Bonds back in favor: Will it last?

As we headed into 2024, the stage seemed set for a rousing rally in US bond markets. A combination of soft economic data releases and a dovish surprise from the Fed Chair Jerome Powell, following the FOMC’s December 2023 press conference, appeared to signal an end to the sustained high-interest-rate regime, with a cutting cycle on the cards.

Instead, the macroeconomic picture proved remarkably resilient, as high-frequency inflation and growth prints continually beat expectations in the early months of 2024. US Treasuries duly sold off while equities continued their upward march, as equity investors chose to ignore inflation and prioritize growth, with the AI boom providing further fuel.

In recent weeks, however, data has started to soften again, giving bond markets a new lease of life and putting equities on the backfoot. At the index level, this weakness has been masked by continued strong performance from a handful of tech giants – mainly NVIDIA and Apple – and is better captured in more economically sensitive benchmarks such as the S&P 500 equal-weighted stock index and global equity indexes.

[Basel III, Basel IV, Basel III Endgame, & Basel 3.1: Terminology Explained]

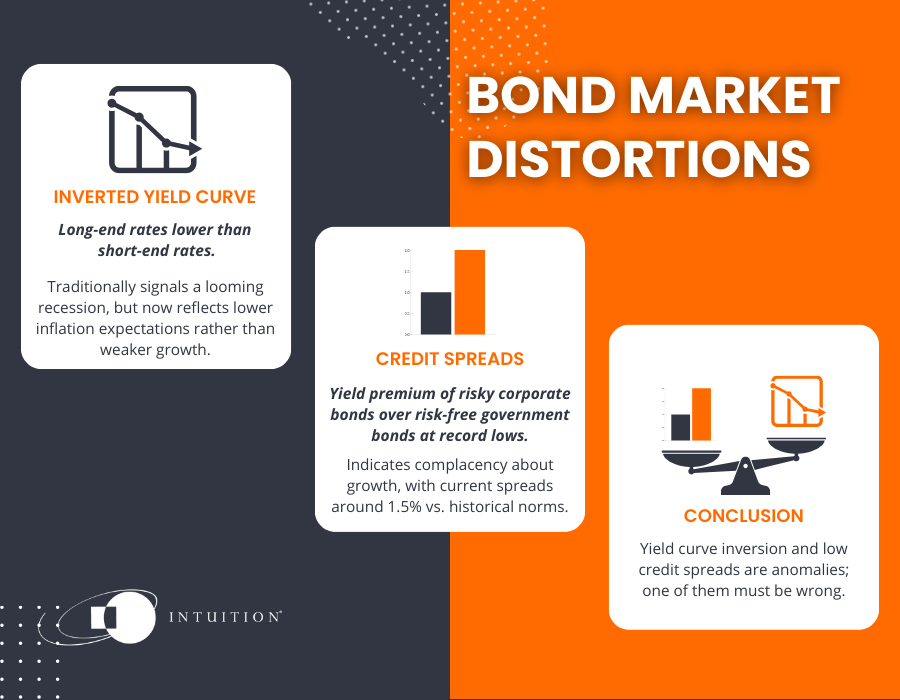

Bond market distortions

The high-interest-rate regime has been accompanied by some persistent distortions in the bond market.

One of these is an inverted yield curve (long-end rates progressively lower than short-end rates).

Traditionally, an inverted yield curve has signaled a looming recession. But on this occasion the inverted yield curve wrongfooted any investors heeding this signal.

The current inversion seems to be an artifact of the peculiar circumstances that triggered the hiking cycle in 2022 – namely COVID-related supply shocks combined with excessive fiscal stimulus. It reflects progressively lower inflation expectations as we move out along the curve, rather than weaker future growth.

Another distortion is credit spreads – the yield premium of “risky” corporate bonds over “risk-free” government bonds – at record lows. At present, US corporate debt is offering a premium of 1.5% over the equivalent US government debt benchmark – about 50 basis points below the historical norm. The message here is in stark contradiction to that of the inverted yield curve. Not only is the bond market showing no distress, with little to no fear of recession, but it’s reflecting outright complacency about growth.

Yield curve inversion coupled with record-low credit spreads is an anomaly. One of them must be wrong. So far, the yield curve inversion has been misfiring as a recession signal, while credit spreads have been on the money, as macro data has by-and-large surprised to the upside. But could this change?

***

Listen to this article and more on ‘The Intuition Finance Digest‘

Listen on Spotify | Listen on Amazon Music | Listen on Apple Podcasts

***

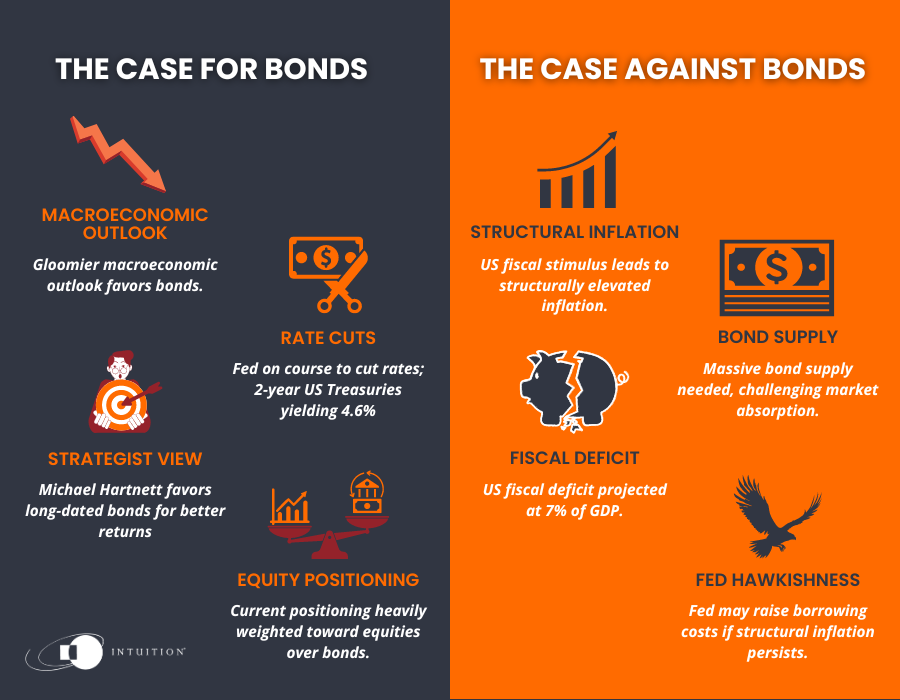

The case for bonds

Some strategists, including Michael Hartnett of BofA, expect the outperformance of US treasuries versus stocks to continue, favoring bonds over equities for the rest of 2024. Hartnett has also stated a preference for more rate-sensitive long-dated bonds, or “duration.”

This may seem odd given the inverted yield curve. With the Fed seemingly on course to cut rates this year, and 2-year US Treasuries still yielding around 4.6% as inflation trends lower again, “bull steepeners” (short rates down/prices up) look like the logical trade.

The case for duration rests on a gloomier macroeconomic outlook than is currently being priced. Hartnett, quoted in a Bloomberg article in May, noted “risk to corporate profits from some weaker signals on the economy” as well as positioning that is still heavily weighted toward equities over bonds. This positioning could provide additional fuel to any reversal in what Hartnett called the “anything but bonds” trade in the second half.

The case against bonds

The bond bears have a strong case too, which rests primarily on structurally elevated inflation in the US, driven by aggressive fiscal stimulus. The US fiscal deficit is projected to reach 7% of GDP this year (according to the Congressional Budget Office) and politicians on both sides of the aisle show no willingness to rein in spending. This means there will have to be massive supply of bonds in the years to come that could be difficult for the market to absorb.

Citing these risks as well as immigration pressures, one Fed governor and noted hawk, Michelle Bowman, even recently stated her willingness (in a speech cited by the FT) to raise borrowing costs if required. She believes structural inflationary pressures could keep US prices rising faster than in other advanced economies, where some central banks have begun cutting rates.

Conclusion

Long-dated bonds have undergone dramatic declines in recent years. TLT, the most widely followed and actively traded long-dated (20+years) US Treasury ETF, is down almost 40% from its all-time high reached in mid-2020. This illustrates the effect of duration (sensitivity of price to yield). It also implies significant room higher if the Hartnett camp is right, though it should be noted that those 2020 highs, or anything close, are well out of reach (an anomaly that may never be seen again).

By the same token, the downside potential to buying duration is significant if the bond bulls are wrong. It’s a high risk/highish reward proposition. Buying short-dated bonds (2-year USTs, for example) looks like a more favorable risk/reward – in the worst-case scenario where bonds take another dive, investors still lock in nominal yields of around 4.6% for two years. But it’s the consensus view and won’t make anyone rich.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Bond Markets – An Introduction

- Fixed Income Analysis – An Introduction

- Fixed Income Analysis – Credit Risk

- US Bond Markets

- Credit Analysis – An Introduction

- Yield Curves – An Introduction

- Yield Curves – Construction

- Duration Analysis

- Financial Authorities (US) – Federal Reserve

- Economic Indicators – An Introduction

- Inflation – An Introduction

- Monetary Policy

- Fiscal Policy Analysis