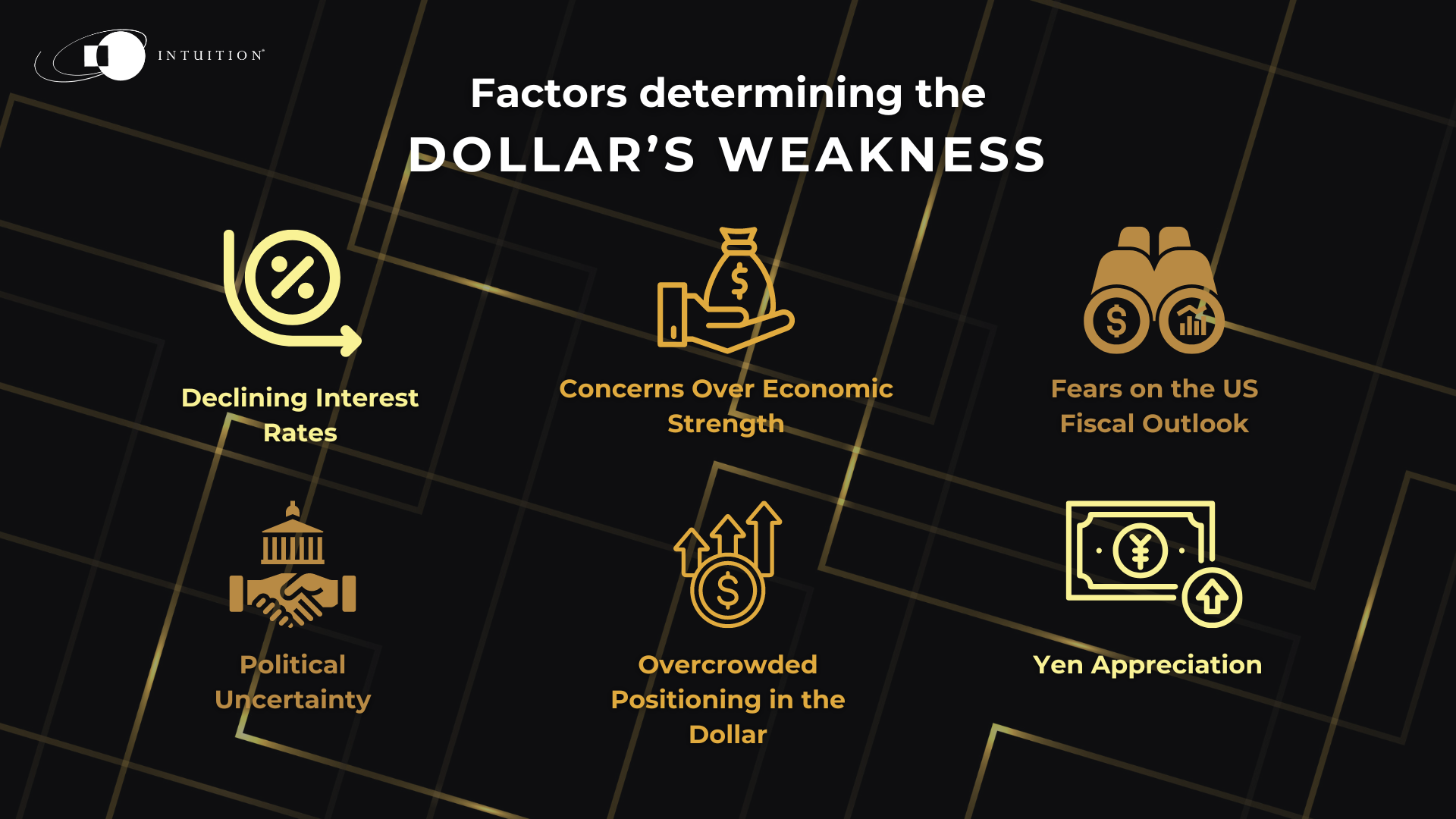

Another key driver, linked to the decline in interest rates, has been a pronounced weakening in the US dollar. Over time, gold has exhibited a negative correlation to the dollar, the primary reason being that gold – like other commodities – is priced in dollars. To understand the factors that have driven gold higher, a look at those that have driven the dollar’s weakness is therefore instructive. Other than declining interest rates, these include concerns over the strength of the economy, fears over the US fiscal outlook, and political uncertainty, with the US elections looming.

Perhaps the most important short-term factor, however, is positioning. With the dollar having enjoyed significant structural inflows in recent years, driven primarily by interest rate differentials, positioning had become overcrowded, making the dollar vulnerable to a reversal. This vulnerability was realized in August, triggered by the above factors and exacerbated by a violent unwind of the so-called yen carry trade. A dramatic appreciation in the yen against the dollar caught many off guard, forcing a rush to cover short positions in the yen, leading to a further sell-off in the dollar and providing additional support to gold.

Geopolitics, China woes & ‘de-dollarization’

Given its strong track record during periods of geopolitical strife, gold has “benefited” from a concentration of geopolitical woes recently, including mounting tensions between the US and China, the ongoing conflict in Ukraine since Russia’s invasion in 2022, and the war in Gaza.

China is a perennial buyer of gold, and both its domestic economic outlook and the geopolitical backdrop point to continued strength in Chinese demand.

On the domestic front, the fallout from the Chinese property crisis is far from over and is exerting deflationary pressure on the Chinese economy. Amid this backdrop, Chinese monetary policy is almost certain to be loose, keeping pressure on the renminbi. This is favorable for Chinese gold demand, not just at the government/central bank level but also among spooked retail investors, who have flocked to gold in the face of the uncertainty.

As for geopolitics, China’s relations with the US show no signs of improvement, as both candidates in the US election are striking a hawkish tone, promising higher tariffs on Chinese exports, a policy finding favor with governments across the developed world. This implies yet further downward pressure on the renminbi, fueling even more Chinese demand for gold.

“De-dollarization” refers to the push by some governments – those on less friendly terms with, or outright hostile to, the US – to upend the US dollar’s status as the global reserve currency.

Following the invasion of Ukraine by Russia, sanctions targeting Russian US dollar reserves have stymied Russia’s ability to trade dollars in the marketplace. This application of economic muscle, enabled by the US dollar’s hegemony, has not gone unnoticed by other “unfriendly” regimes. An obvious corollary of de-dollarization is greater demand for gold, and some experts have noted that “unreported” central bank demand for gold is outstripping reported (monthly) central bank demand.

Investing in gold

Exposure to gold can be obtained in various ways. The purists tend to favor holding physical gold bullion. This, however, has obvious drawbacks in the form of storage and shipping costs. Many therefore opt for more convenient “paper” gold, which means derivatives contracts (mostly futures and options), or financial products such as ETFs and ETPs, even though these products do not eliminate the costs associated with storage and transport, while investors are also subject to risks such as market and counterparty risk. Yet another option is to hold mining stocks, though a key risk here is high operating costs that have led to stark underperformance of mining stocks on aggregate versus the gold price.

Whether we like gold or not, its resilience and scarcity, combined with its timeless appeal, continue to underpin its status as a reliable asset, even in today’s complex financial landscape. Gold is perceived as a portfolio anchor that prioritizes wealth preservation. Financial advisors, even the skeptics, typically recommend some allocation to gold in a portfolio, albeit small (typically single digits).

Intuition Know-How has a number of tutorials relevant to the content of this article:

-

Commodities – An Introduction

- Commodities – Precious Metals

- Asset Classes – Investing

- Asset Classes – Types

- Asset Allocation – An Introduction

- Economic Indicators – An Introduction

- Inflation – An Introduction

- Monetary Policy

- Fiscal Policy Analysis

- Financial Authorities – China