US Stocks Soar Amid Pandemic: When Will the Crash Hit?

Despite the brutal economic consequences of the coronavirus pandemic and a recent correction, US stock markets appear ready to end the year in the black. This is an extraordinary performance at a time when the global economic outlook seems increasingly bleak and global trade seems increasingly threatened. What is driving this surprising market strength? Is it corporate and economic fundamentals, or is it the unintended result of broader monetary machinations?

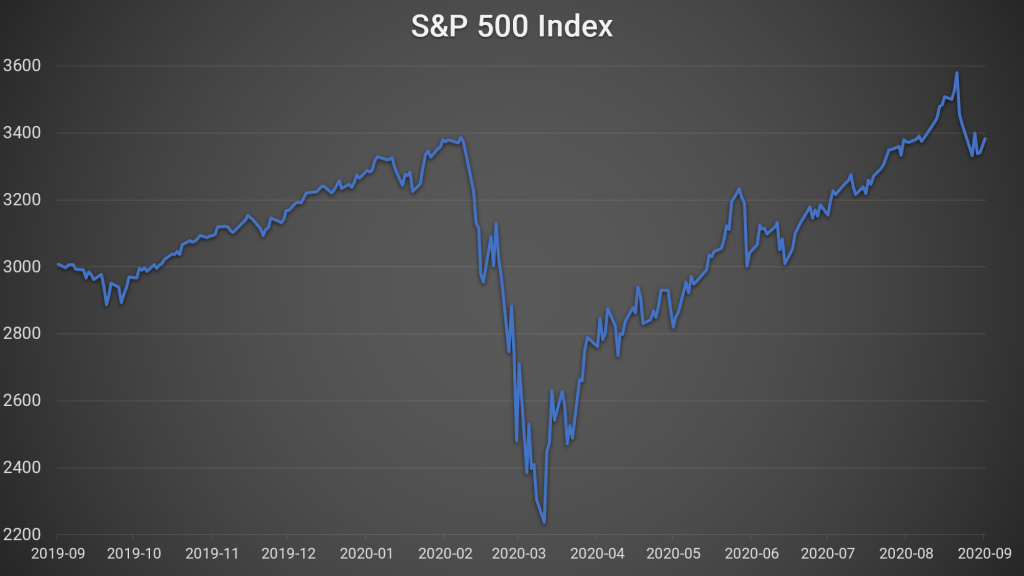

Despite the economic havoc wrought by the coronavirus pandemic, between the end of March and the beginning of September, the S&P 500 experienced virtually uninterrupted growth. Although the market is off its early-September highs, it has nevertheless erased almost all its first-quarter, pandemic-related losses in an extraordinary burst of growth. From its low point on March 23, it rose almost 58% by September 1.

Source: Yahoo! Finance, September 2020.

This exceptional performance comes despite high US unemployment, rising federal debt, slowing global trade, and ongoing social and economic disruption caused by the pandemic. It is also an unusually strong performance given that 2020 is an election year.

What accounts for US stocks’ unexpected resilience?

Two schools of thought

There are, essentially, two schools of thought. The first attributes the US stock market’s performance to fundamental factors. The second argues that stock market outperformance is the unintended consequence of global monetary policy choices and challenging economic realities.

It’s the economy, stupid

The core of this argument is that the stock market is forward-looking. Stock prices do not reflect current economic conditions. Rather, stock prices rise and fall in anticipation of future conditions.

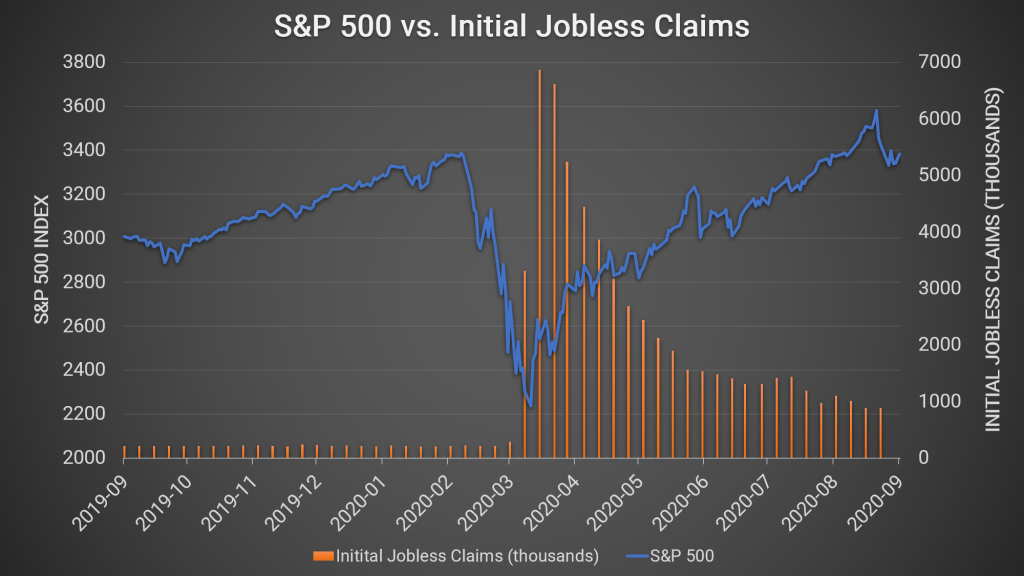

Consider, for example, the relationship between the stock market and job losses. One would expect the stock market to weaken in the face of rising unemployment, as job losses affect consumer spending and corporate profits. However, as the chart below illustrates, the stock market plunged ahead of the dramatic late March and early April spike in jobless claims and then began to rise ahead of the fall in jobless claims. In other words, the market anticipated future job losses (or future improvements in the rate of job losses) rather than responding to them after the fact.

Source: Yahoo! Finance, Federal Reserve Bank of St Louis, September 2020.

As this example illustrates, the stock market tends to be proactive, rather than reactive. The pandemic downturn was reflected in the first-quarter slump in stock prices, but prices have since risen in anticipation of the US economy’s V-shaped recovery.

This argument posits that stock prices are rising based on improving US economic fundamentals and in anticipation of stronger and more robust corporate profits going forward.

While this view may be correct, the market is nevertheless at historically high levels, especially given current economic conditions. In mid-September, the Schiller PE ratio for the S&P 500 was 31.07, compared to its historic mean of 16.74. This suggests that stocks are currently pricing in historically high future earnings, which may struggle to materialize given ongoing global economic weakness.

It’s the Fed, stupid

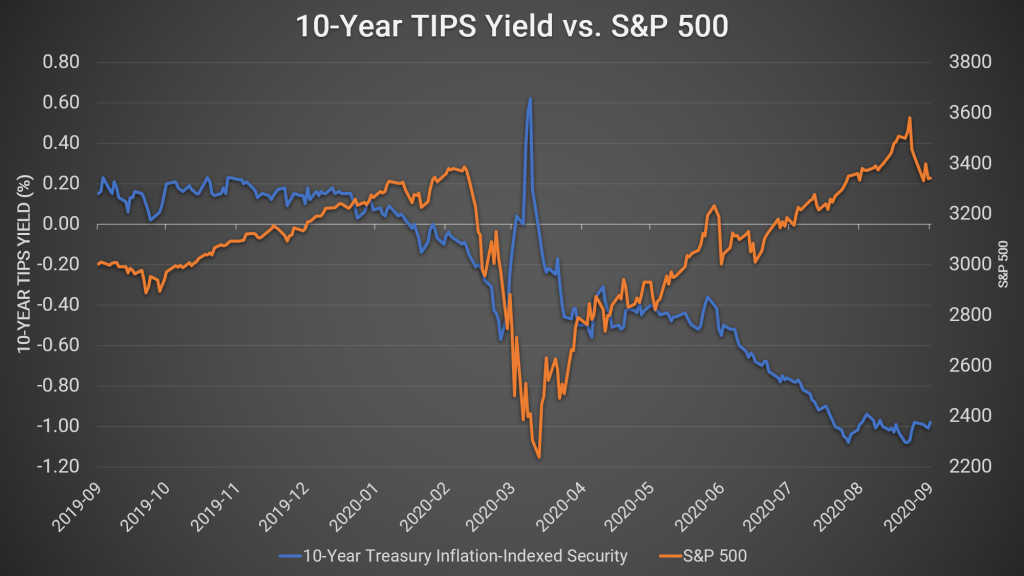

The second school of thought attributes the market’s strength to the impact of monetary policy. Specifically, in the face of massive monetary stimulus and ultra-low interest rates, real yields – the return bond investors can expect after inflation – have collapsed.

The yield on 10-year inflation-linked Treasuries (TIPS) is around -1% – a historically low level. Such deeply negative TIPS yields suggest that investors believe the economic future is bleak and that inflation may rise.

While negative yields have shown up in Europe and Japan in recent years, the US has traditionally offered a safe harbor – positive real yields on safe-haven assets. Now, with TIPS yields turning negative, markets around the world are dealing with the fallout.

From a market perspective, negative real yields on Treasuries means that more and more investors are being forced into riskier assets. The search for yield is driving a flood of money into stocks, pushing up prices even in the face of troublesome fundamentals. As the chart below shows, the stock market has been broadly negatively correlated with TIPS yields over the last year, suggesting that falling real yields may be playing a role in rising markets.

Source: Federal Reserve Bank of St Louis, September 2020.

Whatever the driver behind the US stock market rally – whether its economic fundamentals, monetary policy, or a combination of various factors – many are asking whether the market is overheating and sowing the seeds of a future downturn.

Unfortunately, the answer to that question will depend on how rapid and complete the post-COVID economic recovery is, as well as on investor sentiment and the trajectory of yields in other markets. For now, however, it seems that US stocks may just continue to defy gravity.

Intuition Know-How has a number of tutorials that are relevant to equity markets and trading:

- Equity Markets – An Introduction

- Equity Trading – An Introduction

- Equity Trading – Technical vs. Fundamental Trading

- Equity Valuation – An Introduction

- Equity Returns Analysis

- US Equity Market