How Pension Funds Can Lead The Way In Responsible Investing

Globally, pension funds hold an estimated $20 trillion in assets, making them the single largest asset pool in the world. Given their size – and the fact that they are long-term investors – many have looked to pension funds for leadership in the field of socially responsible investing (SRI). Unfortunately, faced with rapidly aging populations and solvency issues, many funds have been slow to adopt investment practices that consider environmental, social, and governance (ESG) factors. However, as regulations such as the European Union’s IORP II and Action Plan on Sustainable Finance come into force, this may be changing.

Global pension funds represent the largest pool of investment capital in the world. As such, they could have a major impact on the world’s efforts to address issues such as climate change, inequality, and cybersecurity vulnerabilities. By allocating capital to companies and assets that act ethically and for the long-term, pension funds could reshape the global economy.

However, relatively few have fully embraced socially responsible investing (SRI) or incorporated environmental, social, and governance (ESG) factors in their investment processes.

There are many reasons for pension funds’ failure to embrace SRI.

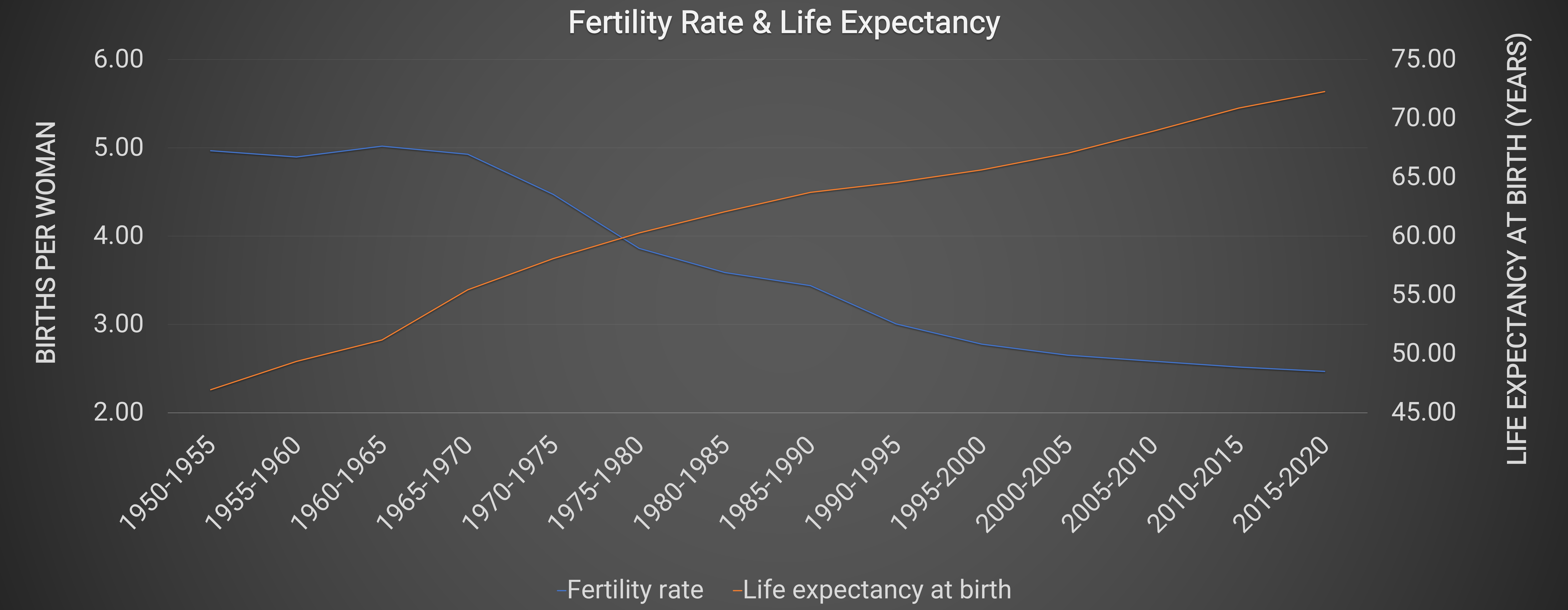

Around the world, funds are grappling with falling birth rates and rising life expectancy, placing a strain on their ability to make payments.

Source: World Bank.

At the same time, a sustained period of low yields has reduced funds’ returns and forced them to turn to higher-risk assets for the growth they need. As funds shift from their traditional sovereign debt allocations into more aggressive allocations to stock markets and private equity, ESG factors have often fallen by the wayside.

However, the regulatory environment is slowly shifting, and new rules are likely to increase the pressure on pension funds to make SRI a core part of their investment approach.

New rules, new approaches

In some respects, the European Union has led the way in the adoption of common standards for SRI. For pension funds, two pieces of legislation, in particular, are changing the way they think about and engage with responsible investing.

The first is IORP II, the 2016 successor to the 2003 Institutions for Occupational Retirement Provision Directive (IORP). IORP II focused on improving the quality of pension fund governance, ensuring that fund members understand their fund’s approach to investing and that investment flows support long-term economic growth that protects the natural environment.

As such, it includes various provisions related to SRI. The first such provision gives pension funds explicit permission to consider ESG criteria as part of their investment management processes.

Historically, some investment managers have been reluctant to consider ESG factors as they feared that doing so would conflict with their fiduciary duty to deliver the best possible returns for fund beneficiaries. Such managers worried that consideration of ESG matters may result in lower returns.

IORP II allows funds to consider ESG matters as part of their broader investment management processes, in a manner that a “prudent person” would find acceptable. Funds must also explicitly disclose their ESG approach in their publicly available Statement of Investment Principles, thereby allowing members to understand the role ESG considerations play in the management of their retirement savings.

The second key provision relates to funds’ risk assessment processes. Funds are required to conduct regular own risk assessments that incorporate “an assessment of new or emerging risks, including risks related to climate change, use of resources and the environment, social risks, and risks related to the depreciation of assets due to regulatory change.”

This means that pension funds must assess and report on the risks that various ESG factors may pose to their funds – including the risk of physical dangers related to climate change, such as increased flooding. This process is likely to encourage pension fund trustees and investment managers to consider ESG factors and to incorporate responsible investing practices to mitigate the risks they may pose.

The provisions of IORP II will be supported by the European Commission’s Action Plan on Sustainable Finance. This detailed plan seeks to connect finance to sustainability in order to ensure that economic growth objectives are aligned with the need for sustainable development.

Among other things, the Action Plan will be supported by legislation that creates a taxonomy of sustainable financial products and makes it easier for investors to find comparable and detailed information about ESG factors. These measures will help pension funds’ efforts to assess their ESG risks and incorporate ESG factors into their investment processes.

Beyond Europe

The EU is in the process of building a comprehensive framework for sustainable finance, seeking to ensure that investment flows into companies that are aligned with the need for sustainable long-term economic growth that minimizes harm to the environment.

In the US, many public pension funds have adopted their own SRI approaches – one estimate states that around $2.7 trillion of US public pension assets apply some form of ESG/SRI screening or strategy. However, there is currently no federal legislation governing issues such as ESG and SRI reporting or investment mandates – although the Department of Labor has clarified that incorporating ESG factors is consistent with trustees’ fiduciary duties under the Employee Retirement Income Security Act (ERISA).

Efforts are underway to implement reporting legislation but, at present, the US Congress has displayed relatively little appetite for creating federal guidelines. Therefore, as nations around the world grapple with rising climate risks and growing investor concerns around sustainability – as well as pension funding crises – many will look to the EU as a regulatory template. IORP II and the Action Plan on Sustainable Finance may ultimately have an extensive, global impact.

Intuition Know-How has a number of tutorials that are relevant to pension funds and sustainable investment:

- ESG & SRI Investing

- Business of Pensions & Retirement

- Financial Regulation – An Introduction

- Financial Authorities (Europe) – ECB

- Financial Authorities (Europe) – ESFS