Banks Seek to Implement Sustainable Finance Strategies

Under pressure from clients and regulators, banks are trying to adopt new strategies designed to channel funding into sustainable economic activities. But the process has been challenging and uneven. A lack of clarity on key definitions and a shortage of necessary data have made it difficult for financial institutions to identify opportunities. At the same time, operational issues including a lack of integration of sustainability criteria in credit risk analysis processes, unclear targets, and insufficient monitoring have slowed the process. Looking ahead, much work is needed to make the goals of sustainable finance a reality.

The headlines on sustainable finance look rosy.

Big US banks have promised to open the spigots for green projects – JPMorgan Chase, for example, is aiming to finance and facilitate more than $2.5 trillion to address climate change and contribute to sustainable development between now and 2030, while Bank of America plans to deploy and mobilize $1 trillion to accelerate the transition to a low-carbon, sustainable economy over the same period.

Major European banks have also stepped up, with blockbuster commitments from institutions including Société Générale, Barclays, ING, Crédit Agricole, HSBC, and many others.

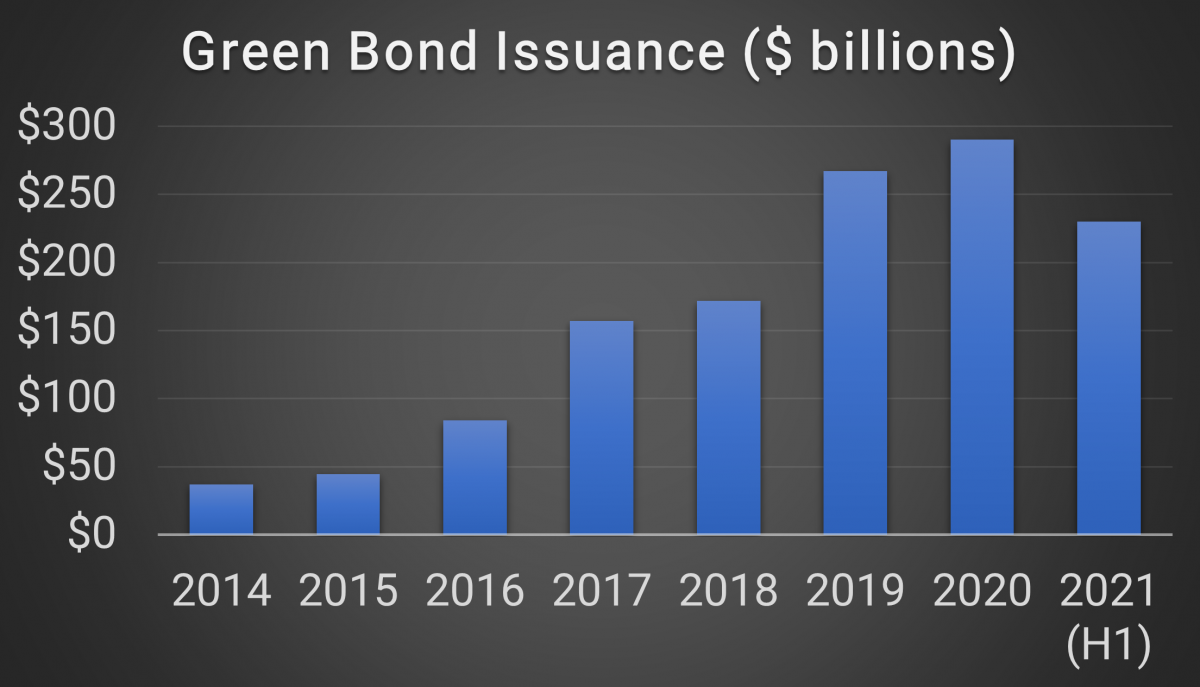

The green bond market is also growing rapidly – it more than tripled in size between 2016 and 2020, according to the Climate Bond Initiative – and is expected to hit around half a trillion dollars in issuance in 2021. The markets for other sustainable instruments, such as social bonds, are also growing fast.

On the strategic side, institutions that have embraced sustainable finance report that it is driving product innovation and enhancing their interactions with clients. Sustainable finance encourages a focus on the long-term, and many banks have found that, as they implement sustainable strategies, they are engaging more with clients about their long-term strategies, thereby building deeper relationships and a greater understanding of their clients’ businesses. This, in turn, is driving the adoption of sector-specific approaches as banks try to support their clients’ efforts to transform.

Climate Bonds Initiative. Green Bond Issuance. November 2021. 2021 data is for the first six months of the year only.

Overall, then, the general picture is one of a sustainable finance boom as institutions embrace ESG principles and the transition to a greener, cleaner, and fairer economy.

However, the positive headlines hide a much more complex, muddy, and patchy reality.

Uneven progress within institutions

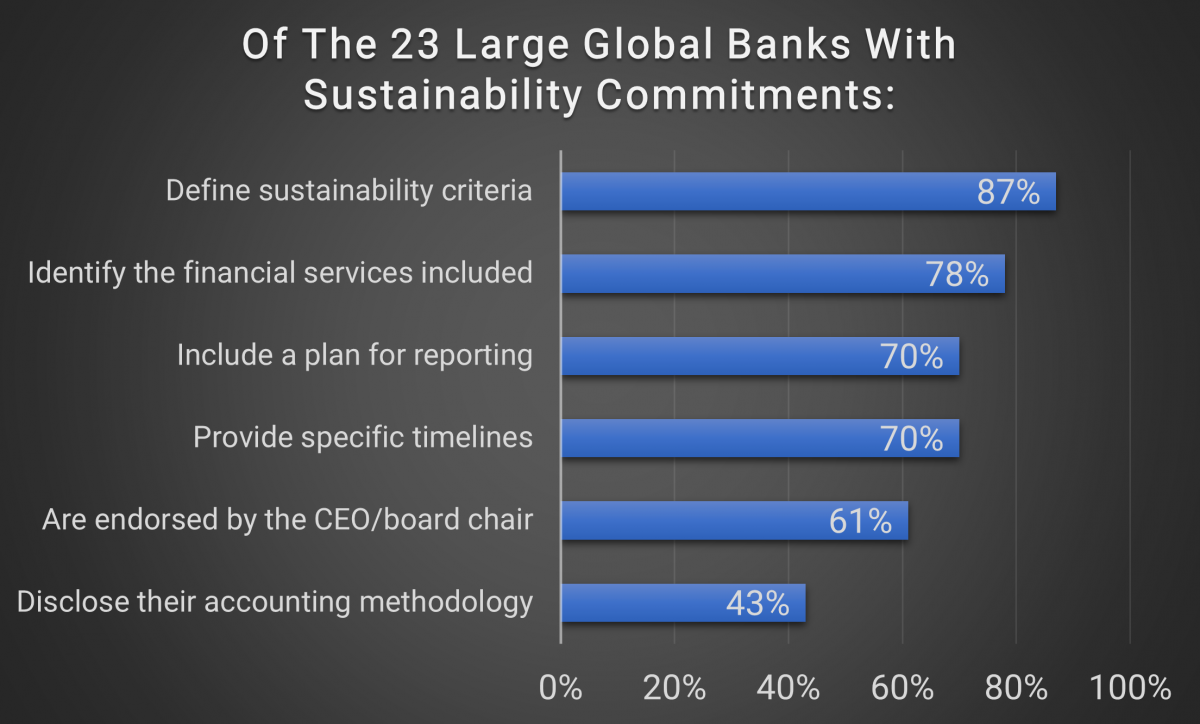

While many financial institutions have established sustainable finance targets, the World Resources Institute reports that less than half of the world’s 50 largest banks have done so, and their definitions of what counts as “sustainable” vary greatly. What’s more, among the 23 banks that do have sustainable finance targets, their average annual level of fossil fuel financing was – between 2016 and 2018 – nearly twice as large as their annualized commitments to sustainable finance.

Related article: Energy Prices are Spiking as the World Weighs its Climate Change Agenda

In addition, fewer than half of banks with sustainable finance targets disclose their accounting methodology for tracking their progress on those targets, making it impossible for external parties to develop a real sense of how much money is truly flowing into sustainable economic activities.

So, while the commitments coming from large global banks are to be applauded, they represent only a tentative first step. Many banks have yet to announce commitments, and investors and regulators need more information about how these institutions define and measure their progress on their sustainability targets.

Another common issue is that many institutions tend to regard sustainable finance as a separate category of financing. Consider, for example, green bonds. Many institutions set targets for green bond financing and consider these instruments to be the center of their sustainability efforts.

Many observers, however, point out that often green bonds finance projects that could as easily have been financed by standard bonds. Instead of developing a special type of funding for sustainable projects, critics argue that banks that are serious about sustainable finance should instead be integrating sustainability considerations into all their credit decisions.

When conducting credit risk analysis, ESG criteria should be given prominence alongside traditional factors and the potential risks associated with climate change and the green transition should be treated as material and important. Sustainability should be woven throughout the business rather than treated as a special interest area.

Broader issues

The problems with the transition to sustainable finance extend beyond the institutional level. At a market level, there are serious problems with definitions and data that are limiting the ability to identify opportunities and measure progress.

One core problem, which lies at the heart of the transition, is defining sustainable economic activities. Consider, for example, an institution that is deciding whether to lend to a hypothetical green technology company. On the one hand, the company has come under scrutiny for several governance issues and labor law violations. On the other hand, the company is producing a novel technology that could dramatically reduce carbon emissions.

Should a loan to this company be considered a positive investment in a low-carbon future or a problematic investment that raises ESG concerns? It is very difficult to answer this question because of the lack of a shared definition of sustainable economic activities.

Some regulators are working to address this. The European Union, for example, has published a taxonomy for sustainable activities that aims to provide a measurable and detailed list of economic activities that can be considered sustainable. The taxonomy should act as a foundation for sustainable finance efforts – anything that appears on the list can be considered a legitimate target for sustainable investment.

However, the process of creating the list and defining technical screening criteria has proven to be highly complex and the industry is still awaiting clarification on many issues. This is causing some anxiety as many rules based on the taxonomy are due for implementation, including the Sustainable Finance Disclosure Regulation (SFDR).

Related article: What is the SFDR? Sustainable Finance Disclosure Regulation

The difficult situation is being compounded by serious issues with data availability. To understand whether an activity counts as sustainable, institutions must be able to measure and assess a range of information. Unfortunately, few companies provide the detailed data required and third-party providers are scarce.

For financial institutions, this means that efforts to comply with EU sustainable finance rules and, more broadly, to shift their focus to funding sustainable activities, face many serious obstacles.

Outside the EU, the problems are even more complex given the lack of legislation around sustainability issues.

Clouded outlook

All of this means that the medium-term outlook for sustainable finance is highly uncertain. While investors and broader society display a strong appetite for the integration of sustainability criteria at banks and other financial institutions, difficulties abound.

Even those institutions that have tried to embrace sustainable finance are struggling to operationalize the process. Setting targets and monitoring progress is challenging, and few institutions have successfully integrated sustainability criteria into their everyday processes. More broadly, efforts to transition to sustainable finance are hobbled by a lack of clear definitions and data.

As the world works to build a fairer and less harmful economic system, financing is urgently needed. But without serious, concerted, and global efforts to overcome the roadblocks to successful sustainable finance, institutions will be forced to continue to muddle through.

Intuition Know-How has a number of tutorials that are relevant to sustainable finance:

- ESG – An Introduction

- ESG Factors

- ESG Investing – An Introduction

- ESG Investing – Strategies

- Impact Investing

- ESG Reporting

- Sustainable Finance – An Introduction

- Sustainable Finance – Principles & Frameworks

- Green Bonds – An Introduction

- Green Bonds in Practice

- Social Bonds & Sustainable Instruments

- Sustainable Development Goals (SDGs) – An Introduction

- Sustainable Finance Disclosure Regulation (SFDR)