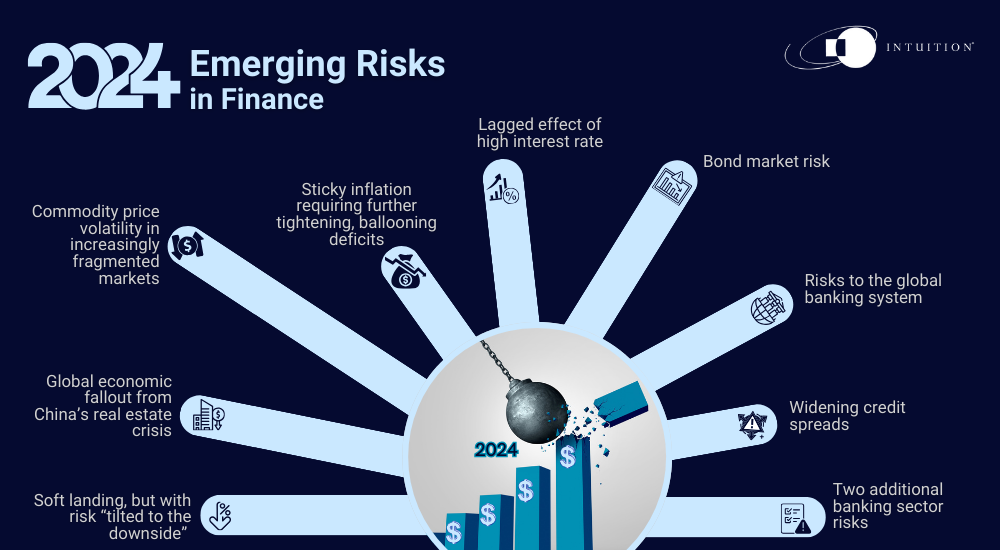

Emerging risks in finance: “Tilted to the downside”?

As the year-end approaches, the focus of market strategists and economists is on the risks to the global economy and markets in 2024. Key potential sources of risk for the global economy include fallout from China’s real estate crisis, commodity price volatility, persistent inflation, and ballooning government deficits. For the global banking sector, key risks include liquidity/funding risk and one less widely talked about – outsourcing risk.

The global economy is “limping along,” having shown “remarkable resilience” to the major shocks of a global pandemic, Russia’s invasion of Ukraine, and the cost of living crisis. This is the verdict of the International Monetary Fund’s (IMF) World Economic Outlook 2024, which also notes widening global divergences.

The IMF’s latest projections show global growth slowing from 3.5% in 2022 to 3% in 2023 and 2.9% next year. Headline inflation should continue to decelerate, from 9.2% year-on-year in 2022, to 5.9% in 2023 and 4.8% in 2024. Meanwhile, core inflation, which excludes food and energy prices, is also projected to decline, albeit more gradually than headline, to 4.5% in 2024.

Soft landing, but with risk “tilted to the downside”

While the IMF sees these projections as increasingly consistent with a “soft landing” scenario, in which monetary authorities succeed in bringing inflation down to their targets without causing a major downturn in activity, it sees the risk to its view as “tilted to the downside.” The IMF identifies several hazards that could thwart a soft landing.

Global economic fallout from China’s real estate crisis

One of the key risks the IMF sees is damage to the global economy from a deepening of the real estate crisis in China, which presents a complex policy challenge for Chinese authorities. A rapid decline in real estate prices has the potential to devastate the balance sheets of both banks and households. Artificial price support may protect balance sheets temporarily, but at the expense of other investment opportunities, according to the IMF. It would also reduce new construction activity and adversely affect local government revenues through reduced land sales.

The IMF concludes that China’s economy needs to pivot away from a credit-driven growth model excessively reliant on real estate. But given China’s importance as a global growth engine in recent decades, can such a transition be achieved without major disruption to the global economy? Economies such as Germany, which have depended heavily on exports to China, could suffer, and indeed the IMF projects recession in Germany in 2024.

Commodity price volatility in increasingly fragmented markets

A second risk highlighted by the IMF is increased commodity price volatility owing to renewed geopolitical tensions and increasingly fragmented markets. The potential for increased dispersion in commodity prices across regions, including minerals critical to the climate transition, “could pose serious macroeconomic risks growing forward, including to the climate transition.” More broadly, it presents a serious challenge to policymakers’ efforts to bring down inflation.

Lagged effect of high interest rates

Monetary policy tends to work with “long and variable lags” estimated to be between 18 months and two years. This would put 2024 right in the line of fire – another major risk in the coming year. According to the IMF, policy tightening has started to bite, and this is a key factor underpinning its lower GDP growth projections for next year. A more dramatic-than-envisaged hit to growth is a key concern for many strategists and economists.

Sticky inflation requiring further tightening, ballooning deficits

Persistent core inflation is another key risk identified by most 2024 “outlooks” that are doing the rounds, including the IMF’s. Despite considerable progress in bringing inflation down, core inflation may yet become entrenched, because of secularly tight labor markets and ample excess savings in some countries. This may in turn require additional monetary tightening from central banks.

Substantial deficits and elevated debt levels in G10 countries are yet another major cause for concern being flagged across the board. The decisive responses by governments and policymakers to the shocks of recent years have contributed to elevated debt levels and ballooning fiscal deficits in major economies, leaving them with little fiscal room to address future shocks.

Bond market risk

A related concern heading into 2024 is the threat these deficits pose to bond markets, particularly US Treasuries, given their importance to the smooth functioning of the global economy. The question many strategists are asking is: who will buy the growing supply of bonds required to fund the deficits?

In an environment of continued monetary tightening, where central banks are not buying – or in some cases, are still selling bonds – the onus would fall on the broader public. This could cause a “crowding out” effect where other asset classes, notably equities, suffer, as positions there become a source of funding for the required bond purchases.

Risks to the global banking system

Drawing on a global stress test, the IMF’s Global Banking Stability Report, published alongside its Outlook, concludes that the global banking system remains broadly resilient. Nonetheless, it points to many banks in advanced economies with the potential for significant capital losses, “driven by marking to market securities and provisioning for loan losses.” In an adverse scenario characterized by severe stagflation, the global stress test identifies the risk of “significant capital losses in a wide set of banks, including several systemically important institutions in China, Europe, and the United States.”

Widening credit spreads

Credit risk – specifically, the potential for credit spreads to widen – is a lingering concern for some strategists. The effects of the high interest rate environment are yet to be felt in any meaningful way in credit markets. Having widened significantly in response to the banking turmoil in March, spreads have since fallen, as pressures have eased. Credit seems surprisingly resilient, with tight spreads. However, the potential for persistent inflation globally, geopolitical uncertainty, and sluggish growth pose a clear threat to this benign picture. If these risks were to materialize, they would impact borrowers’ capacity to pay down debt, causing risk aversion to rise and credit spreads to widen. From currently low levels, some see considerable room for credit spreads to move.

Two additional banking sector risks

Swiss banking regulator FINMA has identified two new risks for the sector to consider in its Risk Monitor 23 publication.

The first of these is liquidity/funding risk, which is the risk that in a crisis, financial institutions will have insufficient liquid funds to meet short- to medium-term obligations. FINMA notes, recent events highlighted the speed with which deposit outflows can occur, the elevated concentration in funding structures, as well as the contribution of social media and digital financial systems.

The second risk FINMA sees – one less widely discussed – is outsourcing risk. Outsourcing has grown strongly in recent years due to digitalization, the boom in cloud services, and a focus by financial institutions on their core business, leaving financial institutions increasingly dependent on third-party service providers to perform critical functions. Two-thirds of banks have outsourced their payments services, FINMA notes, while 80% of banks and 60% of insurers have outsourced settlement for IT infrastructure and operations, and so-called “sub-outsourcers” have added an additional layer of complexity in supply chains.

While these developments bring advantages such as flexibility, innovation, and improved operational resilience, any interruptions and outages of critical functions at key service providers could pose significant risks. The risk is particularly acute where there is a heavy concentration with a single provider, as is the case with cloud services.

In extreme cases, FINMA contends, a disruption in outsourcing could affect the stability of the financial market.

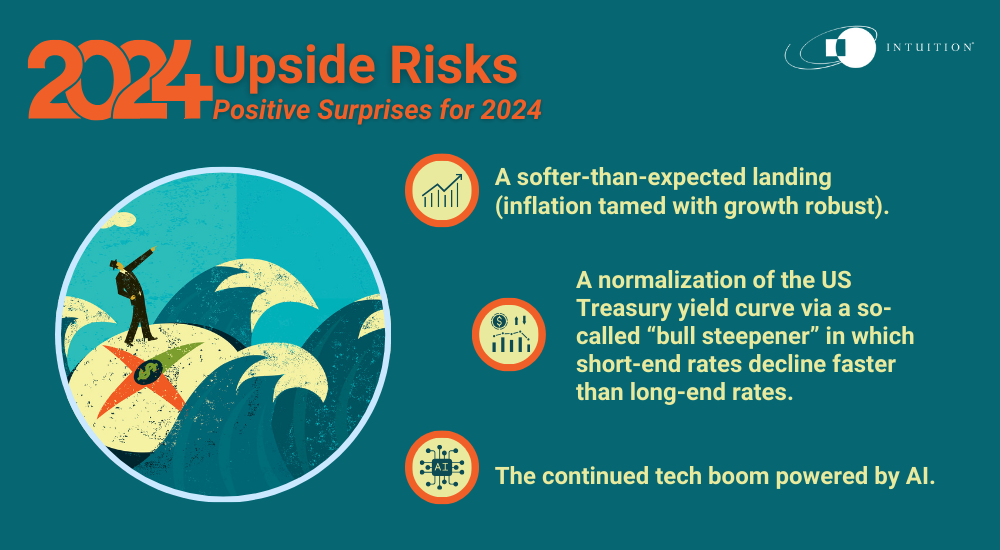

What could go right?

With so much focus on risk heading into 2024, could things instead go right? After all, markets like to surprise. Some of the potential upside risks/positive surprises cited include:

- A softer-than-expected landing (inflation tamed with growth robust)

- A normalization of the US Treasury yield curve via a so-called “bull steepener” in which short-end rates decline faster than long-end rates – notably positive for the banking sector

- The continued tech boom powered by AI

All told, 2024 is shaping up to be a very interesting year.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Economic Indicators – An Introduction

- Inflation – An Introduction

- Monetary Policy

- Fiscal Policy Analysis

- Bond Markets – An Introduction

- Commodities – An Introduction

- Fixed Income Analysis – Credit Risk

- Basel III – An Introduction

- Basel III – Pillar 1 & Capital Adequacy

- Operational Resilience

- Digital Banking

- FinTech – An Introduction

- AI & Machine Learning – Primer