Education as a strategy – Redefining emerging market access in pharmaceuticals

“Impatience” is often cited as a major shortcoming among pharmaceutical companies trying their hand at emerging markets.

The opportunity as discussed in theory, typically depicts the potential growth these countries have to offer, while the reality rarely presents itself so clearly.

Emerging markets do represent a considerable opportunity for pharmaceutical investment. Let us not discourage from that point. But success on the other hand, demands an appreciation for some of the more exacting details, and an awareness of where issues arise when strategy is neglected.

Emerging markets in the form of India, Mexico, China, Brazil, and developing African nations represent some of the most significant regions for new investment moving forward. As populations migrate outward and once rural concentrations become gradually urbanized, illness patterns shift. Non-Communicable Diseases (NCD’s) such as diabetes, cardiovascular disease and cancer tend to surge as markets mature. While disease incidences rise, an ever-mounting stress is placed on underdeveloped medical infrastructures.

HCPs often lack the essential training to treat conditions and comorbidities around the likes of Diabetes. Not because solutions do not exist, but because the information and infrastructural deficits professionals are forced to work around do not nearly reflect the progress made within the science.

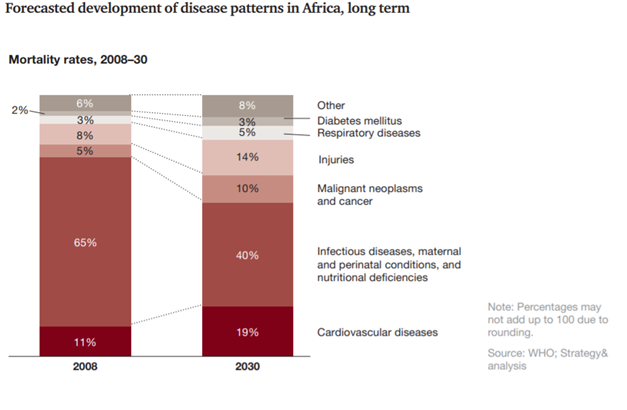

The figure below represents how disease patterns are predicted to shift in Africa over the next decade. As more and more people are lifted out of abject poverty, lifestyle habits begin to reflect improved standards of living, which in turn influences the prevalence of new disease patterns. Cancer and cardiovascular disease constitute some of the biggest expectations in this regard.

Building foundations – educational infrastructure

Emerging markets present their own limitations. Circumstances differ between borders, and more than often illustrate the geo-political, sociological, and cultural complexities of the region.

Organizations must reconcile these factors, leveraging the strengths of any market with a similar, mindful understanding for what it lacks. Educational infrastructure crutches the ability of pharmaceutical companies to meaningfully interact with these economies. The conversation needs to revolve around training standards, and the role educational initiatives might play in unlocking the latent potential of these new geographies.

Local investment should be considered in terms of sustainability, and not as a sunk cost. Collaborating with NGOs on the provision of proper medical training standards can help improve treatment rollout. While working to this end might further solidify the medium through which pharmaceutical companies can provide access to their products over time. By educating domestic HCP populations, organizations empower both sides of the conversation. A commitment to developing local talent creates a positive feedback loop. For the sake of posterity, new generations inherit training standards as they become established and integrated within curriculum rubrics. It is a game of attrition at the end of the day.

Pharmaceutical companies might consider how to avoid becoming too myopic in their approach to strategy in this regard. Shock and awe campaigns critically lack the patience needed to foster long-term growth in these regions. Organizations need to collaborate with communities by facilitating a reciprocal dialogue, focused on improving access to disaffected population groups. This represents the kind of infrastructure that needs to be built slowly, and from the ground up, where education takes centre stage moving forward.

Defining success

Emerging markets will play a pivotal role as major contributors to pharmaceutical profitability over the coming years. As economies mature and the spread of opportunity diversifies, organizations will need to take stock of what these new investments look like, and how they might expect to be managed. Integration strategies need to account for contingencies. Working around market instability is characteristic of the broader challenge presented within emerging economies after all. Volatility at a local and national level should be expected.

Finding, retaining, and developing local talent consistently stands out as one of the key determinants of success in emerging markets, as defined by executives competing in the space. A steady influx of multinationals into these economies has stretched an already scarce resource against the backdrop of new, impatient demand. Incorporating systematic training standards would serve the purpose of bolstering the supply of professionals both in terms of quantity and quality. But it’s more than just simple numbers, or a school-day lesson in economies of scale. Empowering HCP’s with the tools and intelligence necessary to treat inherently “preventable” diseases makes sense, whatever way you look at it.

Conclusion

The influence of emerging markets is on the rise. Populations are ageing, economies are maturing and the capacity for new investment is following suit. The next few decades will surely tell a different story of what direction the pharmaceutical industry takes on its path to exploiting new, commercially viable opportunities. As towns become cities, and urbanization plays its part in shifting disease trends, populations will become equally reliant on how these investment opportunities are actualised.

It’s a less straight forward and far less allegorical process than planting a flag, however. Organizations need to invest as much time as capital to build foundations that support the function of their commitment to these areas. It’s a slow, tempered procedure that requires patience, and a concerted understanding for what specific challenges each market presents. Education can help transform and realize this vision for all stakeholders involved. Empowering HCPs means to empower patient groups at the same time, resolving information gaps and progressing the cause of treatment access forward for everyone.