ESG Runs into Category Confusion

One of the unforeseen consequences of the war in Ukraine has been a re-evaluation of industry categories hitherto understood to be contrary to economic, social, and governance (ESG) principles. This, in turn, has also exposed the limitations of ESG as a convenient catch-all term for ethical investing.

Specifically, the war in Ukraine has placed defense and energy – two sectors until now considered major offenders in ESG terms – center stage.

Related article: What is ESG Investing?

A case can now be made for the role of defense as a counter to unprovoked aggression such as that witnessed in Ukraine: a critical factor in the preservation of democracy and the safeguarding of freedom – the foundation of all social values.

ESG and Financial Markets and ESG Factors Explained:

Source: Intuition Know-How

Energy and defense sectors turn “green”

Traditional (and dirty) forms of energy likewise are being viewed in a new light in terms of providing energy security in wartime – something with inherent social value. Energy self-sufficiency is now acknowledged as crucial as we transition to a green energy future, so can be viewed as consistent rather than contrary to ESG principles – a view notably endorsed by the EU parliament recently.

Related article: Sustainable Funds Labeling Under Examination

In parallel, the market has repriced both sectors – something perhaps not unconnected with this re-evaluation in ESG terms.

Brent Crude Oil Futures:

Source: Refinitiv

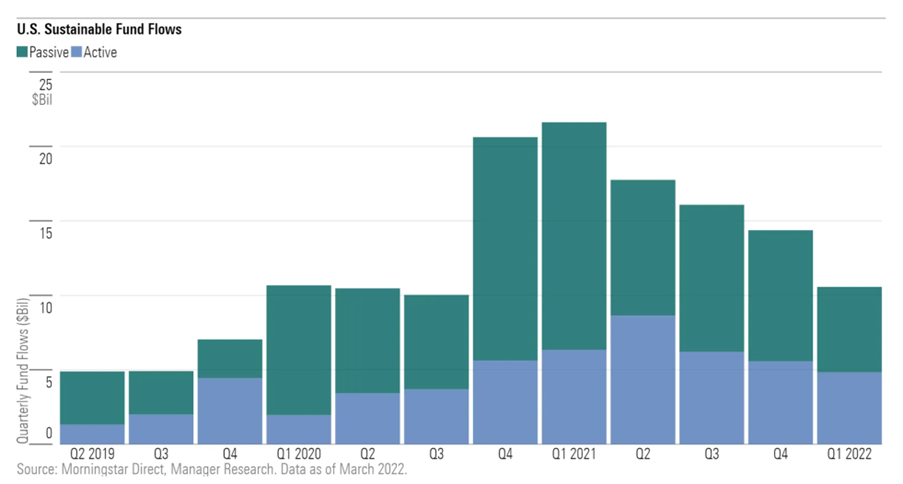

Slowdown in sustainable funds flows

Under the relatively new, ESG-conscious regime that surrounds so much of the business of investment management, it has long been an article of faith that returns from sustainable business should outperform over the longer term. This assertion is fundamental to the ESG marketing message of virtually the entire asset management industry. But the evidence of the past few months indicates that, in fact, sticking to the accepted ESG-compliant business sectors can have negative implications for performance – at least over the short term. This has been reflected in a slowdown in sustainable funds flows.

As long as ESG-compliant investments outperform, so there will be widespread and aggressive deployment of the term in the context of industry marketing. But the performance reversals of late position ESG-led marketing in an entirely different light, understandably leading to calls for a reappraisal of the criteria by which certain sectors and activities are (or are not) considered sustainable.

The Different Forms of ESG Investing:

Source: Intuition Know-How

In fairness, all of this has highlighted the undoubted nuance and complexity that surrounds ESG issues and how compliance with these principles is a moving target depending on market conditions. That has not deterred regulators from attempting to impose a degree of standardization, notably the EU Taxonomy Regulation (or “Green” Taxonomy). Under that regulation (and to the annoyance of many), natural gas and nuclear energy has now been, under certain circumstances, classified as “green.” In justifying its decision, the European Commission drew attention to the role of natural gas and nuclear in facilitating the transition toward a predominantly renewables-based future.

These nuances – as evidenced by the revised attitude towards energy and defense – mean that blanket exclusions by sector on grounds of ESG transgressions are unwise. Such exclusions tie the hands of active managers who might otherwise be in a position to engage with issuers with a view to encouraging them to modify their ESG practices.

Social issues falling behind in ESG considerations

Another issue highlighted by the revised perspective on energy and defense has been a realization that much of the focus of ESG has been on environmental factors and much less on social which is concerned with general societal wellbeing and the maintenance of living standards.

The issues highlighted by the ambiguity over defense in relation to ESG and the controversy over the classification of energy in the EU taxonomy demonstrate the genuine challenges in arriving at a standardized approach to ESG that can credibly counteract accusations of ”greenwashing.” While the term ”ESG” is neat and compelling, and thus has major attractions in relation to marketing application, it is clear that this powerful acronym encompasses a range of often contradictory objectives. By its nature, ESG is inherently dynamic, a moving target where efforts to reconcile its constituent parts are destined to be perpetual.

All of the videos in this article are taken from Intuition Know-How, the premier digital learning solution for finance. Intuition Know-How has many tutorials relevant to the content of this article:

- ESG – Primer

- ESG – An Introduction

- ESG Factors

- Climate Risk – An Introduction

- Climate Risk – Banking & Decarbonization

- Sustainable & Responsible Investing – An Introduction

- Sustainable & Responsible Investing – Strategies

- Impact Investing

- Sustainable Finance – An Introduction

- Sustainable Finance – Principles & Frameworks

- ESG Data & Ratings – An Introduction

- ESG Data & Ratings – Reporting Frameworks

- ESG Reporting

- Sustainable Finance Disclosure Regulation (SFDR)

- Taxonomy Regulation (Europe)