Three-statement modelling explained in three minutes

This content is taken directly from Intuition Know-How, the world’s premier digital learning solution for finance professionals.

The three-statement model is a cornerstone of investment banking and forms the basis for much of the research carried out by analysts right across the financial sector.

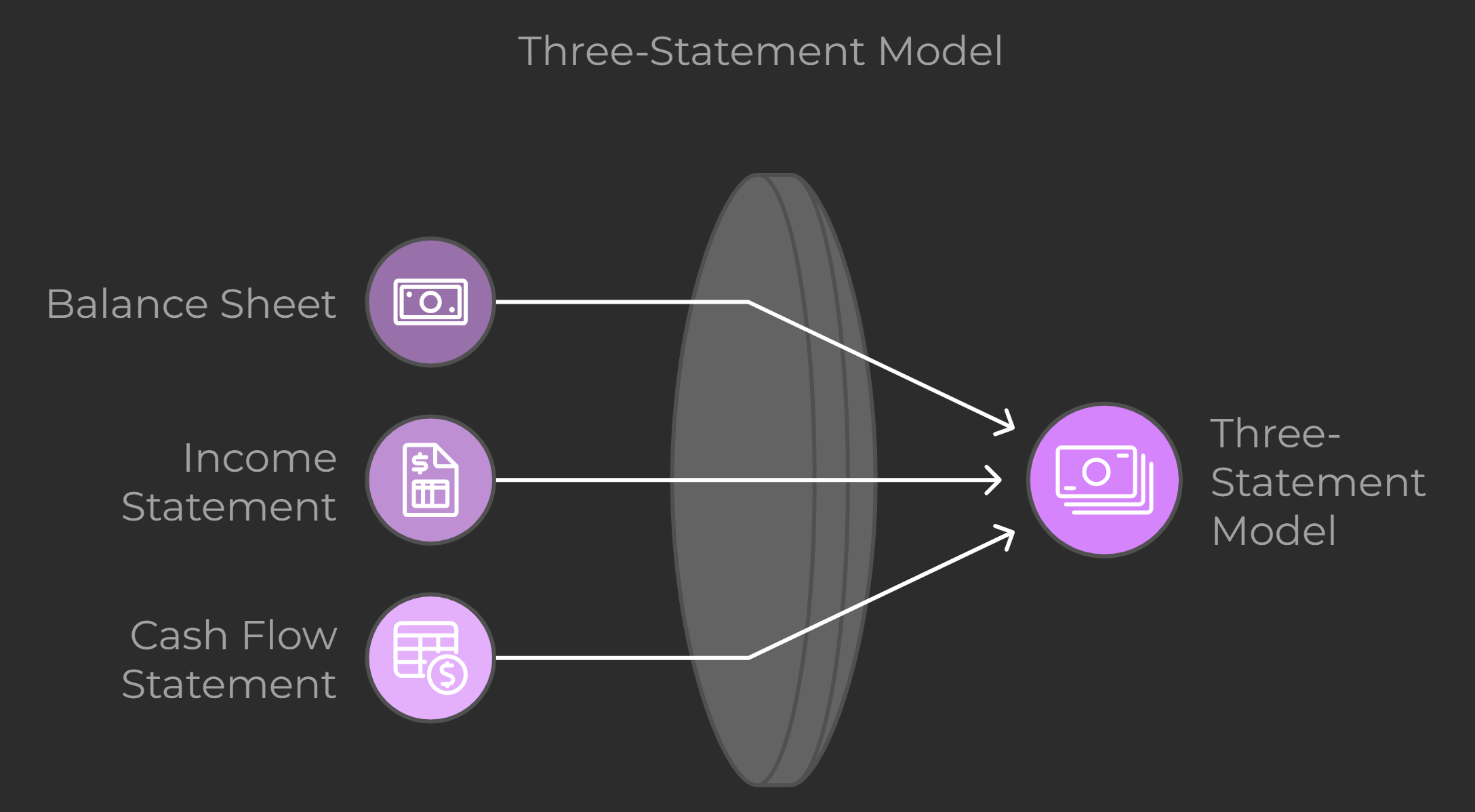

The model is a key forecasting tool for financial professionals – it uses the three financial statements for a company:

And shows how these statements will change in the future.

To generate forecast financial statements, analysts will input historical financial data, which is available from either the company’s filings or from management reports.

Using trends, metrics, market analysis, economic data and any relevant qualitative information, an analyst should be able to make reasonable and justifiable assumptions about what will happen to the company’s financial performance in the future.

A final crucial activity is scenario analysis, which is used to evaluate different potential outcomes for the company under alternative business scenarios and assumptions.

Excel is a highly useful tool for the analyst performing this task.

Steps in the three-statement model

There are several key steps involved in creating and building a three-statement financial model. The first stage is to define the objectives of the model. Questions that need to be asked are:

- What will this model be used for?

- What are the key outputs of the model?

- Who is the end user?

- What information is available?

Next, the analyst will need to decide the layout and format of the model, in particular:

- How many worksheets are needed

- Where the input assumptions will be presented

- What format the outputs will take

- Where any sensitivity analysis will be shown

After this, the analyst can input the historical data, such as the company’s income statement, balance sheet, and statement of cash flows, as well as information from management reports.

The next step is to forecast assumptions. Here, the analyst uses historical information to assess trends and patterns in the historical data to make predictions about what will happen in the future.

After this, the income statement can be forecast. However, the interest expense is not included as this depends on the debt number which is not available at this stage.

The next step is to forecast the balance sheet, excluding the cash and debt numbers which are not available at this stage.

At this point, the analyst will have a better idea of the company’s future position and can forecast the debt and interest numbers which are inserted into the balance sheet and income statement respectively.

In the next stage, the analyst can forecast the company’s future cash flow, linking the net cash used or generated each year to the balance sheet number.

The final stage is to calculate the required outputs and carry out sensitivity analysis on these outputs.

***

Intuition Know-How, the world’s premier digital learning solution for finance professionals, offers a comprehensive course on financial statement analysis. More details can be found below.

If you would like to learn more about this course, please fill in the form.

Accounting is the process of identifying, recording, and reporting financial information on a particular company to interested parties. The main way of communicating this information is through financial statements such as the balance sheet, income statement, and statement of cash flows statement. Information on all aspects of a company’s performance, liquidity, and financial position can be gleaned from these statements.

This course describes the basic principles of accounting and the structure and analysis of the main financial statements. Topics covered include:

- The importance of financial accounting information for internal and external stakeholders of a business

- The importance of the three-stage model in company financial analysis and the key steps in the model in generating forecast financial statements

- Analysis of the balance sheet, income statement, and statement of cash flows, including the use of ratios derived from these statements

- The structure and key elements of the three main financial statements

- The dual effect principle of accounting

- The role of accounting standard setters in developing high quality standards for financial reporting

- The key accounting concepts and conventions used in the preparation of financial statements

Learner Profile

The ability to correctly interpret and analyze financial statements is fundamental to everyday activities such as lending, investment management, and corporate finance. As such, this course is aimed primarily at those working in these areas and who are new to the subject of financial accounting and financial statement analysis. More experienced professionals looking to sharpen their skills or for a modern perspective should also find that the course has something to offer.

Browse full tutorial offering