Winners And Losers As Market Volatility Returns

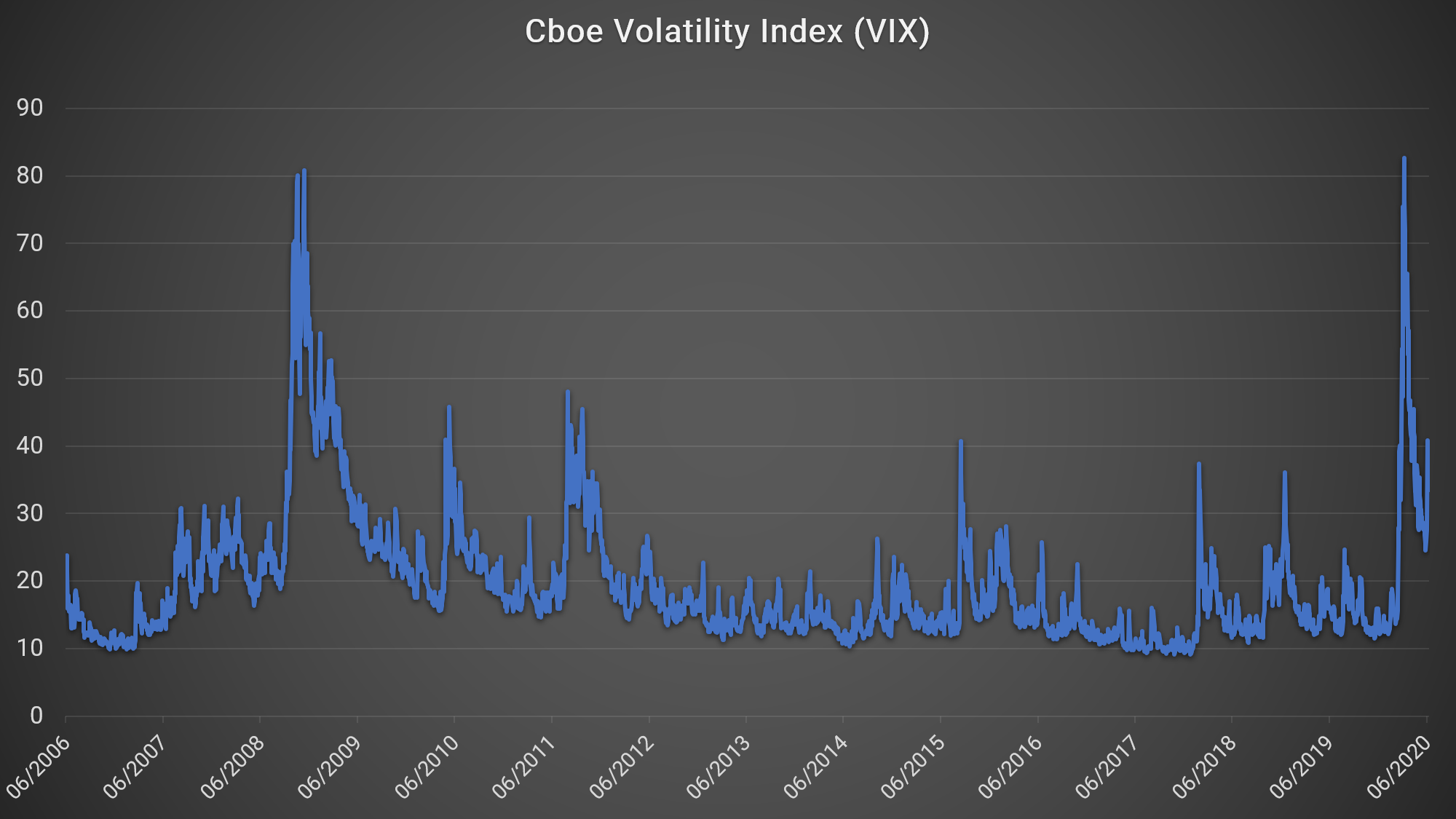

In the years following the global financial crisis (GFC), market volatility remained relatively muted, generally moving within a narrow band. Supported by modest but steady economic growth and accommodative monetary policy, global stock markets experienced few pronounced ups and downs for most of the last decade. Then, in March this year, the coronavirus-inspired market correction reintroduced volatility in a dramatic fashion. Some market participants have benefited from the return of volatility, while others have struggled to adapt to changing market conditions.

For the last decade, benign economic and monetary conditions meant that market volatility was relatively subdued across stock markets, bond markets, and even derivatives markets. This – coupled with the new proprietary trading rules introduced by the Dodd-Frank Act’s Volcker Rule and various other regulatory developments – led to falling trading volumes and fees. In addition, hedge funds and other alternative assets struggled to deliver market-beating returns against the backdrop of a long bull market.

Then the coronavirus hit. As the scale and impact of the pandemic became clear in early March, global equity markets responded with sudden and dramatic crashes.

Cboe. Cboe Volatility Index (VIX) Historical Data. June 2020.

Market volatility spiked as investors fled to safety amidst a stock market meltdown. Massive central bank interventions – in particular, efforts by the US Federal Reserve (Fed) to backstop various key debt markets, including corporate bond markets – helped stock prices to stabilize. In May, as economies began to reopen and hopes for renewed growth rose, volatility declined further.

However, in early June, renewed fears of a second wave of Covid-19 infections and an unusually grim economic outlook from the Fed sent stock prices plunging and volatility surging. These events underscored the new reality facing traders and investors: volatility is definitely back.

Glad tidings for traders

The return of volatility is good news for many market participants. High frequency trading (HFT) strategies, for example, require a degree of volatility to thrive. During the period of subdued volatility that followed the financial crisis, HFT firms saw their profits plunge and HFT declined as a share of overall trading as traders struggled to find good opportunities.

Many other quantitative (quant) traders are also positioned to benefit from higher volatility. Volatility indicates that there are meaningful differences of opinion about prices among market participants. In such an environment, conviction strategies may have a greater chance to flourish. Price dislocations may also create opportunities for quant strategies that rely on arbitrage, and a cheaper market may offer long-term investors fresh incentives to buy.

A mixed bag for alternative funds

Theoretically, hedge funds should be thriving in today’s choppy markets. Many hedge fund managers have blamed the bull market and subdued volatility for their inability to offer alpha in the last decade. However, when the coronavirus hit markets in March, few hedge funds appear to have been ready to capitalize on either the downturn or the volatility surge.

According to early data from Bloomberg, around 75% of hedge funds suffered losses in March, with some funds down as much as 40%. Compounding the pain, many bearish funds that benefited from the March downturn lost money in April when government stimulus measures shored up stock prices. According to Bloomberg, just over 10% of hedge funds made money in the March/April period.

Investors were shaken by these losses and, by the end of April, eVestment data indicated that global hedge fund assets had fallen below $3 trillion for the first time since 2014 as clients withdrew money and paused inward investment. According to eVestment, hedge fund outflows hit $8 billion in the first quarter of 2020.

Other alternative assets such as leveraged loan funds, commercial property private equity funds, and others have also suffered mark-to-market or actual losses as the coronavirus has savaged economies worldwide.

It is hard to predict how markets will perform in the short- to medium-term. Massive economic slowdowns are being mitigated by unprecedented fiscal and monetary actions. The course of the virus once lockdowns are lifted is unclear. The only thing that seems certain is more uncertainty. Many market participants are positioning themselves to benefit from this new reality.

Intuition Know-How has a number of tutorials that are relevant to trading and other topics discussed above. Click any of the links below to see the intro video for that tutorial.

- Equity Trading Strategies

- Quantitative Trading – An Introduction

- Quantitative Trading – Buy-Side

- Quantitative Trading – Algorithmic Trading

- Quantitative Trading – Arbitrage & HFT

- Alternative Assets – An Introduction

- Hedge Funds – An Introduction

- Hedge Funds – Investing

- Hedge Funds – Strategies

- Volcker Rule

- Dodd-Frank Act