DeepSeek’s market shock: What you need to know

A breakthrough AI model by Chinese upstart DeepSeek created a storm in global financial markets in January, slashing nearly USD 1 trillion of US tech sector market capitalization in a single day and forcing a dramatic rethink of AI valuations.

Nvidia plunged 17%, with other semiconductor stocks also suffering steep single-day losses, including Broadcom (-17%), Marvell Technology (-19%), and Micron (-11%). The Philadelphia Semiconductor Index dropped 9.2%, its sharpest decline since March 2020.

***

***

Get weekly insights from The Intuition Finance Digest. Elevate your understanding of the finance world with expertly-crafted articles and podcasts sent straight to your inbox every week. Click here: https://www.intuition.com/finance-insights-the-intuition-finance-digest/

***

Stock market concentration risk

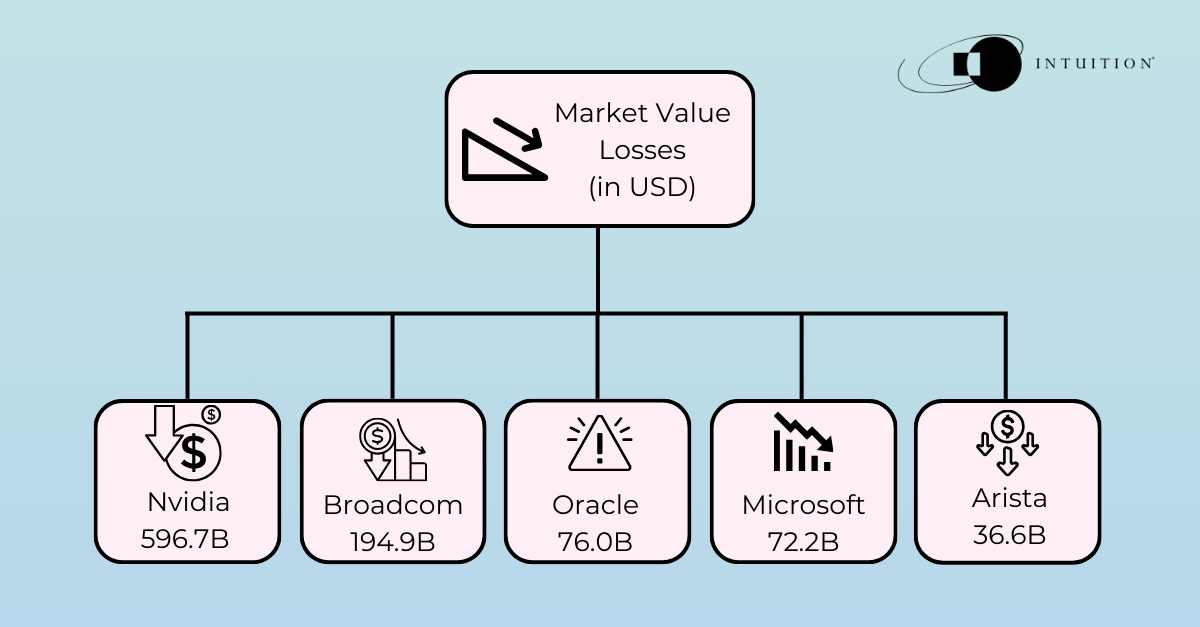

In absolute terms, the losses were even more striking. Nvidia’s 17% decline wiped out nearly USD 600 billion in market capitalization—accounting for about half of the overall losses. This reflects Nvidia’s newfound status as the world’s most valuable company and underscores growing concerns over concentration risk.

The US stock market is experiencing unprecedented concentration, with just 26 stocks now accounting for half of the S&P 500’s value. The overall market’s strong dependence on a few tech giants like Nvidia raises concerns about diversification. Furthermore, the rich valuations of these stocks may imply lower long-term returns while making them – and therefore the market – especially vulnerable to changes in the narrative that propped them up.

The concentration effect was seen across the so-called “Magnificent Seven” tech giants: while Microsoft’s and Meta’s 3.9% and 3.1% declines may seem modest in percentage terms, they translated to billions in lost market cap.

Stocks that recorded largest nominal declines

| Company | Market Value Lost (Billions) |

|---|---|

| Nvidia | USD 596.7 |

| Broadcom | USD 194.9 |

| Oracle | USD 76.0 |

| Microsoft | USD 72.2 |

| Arista Networks | USD 36.6 |

The DeepSeek debacle was good for hedge funds on aggregate, particularly those that had built short positions. Nvidia-related stocks and exchange traded funds (ETFs), and utilities and energy companies also suffered but according to Goldman Sachs, hedge funds had on aggregate meaningfully reduced net exposure to the affected areas.

Why does DeepSeek matter?

The scale of the DeepSeek impact comes down to the sheer magnitude of capex deployed and projected in AI development and investor perceptions regarding this capex.

The largest tech firms have spent heavily on AI development, including cloud infrastructure, specialized chips, and large-scale AI models. Nvidia alone saw its data center revenue more than triple year-over-year, reflecting soaring demand for AI accelerators. Microsoft, Google, and Meta have each directed tens of billions into AI-related capex, with Microsoft’s AI investments reaching an estimated USD 50 billion in 2023 and projecting a further USD 100 billion or so of spending. More recently, President Donald Trump announced the “Stargate” project, a private-sector initiative involving OpenAI, MGX, Oracle, and SoftBank, aiming to invest up to USD 500 billion in AI infrastructure. This ambitious plan underscores the escalating commitment to AI development at the highest levels.

The rationale put forward by the companies themselves for the heavy spending was to widen the competitive gap the giants have over potential disruptors. Unlike past technological cycles where new entrants could disrupt incumbents, AI development would favor those with the capital to invest at scale and the balance sheets to support it. In short, barriers to entry were perceived to be high and the tech giants were investing in AI “moats” – a word that we’ll probably be hearing a lot in forthcoming discussion of this event and its implications.

AI investment projections

| Metric | Current Status |

|---|---|

| AI Infrastructure Spending | USD 300B through 2025 |

| Data Center Investment | USD 1T over 5 years in US, and another 1T invested internationally |

| Microsoft AI Investment | USD 80B for 2025 |

Investors bought the narrative, and it was reflected in significant stock market gains for those giants investing heavily in capex, and the resulting heavy concentration. When a previously unknown company came along with a model that has similar capabilities to those of the giants, at a cost of just USD 5-6 million, it posed a major challenge to this consensus. This was exactly what was not supposed to happen, and the market reaction was all the more pronounced given how heavily positioned investors were in this view through those tech giants.

***

AI stats every business must know in 2025

***

While details are yet to emerge about DeepSeek’s capabilities, and there is also a lot of talk that the stated development cost of USD 5-6 million may be understated, DeepSeek’s AI model has nonetheless demonstrated that high-performance AI can be achieved with significantly lower investment. It is likely to have meaningful implications across a wide range of areas, including:

- AI infrastructure and hardware investment

- Software investment and supply chains, especially for semiconductors

- Energy/utility sector valuations

- Global trade

- Geopolitics

Let’s take a look at some of these.

Infrastructure investment

It was previously assumed that AI development – notably the training and operation of AI systems – required heavy investment in infrastructure such as data centers.

Tech giants have set aside vast amounts of capital, more than half of which is to be allocated to projects within the US. Meta, the parent company of Facebook and Instagram, has projected up to USD 65 billion of capex this year, including funding for a large-scale data center project in Louisiana. Microsoft projects investment of approximately USD 80 billion in 2025 in similar centers.

These plans will likely need to be reassessed. According to Goldman Sachs, companies will now look for more affordable infrastructure solutions, taking advantage of lower barriers to entry into a much more competitive AI market.

The focus could now shift to:

- Flexible infrastructure solutions that enable quick scaling

- Integration of lower-carbon technologies, including carbon capture and renewable energy sources

- Virtual Power Plants (VPPs) as alternative solutions for data center needs

Chinese researchers have come up with new ways to work with existing infrastructure and reshape supply chain dynamics.

Impact on semiconductors

The DeepSeek model was built using just 10,000 Nvidia general processing units (GPUs). They showed they could develop competitive AI models using only 2,000 specialized chips, while other leading models require 16,000.

It’s no wonder then that Nvidia and other semiconductor companies suffered such large stock market losses. If powerful AI systems can be built with fewer chips than previously believed, it lowers semiconductor demand and forces changes to supply chains.

Knock-on effects – energy/utilities

DeepSeek’s cost-efficient model has significant potential knock-on effects on other sectors, notably utilities and energy, in particular producers of natural gas – a key feedstock for power generation.

Utilities were among the top-performing sectors in the S&P 500 in 2024, largely on expectations of strong electricity demand from energy-intensive data centers.

Data centers in the United States used 4.4% of total electricity in 2023.

Impact on jobs

Lower AI development costs could push even faster automation in cognitive jobs and change what companies will need from workers.

New opportunities are likely in:

- AI system optimization and maintenance

- Workforce development programs

- Research and development initiatives

***

Know-How spotlight: Climate risk, crypto, compliance, and more

***

Impact on global trade & geopolitics

DeepSeek, and particularly the decision to open-source its AI models, has significant implications for global trade dynamics. By sharing its code with businesses and researchers across the globe, DeepSeek has lowered barriers to entry, enabling a broader range of entities to develop and implement AI solutions. This move has intensified competition across various sectors globally, as organizations can now access and build upon state-of-the-art AI models without incurring substantial development costs.

DeepSeek’s breakthrough no doubt raises alarm bells for those in the West concerned about China’s abilities. DeepSeek in this regard is a major challenge to the US strategy to contain China’s AI progress through export limits.

Investment community reactions & recommendations

Reactions in the investment community, from institutional investors to sell-side analysts to hedge funds were mixed, as are the recommendations on what investors should or shouldn’t do.

Some investors and analysts are calling this a “Sputnik moment” for the AI industry. Brian Jacobsen, chief economist at Annex Wealth Management, said DeepSeek could be “the proverbial ‘better mousetrap’ that could disrupt the entire AI narrative“.

Others see the event as a welcome correction in over-inflated AI valuations and recalibration of risk, but do not see it derailing the AI growth story. Main Street Research, with USD 2.5 billion in AUM, believes that market volatility continues but DeepSeek poses no real threat to established companies. UBS analysts note the tendency for tech indices to bounce back consistently over 12 months after a 10% reset.

On Nvidia, opinion is also divided. Charu Chanana, chief investment strategist at Saxo, sees fiercer competition in AI challenging Nvidia’s market position. Meanwhile, Daniel Morgan, senior portfolio manager at Synovus Trust Company, which owns nearly a million shares, calls the recent market reaction excessive, and presumably does not plan to sell. There are also those who believe Nvidia may ultimately benefit. While DeepSeek may hurt Nvidia in the short term, it blows the market open to competition and the other disruptors that can now enter the market will all require chips.

Tech valuations & correction risk

As of the start of February, Nvidia Corporation (NVDA) is trading around USD 120 per share, with plenty of volatility.

Analyst consensus price targets are around USD 175, suggesting potential upside of around 40% from current prices. These reflect undeniably punchy assumptions on Nvidia’s future performance that will need to be revisited. From a contrarian, this universal bullishness does not bode well for the stock and price targets will need to be downgraded.

Some believe the tech sector needs a major reset. Analysis from Bank of America shows that 19 out of 20 tech valuation metrics are at extremes. The S&P 500’s trailing price-to-earnings ratio of 25.3 times is 70% above its 125-year average. This points to a possible market correction ahead.

FAQs

Q1. What was the immediate impact of DeepSeek’s emergence on the stock market?

DeepSeek’s breakthrough triggered a massive tech sector selloff, causing Nvidia’s stock to plummet 17% and erasing nearly USD1 trillion in market capitalization. The S&P 500 tech sector experienced its biggest decline since September 2020, dropping 5.6%.

Q2. How did DeepSeek’s AI model development cost compare to its market impact?

DeepSeek’s AI model was reportedly developed at a cost of only USD 5 to USD 6 million, caused a market disruption that threatened nearly USD 1 trillion in market capitalization. This stark contrast highlighted the potential for cost-efficient AI development to challenge established market leaders.

Q3. What were the implications of DeepSeek’s breakthrough for the semiconductor industry?

The semiconductor industry faced significant valuation changes, with companies like Marvell Technology, Broadcom, and Advanced Micro Devices experiencing substantial stock price declines.

Q4. How did institutional investors and hedge funds respond to DeepSeek’s market disruption?

Institutional investors rapidly adjusted their strategies, with some viewing the market reaction as an overreaction. Hedge funds had already begun reducing their exposure to tech stocks in the week before DeepSeek’s emergence, demonstrating foresight in anticipating market shifts.

Q5. What are the projected long-term effects of DeepSeek’s breakthrough on AI sector valuations?

Historical data indicates that the stock market has typically rebounded relatively quickly following corrections. According to Invesco, the average time to recover from a 5%-10% downturn is approximately three months, while a 10%-20% correction usually sees recovery within about eight months. Despite the setback, investors are confident the AI market will rebound, with early valuations already indicating an overreaction to Deepseek’s introduction.

References

Market impact & AI disruption

- Tech Stock Sell-Off: DeepSeek AI’s Impact on Markets – Business Insider

- DeepSeek’s AI App Tops Apple App Store – MacRumors

- DeepSeek’s Impact on U.S. Tech Dominance – Yahoo Finance

- Why China’s AI Startup DeepSeek is Sending Shockwaves Through Global Tech – Al Jazeera

- China’s DeepSeek Sets Off AI Market Rout – Reuters

- The Biggest Winner in the DeepSeek Disruption Story is Open-Source AI – Forbes

Stock market reactions & valuations

- S&P 500 Falls as DeepSeek AI Sparks $1 Trillion in U.S. Tech Losses – Investor’s Business Daily

- Oracle Feeling the Heat Amid AI Disruption – Yahoo Finance

- Nvidia’s Stock Set for Record Wipeout on DeepSeek Fears – New York Post

- Stock Selloff: AI DeepSeek, Nvidia, and Market Investing Strategy – Business Insider

- Stock Market Outlook: Magnificent 7 Tech Stocks Must Maintain Momentum – Business Insider

- ASML’s Earnings Amid DeepSeek’s Market Disruption – MarketWatch

- UBS Analysts: DeepSeek Won’t Derail AI Growth Story – UBS

Semiconductor & AI hardware impact

- Why AMD Stock Declined Following DeepSeek’s Disruption – The Motley Fool

- Micron Technology Earnings Preview – Barchart

- Arm Holdings Shares Drop 9.86% – GuruFocus

- DeepSeek’s Ripple Effect on AI and Supply Chains – EPS News

- The AI Disruption: Nvidia, OpenAI, and the Future of Tech – Financial Times

Investment strategies & risk management

- JPMorgan’s Market Takeaways: AI Frenzy & Portfolio Strategy – JPMorgan

- Bank of America: Market Valuations and the Need for Tech Strength – Financial Times

- Invesco’s Stock Market Corrections & Recovery Insights – Invesco

- Main Street Research: DeepSeek Poses No Real Threat to Established AI Companies – WhaleWisdom

Energy & infrastructure adjustments

- Chevron’s Power Solutions for AI Data Centers – Chevron

- US Power Stocks Plummet as DeepSeek Raises Data Center Demand Doubts – Reuters

- DOE: Data Centers Consumed 4.4% of US Power in 2023, Could Hit 12% by 2028 – Data Center Dynamics

- Grid Connection Backlog Grows by 30% in 2023 – Lawrence Berkeley National Laboratory

- Virtual Power Plants as AI Infrastructure Solutions – Next Kraftwerke

Broader economic & trade implications

- China’s AI Disruption & Global Trade Shifts – Business Insider

- Hedge Funds Were Pausing US AI Bets Before DeepSeek Emerged – Reuters

- The Guardian: Tech Shares Across Asia & Europe Decline Over DeepSeek’s AI Impact – The Guardian

- Saxo Bank: How DeepSeek’s Rise is Reshaping Global AI Competition – Saxo