Cryptocurrency Risk Worries Multiply

Investment is a perpetual search for superior returns relative to risk. At different points in time, various asset classes came into vogue. In the 1970s, gold was in favor. The 1990s saw emerging markets take on a new prominence. This century has seen the rise of alternatives.

All of these asset classes share certain characteristics. They are difficult to gain access to; they have low correlations with existing asset classes; they are relatively illiquid; and they are significantly riskier.

Bitcoin/US Dollar FX Spot

Cryptocurrencies also promised superior returns – indeed their returns over certain time periods have been nothing short of spectacular. But recent reversals have confirmed the skepticism of their critics who contend that crypto can never be taken seriously as an investable asset: this is on the grounds of their volatility, difficulties over their valuation, and an inherent unsustainability given the vast amount of energy expended in the ‘mining’ process.

Central authorities tackle cryptocurrency risk

There is also risk related to the decentralized blockchain technology that is the foundation of crypto assets; the risk of fraud and the risk of holders losing their holdings through their own errors.

The result has been a determination on the part of central authorities to apply downward pressure on the crypto boom, notably the banning of cryptocurrency transactions in China in 2021. At the same time, central banks have accepted that there is a demand for crypto and this has initially been manifested in their efforts to develop central bank digital currencies (CBDC).

For central banks, CBDCs go some way to countering the crypto threat to their mission, in spite of the fact that (relative to crypto) they lack the key feature of anonymity that makes cryptocurrencies so compelling for many. That said, as a means of payment, CBDCs will likely dominate crypto given their official endorsement, safety, and widespread recognition.

Related article: CBDC: Central Banks Mobilize to Retain Control Over Monetary Sovereignty

Cryptocurrency threatens financial stability

And there is further systemic risk posed by crypto that concerns central banks, who view its rise as something inherently unstable in the financial system.

Related article: Five Finance Jobs of the Future

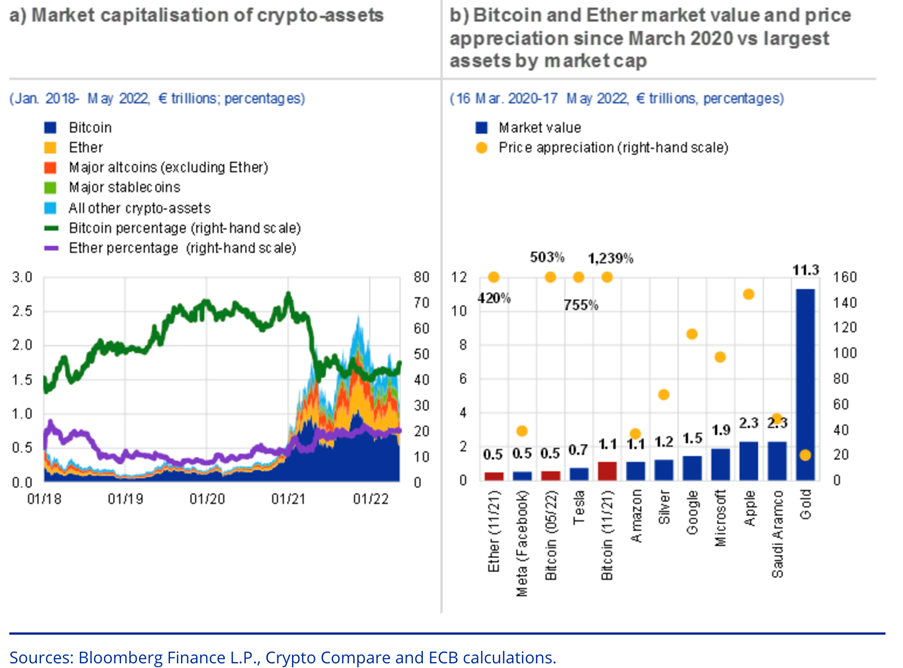

The European Central Bank (ECB) in its Financial Stability Review published in late-May singled out the rise in cryptocurrency for special treatment.

“The stellar growth, volatility and financial innovation currently seen in the crypto-asset ecosystem, as well as the rising involvement of institutional investors, show how important it is to gain a better understanding of the potential risks that crypto-assets could pose to financial stability if trends continue on this trajectory. Systemic risk increases in line with the level of interconnectedness between crypto-assets and the traditional financial sector, the use of leverage and lending activity. It is important to close regulatory and data gaps in the crypto-asset ecosystem to mitigate such systemic risks.”

~ European Central Bank, Financial Stability Review, May 2022

While the ECB report notes that crypto-asset markets currently represent less than 1% of the global financial system in terms of size, they have grown significantly since the end of 2020. Yet, despite recent declines, “they remain similar in size to, for example, the securitised sub-prime mortgage markets that triggered the global financial crisis of 2007-08.” The report also observes that “increasing correlation of crypto-asset prices with mainstream risky financial assets during episodes of market stress casts doubt over their usefulness for portfolio diversification”.

Cryptocurrency increases links to traditional finance

Interconnectedness with the wider financial system has been growing. According to the ECB’s report, this is occurring “mainly via expanded portfolios or ancillary services associated with digital assets (including custody and trading services).” But the report also notes that major payment networks have increased support of crypto-asset services through their retail networks. This has made crypto-assets more easily accessible to consumers and businesses who are vulnerable in the face of its volatility. Institutional investors, including hedge funds, family offices, some nonfinancial firms, and asset managers are now also investing in Bitcoin and crypto-assets more generally, with market intelligence suggesting that the growing involvement of asset managers is largely in response to demand from their own clients.

For some industry observers and practitioners, increased regulatory scrutiny is timely. A group of leading technologists has written to US lawmakers to counter the crypto boom, as quoted by the Financial Times: “We urge you to resist pressure from digital asset industry financiers, lobbyists, and boosters to create a regulatory safe haven for these risky, flawed, and unproven digital financial instruments.”

In this respect, this group are fully aligned with the ECB which concludes that “if the present trajectory of growth in the size and complexity of the crypto-asset ecosystem continues, and if financial institutions become increasingly involved with crypto-assets, then crypto-assets will pose a risk to financial stability.”

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Cryptography

- Blockchain – Primer

- Crypto Assets

- Asset Classes – Primer

- Asset Classes & Investing

- Asset Classes – Types

- Alternative Assets – An Introduction

- Commodities – Gold & Other Precious Metals

- Emerging Markets – An Introduction

- Payments – An Introduction

- Digital Money & Mobile Payments