Sustainable Investing: 3 Primary Drivers for ESG Investments

- A change in global focus

- A shift to socially conscious investors

- A rise in evolving data and analytics

Click here to learn how we are helping our clients with ESG.

1 A Change in Global Focus

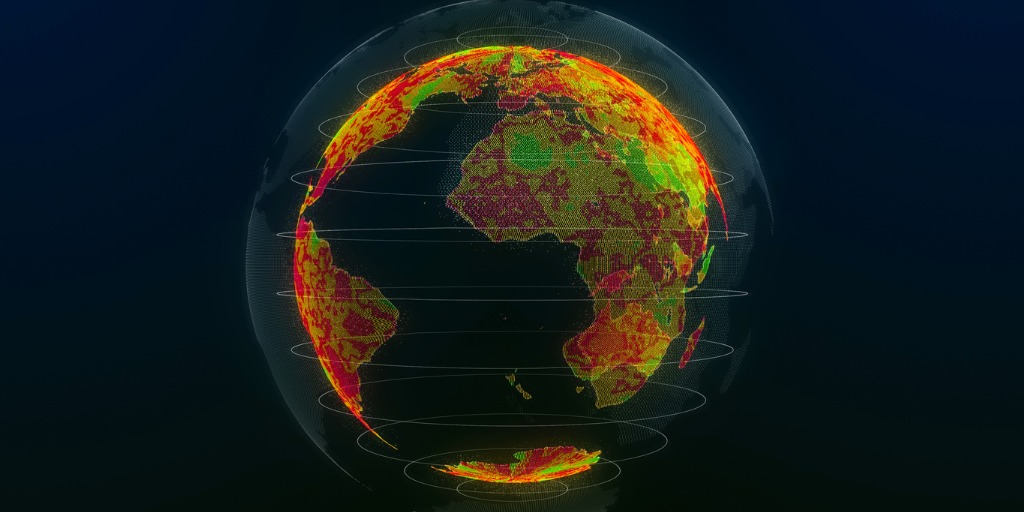

The global regulatory environment is changing fast, with many countries enshrining ESG requirements in regulations. According to a recent study, in the last decade, governments worldwide have enacted over 500 new measures to promote ESG issues. Given the magnitude of the task, various players are involved including governments, regulators, capital markets, businesses, and consumers – supported by green technologies and business model innovations.

In America and Europe in particular, some politicians, senior managers, and investors want to shift from measuring corporate performance based mainly on shareholder returns to considering factors such as their impact on climate change and other global sustainability challenges, including:

- Flood risk

- Rising sea levels

- Privacy and data security

- Demographic shifts

2 A Shift to Socially Conscious Investors

Many financial professionals believe that ESG investing is particularly attractive to millennials.

Millennials represent 79.4 million people in the U.S. alone. Findings from one study indicated 87% of high net worth (HNW) millennials considered a company’s ESG track record an important consideration in their investment decision, while another study found 90% of millennials sought greater opportunity to tailor their investment impact to their values.

Adoption of sustainable investing is further driven by a growing conviction that investors can generate financial gain and a positive social and environmental impact at the same time.

In a poll by a leading asset management firm, 88% of respondents agreed it was possible to balance financial returns with a focus on social and environmental impact. Almost as many (86%) believed companies embracing ESG practices may be more profitable and better long-term investments.

Many pioneering ESG investors are women. One survey found women are much less likely to note poor or limited returns as a reason for not investing in ESG. The survey found women were 47% more likely than men to believe there is a positive association between ESG factors and corporate financial performance. Nearly half (49%) of women in this study agreed with this statement compared to 30% among their male counterparts.

3 A Rise in Evolving Data and Analytics

Investor demand for ESG data and products has never been stronger. This has triggered the growth of data providers who focus on tracking ESG by providing quantitative analytics based on qualitative ESG datasets. Ultimately, creating a better understanding of the ESG investment landscape.

With better data from businesses combined with increasing ESG research and analytics capabilities, there has been a rise of systematic, quantitative, objective, and financially relevant approaches to measuring ESG issues. Better data and analytics have paved the way for more and better ESG investing.

ESG considerations are becoming increasingly important for both investors and businesses. The recent growth in investor demand for ESG products suggests investment management firms and businesses alike should act today to maximize the ESG opportunity.

Sources: