AI and NVIDIA drive markets boom

Since the launch of ChatGPT-3 in June 2020, AI has captured the public imagination in a manner like no technological development since the Internet. The widespread availability of ChatGPT-3 and subsequent enhanced versions, along with a constant stream of other AI products coming to market, seem to be heralding the dawn of an AI-powered economy and society. The reaction has been mixed, with optimism regarding the productivity gains that AI brings tempered by fears about the disruption and displacement of vast swathes of the economy.

As individuals come to terms with the likely impact of AI on their future employment, investment markets have been experiencing a bonanza reminiscent of the dotcom boom of the late 1990s. AI-related assets have soared, with semiconductor chip manufacturer NVIDIA emerging as the poster child of the AI revolution, akin to what Apple was to the smartphone industry.

NVIDIA’s stock price surged 450% from January 2023 until March of this year, when it recorded a record high of over $950, nearly doubling since the start of the year. (The stock has since pulled back somewhat.)

Backed by fundamentals

A big difference compared with the dotcom era is that the current boom is backed by fundamentals in the form of surging real revenues and earnings. NVIDIA’s revenues grew by 126% year-on-year in the fiscal year ending January 28, 2024, while net income surged 581%, reflecting a significant increase in profit margins.

The results prompted analysts to upgrade their estimates for 2024 and beyond, both for NVIDIA and the broader semiconductor sector. Analysts now project semiconductor EPS growth for 2024 of 40.7%, up from 28% previously.

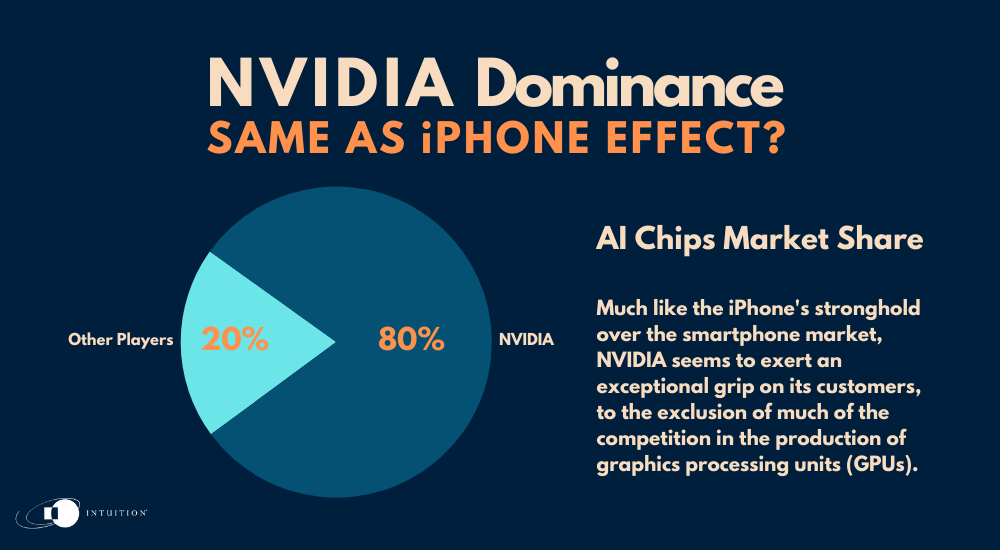

NVIDIA dominance recalls iPhone effect

NVIDIA’s dominance of AI is reminiscent of the iPhone effect, which described the dominance Apple enjoyed during the heyday of the iPhone. Analyst estimates reveal that NVIDIA’s graphics processing units (GPUs) command an impressive 80% share of the AI chips market. Much like the iPhone’s stronghold over the smartphone market, NVIDIA seems to exert an exceptional grip on its customers, to the exclusion of much of the competition.

The tech leadership carousel

The ongoing secular bull market in tech that took shape in the wake of the global financial crisis of 2007-2009 has seen several changes of leadership, with an acronym inevitably emerging to represent the leadership of the day. Not so long ago, it was the FAANGs – Facebook (now Meta), Amazon, Apple, Netflix and Google. Soon after it was FANGMAN, primarily to accommodate Microsoft. This was recently eclipsed by the so-called Magnificent Seven (FANGMAN minus Netflix, plus Tesla and NVIDIA) or Mag 7 for short.

Such is the fickle nature of the stock market that Mag 7 may already be past its sell-by date, given the poor performance so far in 2024 of Tesla and Apple. When it comes to the AI boom, NVIDIA and Microsoft are the ones that are really in the driving seat, while Apple’s fall from grace is almost certainly connected to it being perceived as a laggard in that boom. There are other reasons for Apple’s poor performance, including a valuation which, at 26x estimated 2024 earnings (down from a high of 32x), looks high for a company that may have gone ex-growth. Amid the AI hype, investors would almost certainly look past valuations if Apple were seen as a significant AI pioneer.

NVIDIA driving all markets

The surge in NVIDIA’s stock price saw its market capitalization rise to USD 2.3 trillion at the recent peak, making it the third largest stock in the US by market cap – just shy of Apple’s at USD 2.6 trillion and still a way behind the leader Microsoft at USD 3.1 trillion. However, in terms of its influence on stock market moves, NVIDIA punches well above its heavy index weighting, exerting more influence on the market than any other stock (including the two larger ones) due to its higher volatility.

Further, NVIDIA’s dominance is not confined to the tech sector and the US market – potential productivity gains from AI seem to be getting priced into assets across multiple sectors and geographies. NVIDIA’s results announcement in February catalyzed already buoyant stock market indexes across the globe. European indexes gapped higher and have not looked back since, with many going on to record new all-time highs. In Japan, the Nikkei achieved a milestone that had been elusive for decades, surpassing its previous all-time high last reached in the late 1980s. The MSCI world index of stocks was up 7.7% in the first quarter of 2024 – its best performance in five years.

While there are other drivers of these gains that may be more relevant, such as improvements in underlying economic data in the face of excessive pessimism (particularly as regards Europe), the timing of the latest leg higher makes it difficult to dismiss AI’s contribution.

Some caution warranted amid AI euphoria

While it’s hard to argue against the potential of AI, and the boom appears to be on solid foundations, many commentators urge caution. In the current climate of exuberance, investors appear to be piling into assets – whether directly or indirectly related to AI – without asking too many questions. But there are several questions worth asking, relating to:

- Long-term impact on the job market – what happens to the affected workers if indeed swathes of the economy are displaced?

- Ethical implications – for example, what measures can be taken to safeguard data privacy?

- Vulnerabilities – AI systems remain susceptible to errors, manipulation, and security breaches

- Monopolization – the immense resources of the tech giants leading the AI boom may raise anti-trust concerns

- High capex requirements – significant capital outlays are required to power AI, with most of the investment to be provided by a sector touted by investors for being asset-light

- Sustainability – the required capex is likely to consume vast levels of water and energy, posing risks to climate targets

There’s also the potential scenario where none of these risks materialize, yet the valuations of the associated assets overshoot, leading to a bubble and crash. It wouldn’t be the first time. But for now, there seems no end in sight to the party, as the AI hype continues to propel asset prices higher, albeit with the occasional wobble such as we are seeing now.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- AI Applications – Chatbots

- AI Applications – Fraud & Compliance

- AI Applications – Credit Risk

- AI Applications – Internet of Things (IoT)

- Corporate Valuation – An Introduction

- Equity Markets – An Introduction

- Equity Valuation – An Introduction

- US Equity Market

- European Equity Market

- Japanese Equity Market