Sustainability in 2025: Key business stats

In 2025, sustainability criteria are no longer optional components of corporate strategy but are drivers of business success. Regulatory pressure, consumer demand, and investor expectations have positioned sustainability as a vital framework for growth across industries.

In this article, we explore the stats and trends shaping sustainability in business through 2025.

Other articles in this series:

AI stats every business must know in 2025

L&D trends and stats essential for every workplace in 2025

Sustainability and finance

In 2025, sustainability criteria are central to financial strategies worldwide, with investors increasingly prioritizing sustainable and ethical considerations alongside profit. Asset managers and institutional investors are focusing on companies that demonstrate clear policies in regard to reducing carbon emissions, ensuring diversity, and upholding transparent governance practices. Financial markets are responding with innovative sustainability linked products, such as green bonds and sustainability linked loans, which tie financial incentives to environmental and social outcomes.

- Sustainability assets will hit USD 50 trillion by 2025, representing more than a third of the projected USD 140.5 trillion in total global assets under management (Bloomberg).

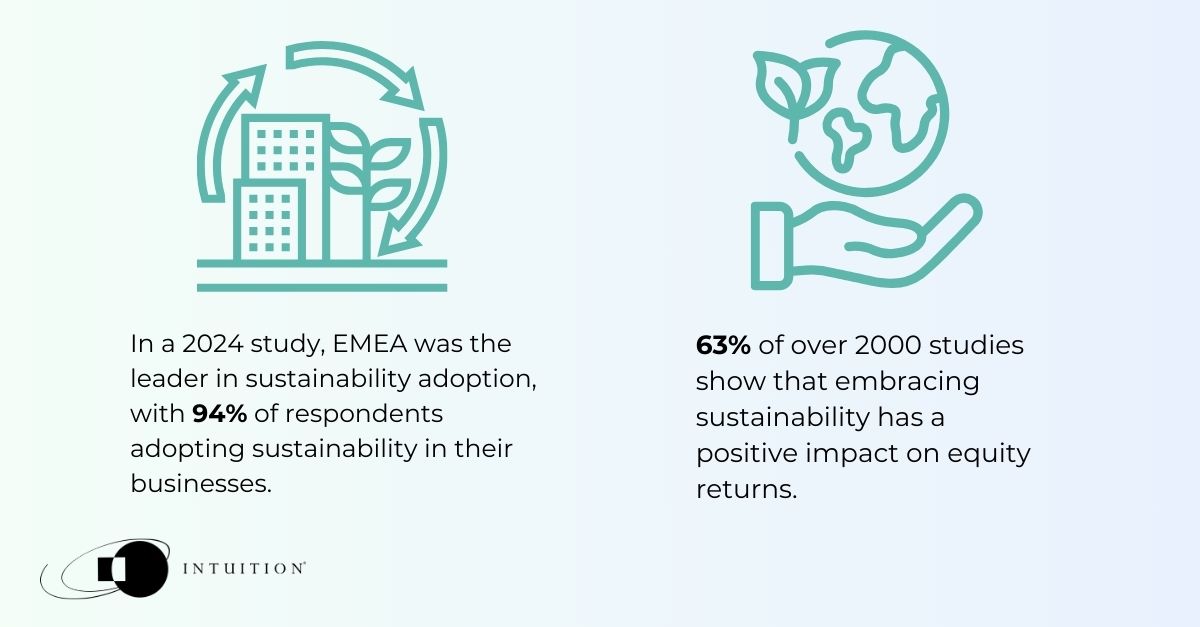

- 63% of over 2000 studies show that embracing sustainability has a positive impact on equity returns (KPMG).

- 85% of asset managers acknowledge sustainable investing as a high priority for their companies (Index Industry).

- Bloomberg reports that 71% of business leaders globally believe that no investment decisions will be made without considering sustainability in the near future.

- 45% of companies asked about the global momentum behind sustainability have stated that they believe that sustainable investments will increase by at least 20% in the next 5 years (Bloomberg).

Sustainability adoption

Sustainability adoption is accelerating as regulatory bodies worldwide introduce stricter mandates and policies on corporate transparency and sustainability practices. Investors are prioritizing companies with clear sustainability frameworks, making responsible environmental, social, and governance practices a competitive advantage in securing capital. This rapid shift is reshaping industries, as companies that align policies with sustainability standards are gaining favor in markets, while those that lag risk financial and reputational setbacks.

- In a 2024 study, EMEA was the leader in sustainability adoption, with 94% of respondents adopting sustainability in their businesses (Capital Group).

- PWC has stated that 77% of companies surveyed are planning to reach net zero by 2050 (PWC).

- More than 75% of executives are reporting significant or moderate levels of progress toward their sustainability goals and targets in the past year (Deloitte).

- In 2024 banking trends, over half (54%) of the world’s banks include climate-related data in their financial statements (Vena).

- PWC has found that many companies’ current focus is on the environment. 80% of companies have clearly defined long-term targets for emissions, while only 60% have social and governance targets (PWC).

Sustainability compliance

2025 will be a pivotal year for sustainability policy and regulation. The Corporate Sustainability Reporting Directive (CSRD) is a key regulation adding strict reporting requirements to both EU based companies and non-EU companies with significant EU operations or listings. This directive mandates detailed disclosures on sustainability impacts, along with third-party assurance to ensure data accuracy. Initially, only “limited” assurance will be required, but by 2028, companies will need more extensive “reasonable” assurance, similar to financial audit standards .

Outside of Europe, the International Sustainability Standards Board (ISSB) introduces the IFRS Sustainability Disclosures Standards, creating a globally aligned framework. These standards may be voluntarily adopted by firms outside the EU, establishing a “global passport” for sustainability reporting. This aims to improve comparability, reduce greenwashing, and provide investors with more consistent data.

- Companies that took a “wait and see” approach to sustainability have fallen behind companies with a cross-functional sustainability group. 52% of these companies surveyed are preparing extensively for new regulations, while only 24% of companies with no dedicated sustainability group are (Impact).

- 91% of corporate leaders acknowledge their company’s duty to address sustainability issues (Key ESG).

- 99% of respondents in one survey are preparing for potential increases in sustainability requirements, with 77% of these creating new roles and responsibilities as a result (Deloitte).

- In 2024, 68% of investors surveyed stated that their approach to sustainability is to “ensure compliance with regulatory requirements” (Capital Group).

Sustainability and technology

Technology is a driving factor in sustainability advancements, enabling companies to monitor and improve their sustainability policies in real-time. Technology such as AI-powered analytics is making sustainability goals more achievable and measurable than ever. This digital transformation not only enhances accountability but also allows businesses to proactively adapt.

- 74% of public companies are planning to invest in sustainability reporting technology and tools over the next year to make the collection, analysis, and reporting of sustainability data more efficient and accurate (Impact).

- Only 10% of respondents currently use generative AI to analyze sustainability data, but 53% plan to do so in the future (Capital Group).

- In one report, investors with USD 25 trillion of assets were surveyed and 53% of global respondents said they were concerned about “poor quality or availability of sustainability data and analytics” (PWC).

- 81% of executives report sustainability documentation as one of their top three challenges (Impact).

Sustainability and brand reputation

Sustainability factors are critical to brand reputation, as stakeholders expect companies to actively uphold environmental, social, and governance standards. Brands with strong sustainability commitments gain public trust and loyalty, while those that fall short face increased scrutiny and reputational risks. This heightened focus on sustainability has transformed it into a foundational element of brand value, shaping how companies are perceived in a competitive marketplace.

- 33% of business leaders say sustainability efforts improve their company’s internal brand through employee commitment and retention (Vena).

- 76% of consumers would cease buying from firms that neglect environmental, employee, or community well-being (Key ESG).

- 74% of executives worry that failing to improve sustainability performance will negatively impact their brand’s standing in the market (Vena).

- 45% of employees want their companies to reveal environmental efforts, 41% of consumers want brands to be transparent about their sustainability actions, but only 36% of businesses disclose sustainability information (PWC).

As sustainability becomes increasingly embedded in the core of business strategy, it redefines competitive advantage and reshapes financial markets, regulatory landscapes, and corporate reputations worldwide. Beyond compliance, the adoption of sustainability policies signals a shift in corporate priorities, emphasizing long-term value, and societal impact. This creates an environment where businesses are not only judged on profits but on the contributions they make to society and the environment. Going forward, organizations that fully integrate sustainability policies into their operations will be well-positioned to navigate evolving expectations.