Clean vs. renewable energy: What’s the difference?

While there is significant overlap between “clean” and “renewable” energy, they are not exactly the same.

Clean energy does not release any greenhouse gases or pollutants into the atmosphere.

Renewable energy, meanwhile, is defined as energy that comes from resources that are constantly replenished and never run out.

Most clean energy sources are also generally regarded as renewable. Nuclear is a notable exception, as it relies on finite resources of uranium, a material mined from the ground and only found in certain locations.

***

Get weekly insights from The Intuition Finance Digest. Elevate your understanding of the finance world with expertly-crafted articles and podcasts sent straight to your inbox every week. Click here: https://www.intuition.com/finance-insights-the-intuition-finance-digest/

***

When renewable isn’t always clean

Similarly, while most renewable energy sources are considered clean, this is not always the case.

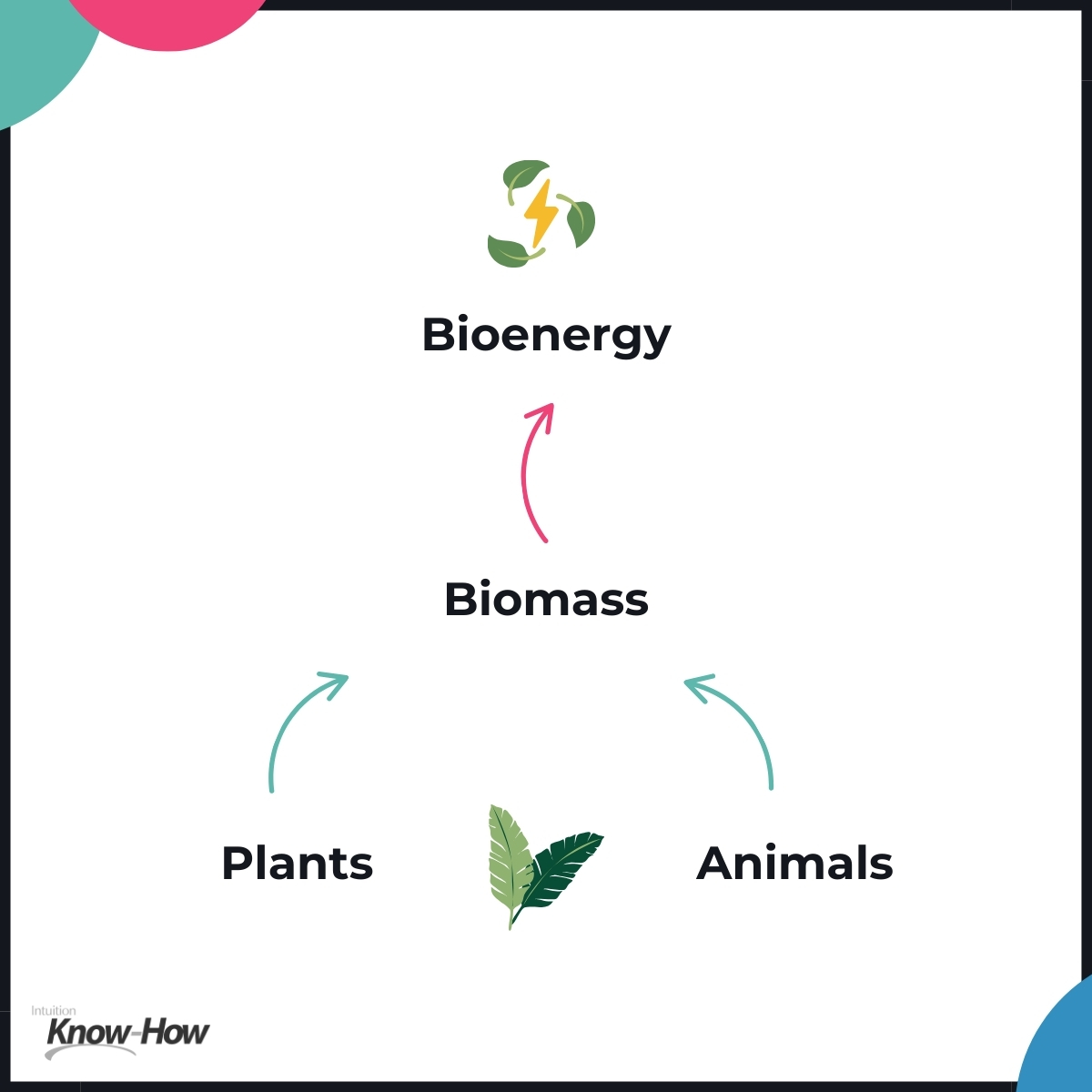

Take bioenergy, for instance. This comes from a variety of organic matter, called biomass, such as plants and animals. It is therefore considered renewable.

But burning biomass releases greenhouse gases, which are damaging to the environment.

However, the emissions from burning biomass may potentially be offset by the carbon dioxide absorbed by the plants that are the source of bioenergy.

This can potentially make biomass a carbon-neutral energy source, although many scientists do not agree with this.

The benefits of clean energy

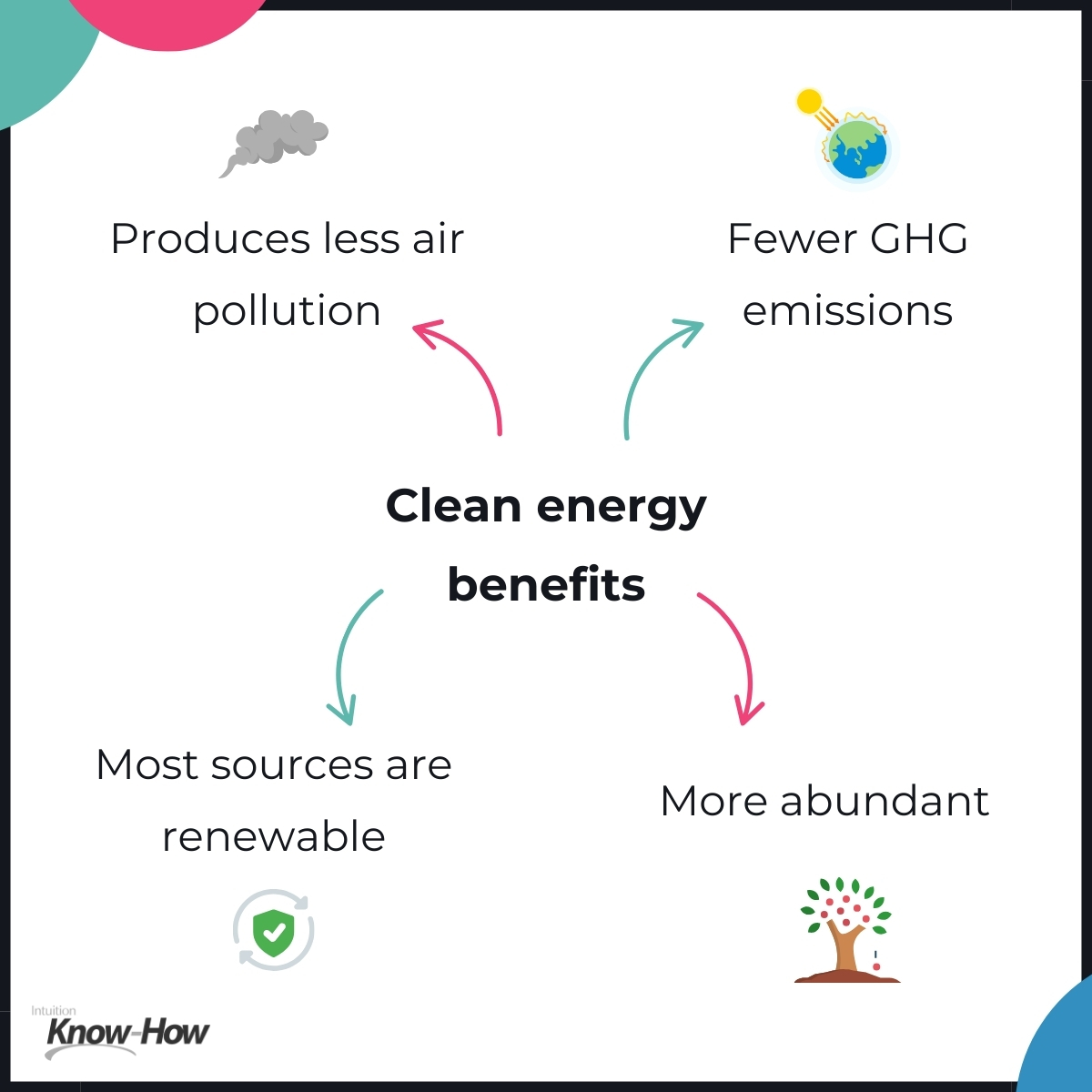

Compared with fossil fuels, clean energy offers many benefits.

It produces less air pollution and fewer GHG emissions.

It is more abundant. Fossil fuels are finite, but most sources of clean energy are renewable.

Clean energy is also more diverse than fossil fuels, which are unevenly distributed around the world.

In most cases, clean energy is cheaper, with the cost of this technology falling dramatically in recent times.

Clean energy also enhances energy security and independence, as countries can rely on their own domestic sources rather than importing fossil fuels.

One final advantage is that, with an abundance of new and emerging technologies, the clean energy sector creates new jobs and significant economic opportunities for many countries.

The financial sector’s role in the transition

The financial sector has a vital role to play in supporting clean energy by providing the capital and incentives needed to accelerate the transition to a low-carbon economy.

Banks and other financial institutions can support this transition in a number of ways.

Broadly speaking, they need to more closely align their portfolios and activities with the goal of achieving net-zero emissions by 2050.

This requires reducing exposure to the fossil fuel sector while increasing investment in clean energy technologies and infrastructure.

Lenders and investors will need to scale up clean energy finance by mobilizing more capital for clean energy projects.

This includes funding clean energy technologies that are essential for achieving net zero, as well as providing financing for R&D, demonstration projects, market entry strategies, and so on.

At times, this will require the financial sector to work with other stakeholders, including development banks, academia, governments, and other public sector institutions.

Supporting the clean energy transition will also require innovation in new financial products and services with a “green” or “sustainability” focus.

Such products and services can help to lower the cost of capital and diversify funding sources for clean energy projects.

In addition, the financial sector has a role to play in engaging with various stakeholders – from consumers and communities to businesses and governments – to promote clean energy and address potential barriers or trade-offs.

To sum up, the global economy’s reliance on fossil fuels cannot continue.

Energy that is clean, accessible, reliable, affordable, and sustainable is the future.

The transition to clean energy is essential to lower dependency on fossil fuels, control climate change, and ensure a sustainable future for all life on earth.

Intuition Know-How, the world’s premier digital learning solution for finance professionals, offers a comprehensive course on sustainability and ESG. More details can be found below.

If you would like to speak to a member of our team about gaining access to this course, please fill in the form.

Sustainability is perhaps the biggest challenge of our time, and businesses across all sectors are increasingly embracing more sustainable practices. In the financial sector, investors are searching for investment options that go beyond traditional financial and economic concerns to incorporate environmental, social, and governance (ESG) issues. Meanwhile, banks and other lenders must now embed sustainability concerns into their day-to-day decision-making and risk management.

This course provides a high-level overview of sustainability and ESG, covering topics such as:

-

The fundamentals of crucial sustainability concepts such as sustainable development, net zero, climate change, the circular economy, greenwashing, deforestation, and clean energy

- The definition of ESG and the key strategies for incorporating ESG

- The impact various ESG factors may have on corporate performance and how ESG analysis can inform investment decision-making

- The role of the UN Sustainable Development Goals (SDGs) and how they are changing the way companies transact business and make investments

- The concept of biodiversity, including the impact of biodiversity loss and how financial institutions can play their part in its mitigation

Learner Profile

This course provides a broad overview of sustainability and ESG for newcomers to the field or for more experienced financial professionals who wish to refresh their knowledge.

Browse full tutorial offering