Global Supply Chains are Under Pressure and it’s a Problem

Around the world, supply chains are groaning under the weight of pandemic disruptions, materials shortages, and a lack of key workers. In some places, such as the UK, these problems are being exacerbated by domestic factors. At the same time, reopening is driving record levels of consumer demand in countries like the US, putting additional pressure on already-strained transport networks, manufacturing plants, and infrastructure. It all adds up to danger for the global economy in the form of product shortages, higher inflation, and slower-than-expected growth in key industries. Worse yet, despite efforts by governments and industry, there are few simple solutions to the problems bedeviling supply networks.

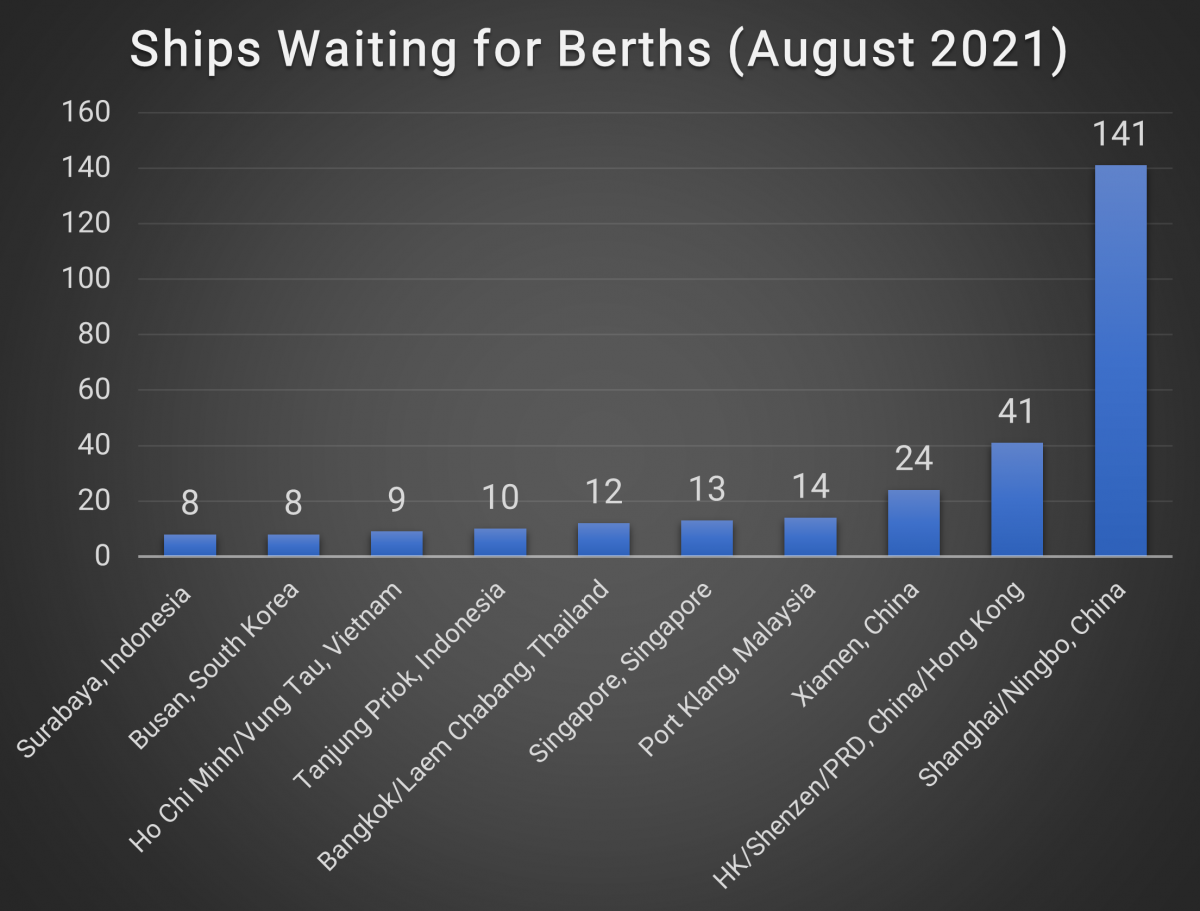

In late September, at the adjoining ports of Los Angeles and Long Beach in California, a record 62 container ships waited in line for a berth. Such queues were virtually unknown a couple of years ago, but since the coronavirus pandemic, they have become a familiar sight at many of the world’s busiest ports.

Source: Bloomberg. China Port Congestion Worsens as Ningbo Shuts for a Week. August 17, 2021.

These strings of waiting ships are just one outward sign of the massive disruptions in supply chains that have emerged over the last eighteen months – the result of a complex set of factors that have led to shortages in multiple key areas.

Recent article: Energy Prices are Spiking as the World Weighs its Climate Change Agenda

From empty shelves in British supermarkets to rising prices at US gas pumps, consumers and companies around the world are feeling the bite of the supply chain crisis.

Boom and bust

One important reason for today’s supply chain crunch is uncertainty.

Back in early 2020, when the coronavirus began to spread and country after country entered lockdown, demand plunged almost overnight. This – combined with shutdown orders and employee absenteeism – drove many manufacturers, miners, and energy companies to slash output and shutter plants.

Recent article: The Applications of Artificial Intelligence in Banking and Finance

When economies began to reopen, it was difficult for these organizations to restart production. Workers had moved on, suppliers had gone bust, and firms, unsure of how robust the recovery would be, were hesitant to invest. Capacity returned unevenly amid shortages of components, raw materials, and staff.

Since then, periodic disruptions to the production cycle have continued. The progress of the pandemic and national responses to it have varied from place to place. As a result, output and demand have been hobbled by sudden shutdowns in key locations at unpredictable moments.

For example, manufacturers in Vietnam have recently been forced to cut production in the face of a delta variant outbreak and associated government restrictions. This has hobbled the supply of many key components and caused significant knock-on effects throughout the manufacturing hubs of East Asia.

Besides affecting the availability and prices of products and thereby contributing to the supply chain crisis, this boom-bust pattern of supply and demand has also placed pressures on another key node in the world’s logistics networks, global transportation.

Road and rail

Like many sectors, transport networks have faced major coronavirus disruptions.

Consider, for example, the global shipping industry.

In the early days of the pandemic, air freight capacity virtually vanished, and cargo was rerouted to ships. Unfortunately, this meant that, for much of 2020, thousands of overworked merchant marines were trapped at sea by high demand and changing visa and quarantine requirements. As a result, many left the industry once they were able to get ashore. Adverse weather, including an unusually severe 2020 storm season, slowed fleets already wrestling with sailor shortages, and in March, a nearly weeklong closure of the Suez Canal brought global shipping to a halt.

These difficulties have combined to push shipping rates to record levels – according to the Drewry World Container Index, the cost of shipping a container from Asia to Europe rose tenfold between May 2020 and September 2021. Overall, the global shipping industry is struggling to move cargo reliably from point A to point B and prices continue to rise.

What’s worse, once ships reach ports, the transportation problems continue.

As already noted, port capacity has been strained by uncertainty and worker shortages, leading to prolonged and expensive delays in unloading. And once the cargo is ashore, companies face the challenges of the “last mile,” including crippling shortages in trucking and rail capacity. Around the world, truck drivers and rail operators are in short supply, neglected road and rail infrastructure is causing bottlenecks, and warehouse capacity is scarce.

Overlaying all these challenges is the threat of ongoing pandemic-related uncertainty. In August, for example, part of the busy Chinese port of Ningbo was closed for two weeks after a dockworker tested positive for the delta variant of COVID-19, sending painful ripples through the already-strained global transportation network.

Domestic disturbances

In many countries, domestic factors are further exacerbating these global challenges.

In the UK, for example, problems in the supply chain have been worsened by the impact of Brexit. In the wake of the UK’s departure from the European Union, thousands of predominantly Eastern European truck drivers left Britain. This exodus, combined with pandemic-related disruptions to licensing tests, has left the UK with a serious driver shortage. Britain now faces empty supermarket shelves and rising food prices as it tries to repair the damage to its internal transport networks.

Similarly, the US is facing an unprecedented surge in demand for goods, combined with the disruptive legacy of former president Donald Trump’s tariff wars and its own immigration-linked lack of truck driver. This combination of factors has led to shortages of many products and fears of serious problems during the upcoming holiday shopping period.

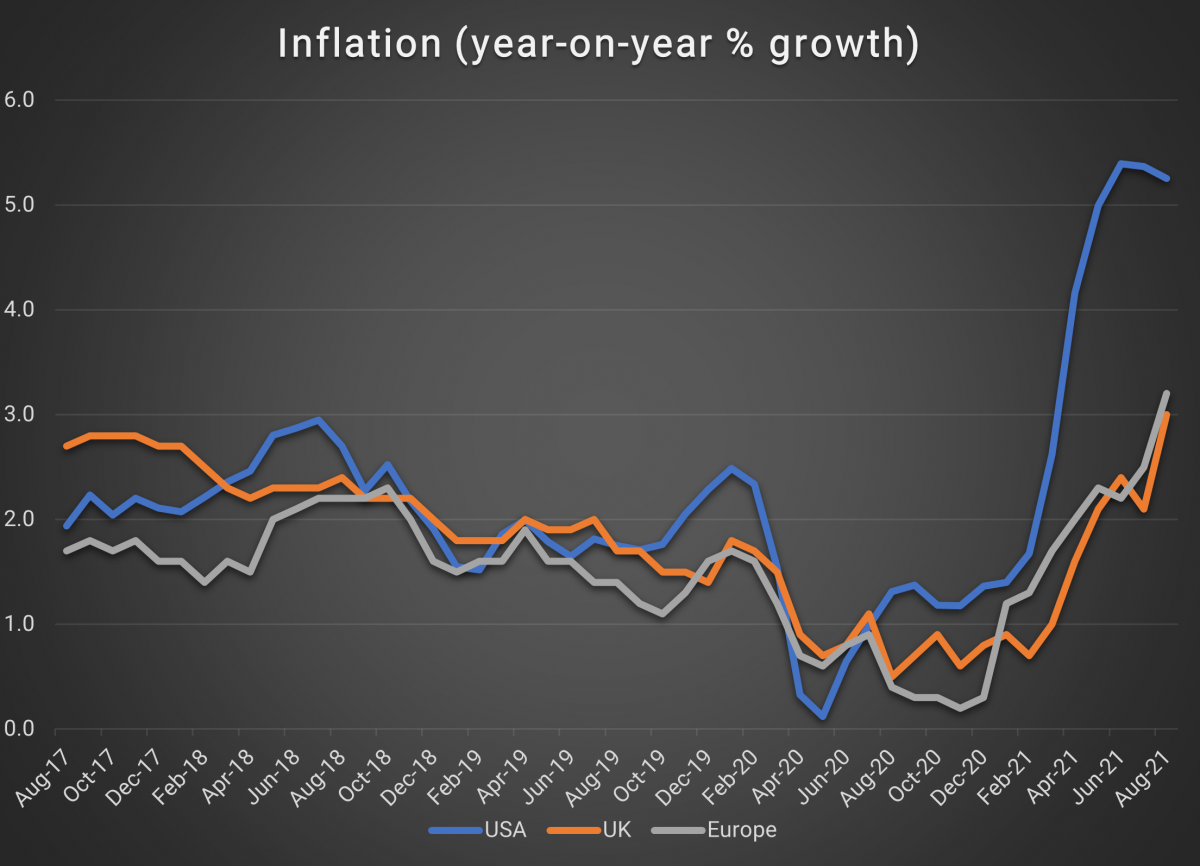

Inflation rising

The upshot of all of this is that prices are rising – fast. Unpredictable production and higher transport costs are translating into higher prices for consumers and economists increasingly believe that these elevated prices will endure for longer than initially expected.

Source: US Bureau of Labor Statistics, UK Office for National Statistics, Eurostat. Consumer Inflation, All Items. September 2021.

In response, policymakers are looking more closely at their interest rate strategies. The US Federal Reserve and the Bank of England, for example, have both signaled their intention to tighten monetary policy and central banks in Norway, Pakistan, Brazil, and others have all recently raised rates.

Given the unevenness of the economic recovery, some worry that rate tightening could be premature and that the world may face a prolonged period of uncertainty and slow growth if the process is not carefully managed.

Trade finance

Even as consumers and producers struggle to absorb higher costs, for institutions providing trade finance, the supply chain crisis offers both risk and opportunity. Rising prices and bidding wars have raised demand for funding, and technological innovations adopted during the pandemic have lowered costs and eased processes in the traditionally paper-based trade finance industry.

However, risks abound as transportation and logistics firms grapple with unpredictable pricing, shortages, and failing counterparties.

No way out

There are no easy solutions to the problems facing global supply chains and trade finance networks. Investment in new capacity – including infrastructure such as ports and new ships, trucks, and trains – is needed, as is significant investment in human capital. Working conditions in transportation must improve if trucker and sailor shortages are to be eased and wages may have to rise. Many countries, scarred by the effects of the pandemic, are prioritizing reshoring of productive capacity, and increasing stockpiles. While this may improve the resilience of supply chains, it is costly.

All of this means that prices may remain elevated for some time to come. And even massive investment will not solve the problems overnight. We can expect disruptions and shortages to continue, along with rising prices, for many months to come.

Intuition Know-How has a number of tutorials that are relevant to supply chain and trade issues:

- Trade Finance – An Introduction

- Export & Import Finance

- Structured Trade & Commodity Finance

- Corporate Banking Products – Accounts Receivable Finance

- Corporate Banking Products – Trade Finance

- Business Cycle Indicators

- Inflation – An Introduction

- Inflation Indicators

- Labor Market Indicators

- Trade Indicators

- Monetary Policy Analysis