Energy transition: How finance professionals can overcome challenges

The energy transition represents a global shift from fossil-based systems of energy production and consumption — including oil, natural gas, and coal — to such renewable energy sources as wind, solar, and batteries. This significant shift is driven by a combination of environmental, economic, and technological factors. Despite the challenges, it is rapidly transforming not just the energy sector but also industries and economies around the world. This represents an extraordinary and complex venture that requires the contribution of various sectors, including finance.

Finance professionals play an instrumental role in this transition. They are the backbone of energy projects, providing the necessary financial resources and devising strategies to manage risks and ensure project viability. However, the energy transition presents a unique set of challenges for these professionals, including regulatory uncertainties, technological risks, and market volatility.

However, despite the challenges, the energy transition also brings numerous opportunities for finance professionals. These include new investment opportunities in renewable energy, the chance to drive sustainable growth, and the potential to contribute to a cleaner, greener future. Understanding these opportunities is a critical step in effectively navigating the energy transition.

Challenges faced by finance professionals in the energy transition

The energy transition is a complex process fraught with numerous challenges. For finance professionals, these challenges often revolve around project financing, risk management, and regulatory compliance.

Project financing for renewable energy projects can be a significant hurdle. Unlike traditional energy projects, renewable energy projects often require substantial upfront capital investment. However, they generate returns over a longer period, creating a mismatch between investment and return timelines. This presents a unique challenge for finance professionals, who must find ways to bridge this gap and ensure project viability.

Risk management is another critical challenge. The energy transition is characterized by significant technological and market uncertainties. Technological risks arise from the rapid pace of innovation in renewable energy technologies, which can render existing technologies obsolete. Market risks stem from fluctuations in energy prices, which can impact the profitability of renewable energy projects. For finance professionals, managing these risks requires a deep understanding of both the energy sector and financial markets.

Regulatory compliance is a third challenge. The energy transition is heavily influenced by public policies and regulations, which can vary from one jurisdiction to another. For finance professionals, navigating this regulatory landscape requires a thorough understanding of energy policies and the ability to adapt to changes in the regulatory environment.

Opportunities for finance professionals in the energy transition

Despite the challenges, the energy transition also brings numerous opportunities for finance professionals. These include new investment opportunities in renewable energy, the chance to drive sustainable growth, and the potential to contribute to a cleaner, greener future.

Investment opportunities in renewable energy are particularly promising. As the demand for clean energy grows, so too does the need for capital to finance renewable energy projects. This presents a significant opportunity for finance professionals to invest in these projects and generate attractive returns. Moreover, as more businesses and governments commit to reducing their carbon footprint, the market for renewable energy is expected to grow, further increasing the potential for investment.

Driving sustainable growth in the energy sector is another opportunity. Finance professionals play a crucial role in steering the direction of the energy sector. By prioritizing investments in renewable energy and developing financial products that support sustainability, they can help drive the sector toward a more sustainable future.

Finally, by participating in the energy transition, finance professionals have the opportunity to contribute to a cleaner, greener future. The transition to renewable energy is critical for reducing greenhouse gas emissions and mitigating climate change. By providing the necessary financing for this transition, finance professionals can take part in this global effort.

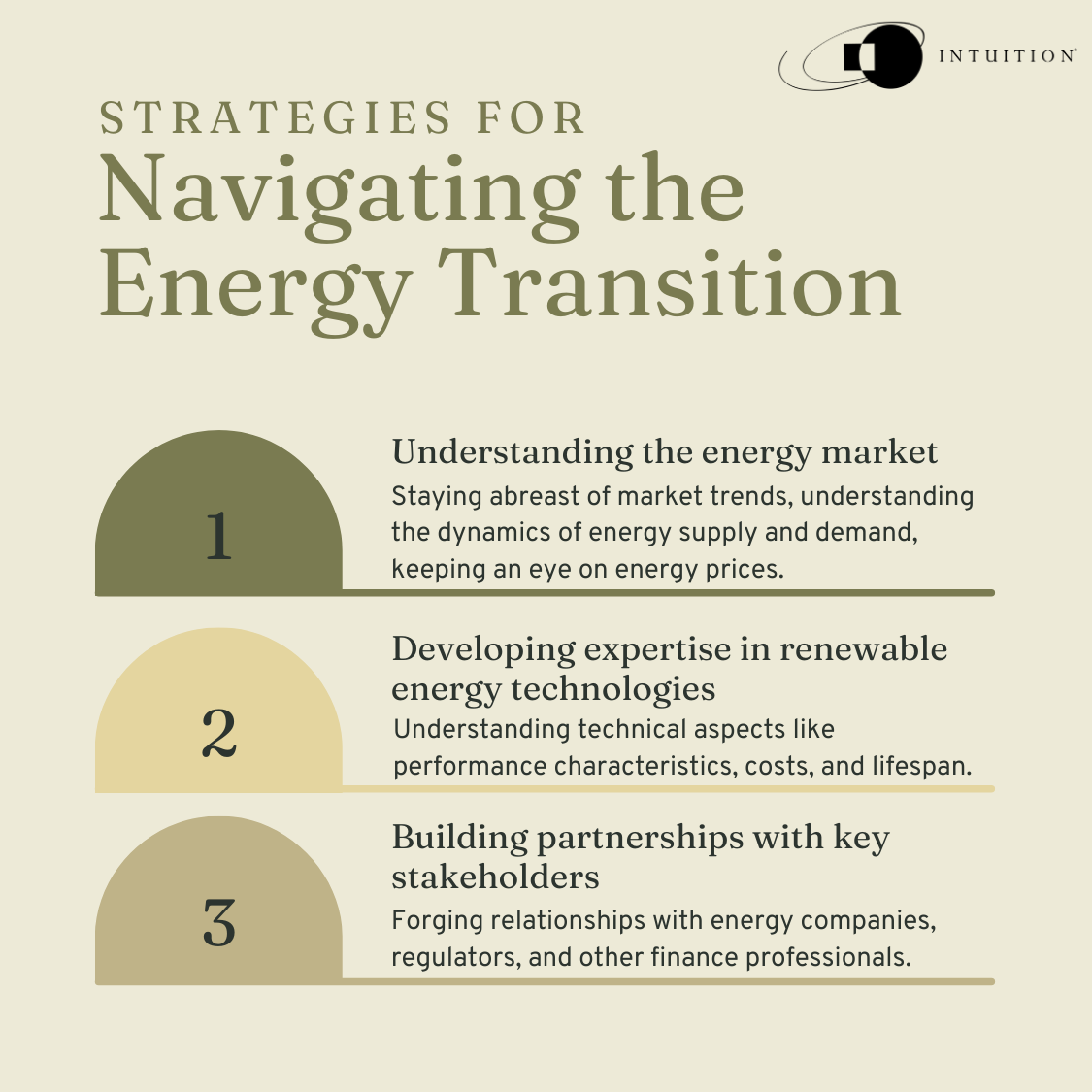

Strategies for navigating the energy transition

As finance professionals navigate the energy transition, they will need to develop new strategies and skills. These include understanding the energy market, developing expertise in renewable energy technologies, and building partnerships with key stakeholders.

Understanding the energy market is crucial. This involves staying abreast of market trends, understanding the dynamics of energy supply and demand, and keeping a close eye on energy prices. This understanding will enable finance professionals to identify investment opportunities and manage risks effectively.

Developing expertise in renewable energy technologies is another critical strategy. This involves understanding the technical aspects of these technologies, including their performance characteristics, costs, and lifespan. This technical knowledge will enable finance professionals to evaluate the viability of renewable energy projects and make informed investment decisions.

Building partnerships with key stakeholders is a third strategy. This includes forging relationships with energy companies, regulators, and other finance professionals. These partnerships can provide valuable insights, facilitate knowledge sharing, and enhance decision-making.

Future outlook: The role of finance in the energy transition

Looking forward, the role of finance in the energy transition is expected to grow. As the demand for clean energy continues to rise, the need for capital to finance renewable energy projects will also increase. This presents a significant opportunity for finance professionals to play a leading role in the energy transition.

However, to seize this opportunity, finance professionals will need to continue to evolve. They will need to deepen their understanding of the energy market, develop expertise in renewable energy technologies, and build strong partnerships with key stakeholders. Only by doing so can they overcome the challenges of the energy transition and seize its many opportunities.

In this journey, finance professionals will not only contribute to a cleaner, greener future but also create value for their clients and stakeholders. The energy transition, therefore, represents not just a challenge but also a unique opportunity for finance professionals to shape the future of energy and make a meaningful impact on the world.

Conclusion

In conclusion, the energy transition presents a unique set of challenges and opportunities for finance professionals. Despite the challenges, the energy transition also brings numerous opportunities for finance professionals. These include new investment opportunities in renewable energy, the chance to drive sustainable growth, and the potential to contribute to a cleaner, greener future.

To navigate this complex landscape, finance professionals will need to develop new strategies and skills. These include understanding the energy market, developing expertise in renewable energy technologies, and building partnerships with key stakeholders.

As the world continues to transition toward renewable energy, the role of finance in this transition will only grow. This presents a significant opportunity for finance professionals to shape the future of energy and make a meaningful impact on the world. The journey may be challenging, but the rewards — both financial and environmental — are well worth the effort.