As Bitcoin-Related ETFs Launch, Traditional Financial Firms Are Poised to Dominate the New Market

With the launch of the first US-based Bitcoin futures exchange-traded funds (ETFs) in October, crypto assets took another important step toward mainstream acceptance. Many questions remain, including the timeline for ETFs that invest directly in coins (rather than futures) and the role of regulators in the market. Nevertheless, the early success of the new funds is a marker of the growing popularity of the asset class and Wall Street’s rising interest in it. While crypto enthusiasts see blockchain-based currencies as an alternative to the mainstream financial system, traditional financial firms may be the main beneficiaries of investor appetite for these new assets.

On October 19, the ProShares Bitcoin Strategy ETF launched on the New York Stock Exchange amid great fanfare. The fund saw almost $1 billion in trade on its first day as US investors flocked to gain exposure to the world’s biggest cryptocurrency, and it was quickly followed by the similarly structured Valkyrie Bitcoin Strategy ETF on October 22.

These new ETFs – and others like them elsewhere – hold futures contracts that track the price of Bitcoin, rather than holding the coins directly. Regulators prefer this model because futures trade on regulated markets, in contrast to bitcoins, which trade primarily on unregulated exchanges.

That means that futures ETFs offer investors a way to gain exposure to Bitcoin without the risks associated with using unregistered coin exchanges, many of which have been the target of fraud, AML, and other financial misconduct investigations – as well as hacks in which millions of dollars of coins were stolen.

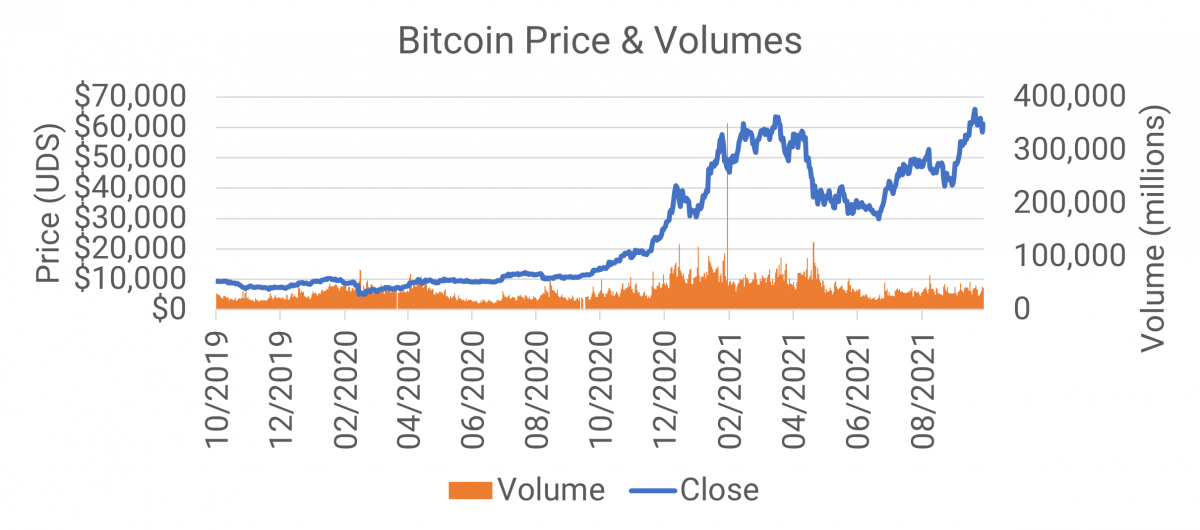

Source: Yahoo! Finance. Bitcoin Price and Volume. October 2021.

Wall Street comes knocking

The success of these new ETFs underscores Wall Street’s growing interest in crypto assets – and the fees generated by crypto products.

Related article: The Rise And Further Rise Of Bitcoin?

Already, US investors can access Bitcoin and other cryptocurrencies through private trusts. With the launch of Bitcoin futures ETFs, however, the market is now open to a greater range of investors, including retirement accounts such as 401(k)s and IRAs. As more investors dip their toes into crypto through derivative instruments, products with the reassuring stamp of traditional financial firms stand to grab significant market share.

That could make traditional financial firms among the biggest beneficiaries of the emergence of crypto assets – an irony, given the stated desire of many cryptocurrency enthusiasts to build an alternative financial system uncorrupted by traditional firms.

Regulatory tussles

As mainstream investors move assets into crypto markets and Wall Street firms launch crypto-linked products, regulators are taking these assets more seriously. Efforts are underway in many jurisdictions to expand oversight of digital assets, although the results have been patchy.

In the US, for example, there has been some confusion over the regulation of crypto assets. The US system divides responsibility for financial oversight among multiple agencies. The Commodity Futures Trading Commission (CFTC), for example, has responsibility for regulating derivatives, while the Securities and Exchange Commission (SEC) regulates securities.

This has meant that different crypto instruments fall under different agencies. The CFTC defines cryptocurrencies as a commodity, meaning that the agency has authority over crypto derivatives, including swaps and futures. However, some digital tokens have been defined as securities – the SEC, for example, has charged Ripple with conducting an unregistered digital securities offering by selling its coin XRP.

As a result of these wrangles, it is unclear which agency should take primary responsibility for the regulation of crypto assets, and both the SEC and the CFTC have sought to expand their authority in this area.

Recently, for example, the CFTC has been increasingly aggressive in its oversight of crypto markets – in October it fined Tether, an issuer of a US dollar-linked stablecoin that has a close relationship with Bitcoin, $41 million for making false and misleading statements about its reserves. The CFTC also fined the cryptocurrency trading platform Bitfinex $1.5 million for illegal transactions. Rostin Behnam, the Biden administration’s pick to head the CFTC, has said that Congress should expand the CFTC’s power over cryptos given the explosive growth in digital assets.

But at the same time, SEC head Gary Gensler has pushed for more power to oversee digital coins and the SEC has flexed its regulatory muscles with action against Ripple, online crypto lending platform BitConnect, and others.

Heading to the moon

While it’s yet unclear how the regulatory environment will evolve, Wall Street obviously sees enormous potential for the crypto market.

Even though regulators don’t yet allow traded funds to directly hold coins, derivatives products that track cryptocurrencies and other digital assets offer a regulator-approved – and, for Wall Street firms, highly lucrative – avenue for crypto investment. With the success of the Bitcoin futures ETFs, we will doubtless see many new instruments emerging over the next few years.

Once the regulatory dust settles and effective oversight over crypto is established, it is likely that big Wall Street firms – much derided by crypto enthusiasts – will be among the most important players in the market.

Intuition Know-How has a number of tutorials that are relevant to crypto assets, ETFs, and futures contracts:

- Cryptography

- Blockchain – Primer

- Crypto Assets

- Exchange-Traded Funds (ETFs) – An Introduction

- Exchange-Traded Funds (ETFs) – Types

- Forwards & Futures – An Introduction

- Forwards & Futures – An Introduction

- Financial Regulation (US) – SEC

- Financial Regulation (US) – CFTC