ETFs – popular as ever, with increased specialization

Exchange-traded funds (ETFs) are one of the major financial innovations of recent decades, their growing popularity reflected in an ever-rising share of assets under management. Global ETF assets hit the USD 10 trillion mark this year, of which the US accounts for the vast majority (over USD 6 trillion). But not all of them are the same and ongoing expansion of the product offering has come with increased risk.

ETFs and the democratization of investing

ETFs are widely seen as having democratized investing, providing investors with easy access to an ever-broader range of financial markets and instruments. Among the early products were passive ETFs designed to track broad-based indices such as the S&P 500. These provided this exposure at notably lower costs than those offered by other funds such as mutual funds, leading to intense competition in the space that has eviscerated fees charged by funds across the board.

Given ease of access and the products on offer, it is entirely possible nowadays for anyone to construct a well-diversified investment portfolio exclusively through a handful of passive ETFs, at a low cost and with relatively low risk. At the same time, the expansion of the ETF offering also means there are many more potential pitfalls.

No doubt buoyed by the initial success, ETF offerings have broadened considerably over time, with increasingly specialized ETFs coming to market. These include smart beta, sector-based, commodity, thematic, and single stock/asset ETFs (the latter are technically exchange-traded products, or ETPs, rather than ETFs).

As these funds incur higher running costs, and many of them are actively managed, they are offered at notably higher fees than the more passive ETFs.

“Fad effect” dents specialized ETF returns

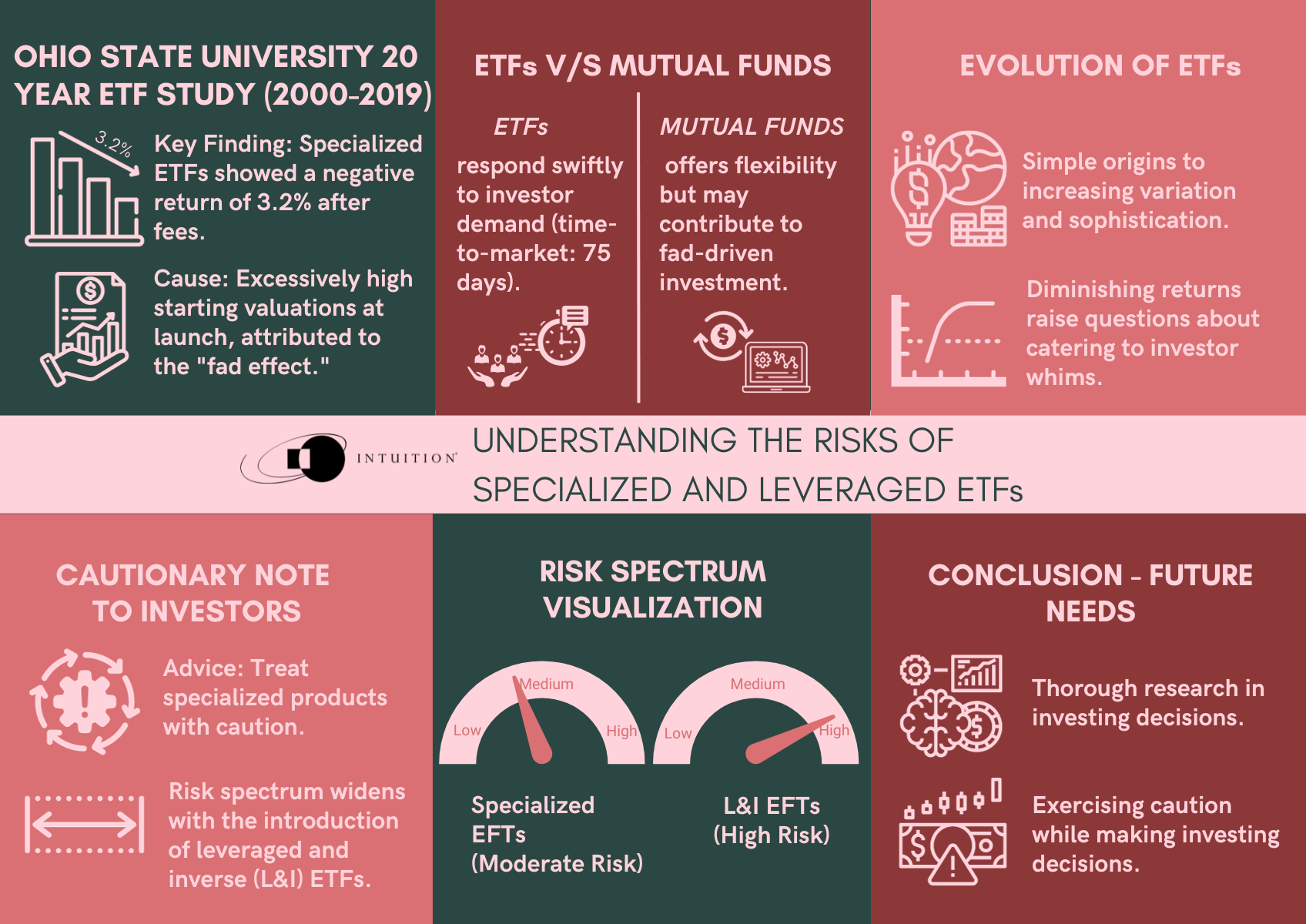

But these higher fees have not necessarily been associated with higher returns. A 20-year study (2000 to 2019) by the Ohio State University found that specialized ETFs showed a negative return of 3.2% after fees. However, this disappointing performance was due not to higher fees or transaction costs, but rather to excessively high starting valuations of the underlying products at the time of launch. Invariably launched amid peak popularity for the underlying product, these ETFs appear destined to suffer from a “fad effect.”

By their very design – unlike conventional mutual funds – can respond swiftly to investor demand. The time-to-market for new ETF products can be as short as 75 days. As they offer intraday liquidity (ETF shares can be bought and sold daily on the secondary market), ETFs can easily satisfy investor demand for popular investment themes or fads.

From its simple origins, the story of ETF product evolution has been one of increasing variation, sophistication, but also of diminishing returns, leading some observers to wonder whether satisfying the whims of investors has become too easy. Whatever the case may be, investors are advised to treat these specialized products with caution.

At the same time, if these products seem risky compared with those early iterations, they look positively tame compared with some of the offerings at the riskiest end of the ETF spectrum – namely leveraged and inverse (L&I) ETFs. This illustrates just how broad that risk spectrum has become.

L&I ETFs and the threat to financial stability

Leveraged ETFs use borrowed money to deliver a specified multiple of the return on a basket of securities over a one-day period – typically a multiple of 2x or 3x. Inverse ETFs, meanwhile, are designed to deliver a return opposite to that on the underlying basket. Leveraged inverse ETFs combine the two models, often using derivatives to secure the desired exposure.

The considerable risks posed by these products are well known to financial professionals, but not always to the broader public. A key problem with those that short or use leverage lies in the words “daily returns” that feature in any prospectus or description of such ETFs, as in “…[fund name] aims to deliver double the daily returns of x.”

ETFs are obliged to rebalance at the end of the trading day. The compounding effect of daily returns magnifies losses over time – the greater the leverage, the greater the losses. As for leveraged inverse ETFs (the ones that short assets and use leverage), the general upward bias of most financial asset prices means that these products are almost guaranteed to wipe out positions held for long enough.

As these products still account for only a minute share of the investment universe, they probably don’t pose a threat to the financial system. Even so, suitability and investor protection are key concerns from a regulatory standpoint. Many retail investors that buy these products may have an insufficient understanding of how they work and the risks involved. While decisive action (in the form of product bans, for example) has not been taken yet, these products are very much on the radar of regulators, who have been at pains to warn investors of the considerable risks they carry.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- ETFs – An Introduction

- ETFs – Types

- Smart Beta – Primer

- Fund Types & Structures

- Mutual Funds (US) – An Introduction

- MiFID II/MiFIR – Key Requirements

- Portfolio Management – Passive vs. Active Approaches