FinTech’s evolution: Driving a changing financial landscape

One of the major consequences of the global financial crisis of 2007-09 was a series of systematic moves by regulators to loosen the vice-like grip that incumbent banks – largely courtesy of regulators themselves – had on virtually all aspects of the payments and broader financial services market.

In the years following the crisis, various measures, including landmark legislation such as the Payment Services Directives and the E-Money Directives in the EU, opened the door for new, technologically-driven organizations to grab a piece of a business that heretofore had been the exclusive preserve of licensed banks.

And so the FinTech sector was born and, for more than a decade, investment flooded into these new and innovative firms in the belief that a revolutionary transformation in banking and financial services was taking hold. The new entrants included digital-only neobanks who attempted to take on incumbent banks directly, as well as other more niche operators.

While many neobanks have struggled to emulate incumbent banks with a full-service digital offering, FinTech firms in general have adapted through flexibility in their strategic approach.

Many FinTechs came to recognize that replacing incumbent banks was unrealistic and instead chose to partner with these banks. They accomplished this by selling them access to their platforms and other services that they themselves are able to execute more efficiently through up-to-the-minute technology. Other FinTechs were routinely acquired by banks and plugged into their existing product and services offering.

The FinTech wave has generated a host of business models and terminology that have now entered into the mainstream.

Harnessing open banking

The EU’s Payment Services Directives, particularly PSD2, and the E-Money Directives were highly influential and, in some instances, emulated in other jurisdictions around the world.

A major development was the mandatory sharing of bank data (with customer consent) that gave FinTechs access to key customer information, particularly in relation to payments, through application programming interfaces (APIs).

For this reason, many early FinTechs targeted payments services and personal financial management (PFM) services. This phenomenon of data sharing is now referred to as “open banking” and, with regulators motivated to encourage it, the concept has spurred innovation across the industry.

Open banking led further to the development of new models such as banking-as-a-service (BaaS) and payments-as-a-service (PaaS) that allow nonbank entities to effectively white-label banking and payments services and integrate these into their own platforms and apps. Embedded banking, for instance, is the integration of banking services such as account servicing, payments services, and BNPL (buy now, pay later) into nonbank digital platforms.

FinTech financing slows down

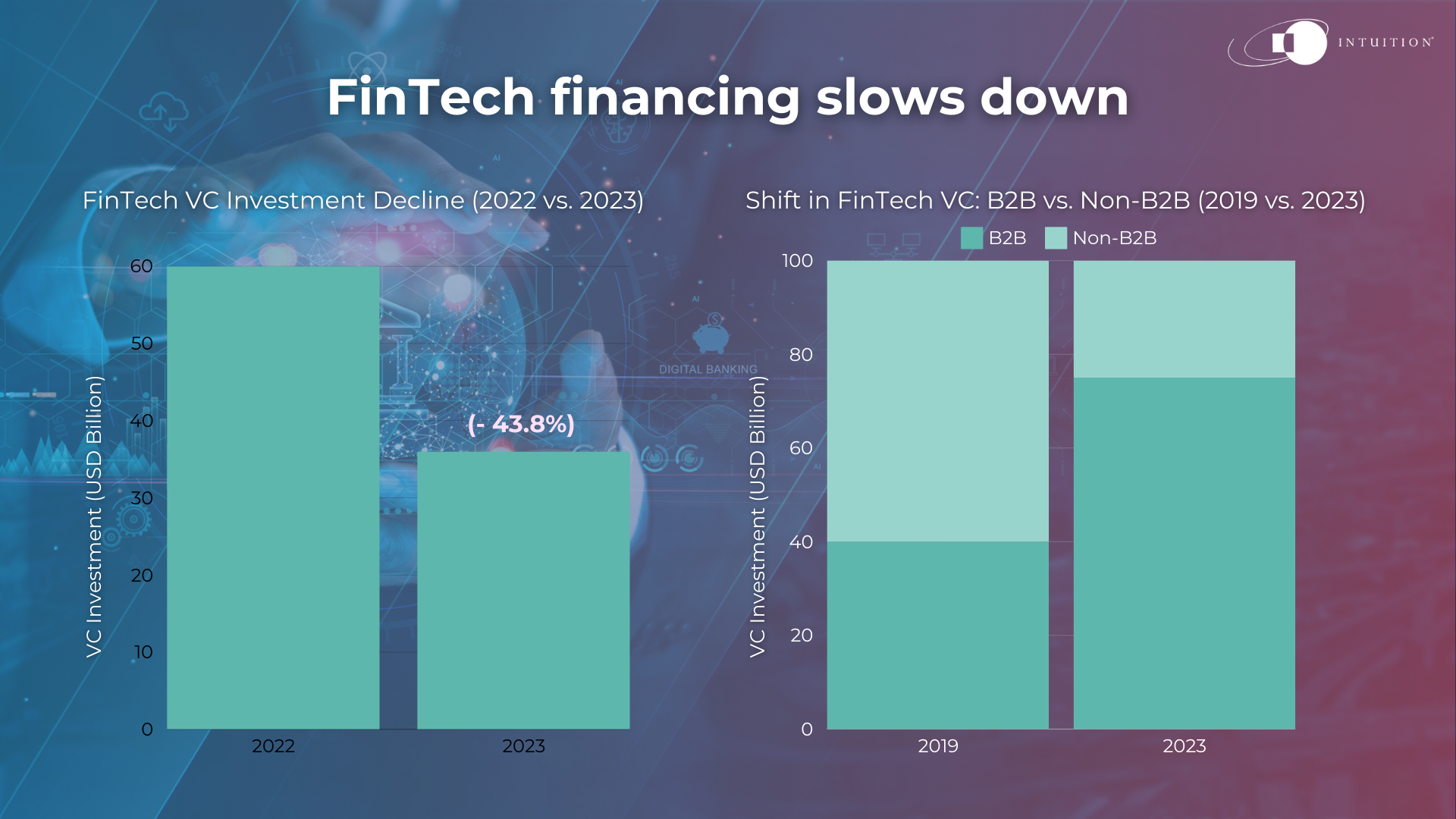

The FinTech investment boom era drew to a close with the upward turn of the interest rate cycle at the start of 2022. In 2023, some USD 34.6 billion of FinTech venture capital (VC) was recorded and this represented a -43.8% year-on-year decline, according to data from Pitchbook. The direction of capital skewed toward B2B (business-to-business), which accounted for around 72% of total FinTech VC in 2023, compared to just over 40% in 2019.

Sectors that received the most VC in 2023 included payments, alternative lending, capital markets, and credit and banking. Pitchbook identified several key trends within these subsegments, citing opportunities in generative AI, real-time payments, and open banking.

But while FinTech is facing some financing headwinds, the sector is far from dead. Indeed, more recent figures from Pitchbook show that retail FinTech VC deal values rebounded in Q2 this year (though this was primarily driven by larger deals announced in previous quarters that closed in Q2). Also in Q2, FinTech start-ups raised $4.5 billion across 168 deals, compared with $1.2 billion across 139 deals in Q1.

FinTechs become household names

While the FinTech sector may be finding life a little more difficult in terms of investment capital and valuation, there is no question that these entities continue to exert a major impact on the industry with many one-time upstarts rapidly becoming household names.

Klarna, for example, is a leader in the BNPL segment that has taken swaths of business that was formerly the preserve of bank-issued credit cards. It is about to offer its own checking account-like product and a cashback offering that rewards users for shopping via its app. Its stated intention is to “disrupt retail banking,” and the company is currently prepping for an IPO next year.

Meanwhile, Revolut, which began life as a remittances platform, has steadily increased the range of its offering beyond payments and now has plans to launch mortgage products.

Other firms, such as Square, have been pivotal in dramatically increasing the abilities of small businesses to accept digital payments from their customers.

At this stage, the FinTech revolution is practically unstoppable regardless of a less benign financing environment. Notably, these companies have raised customer expectations across the board and there is no going back to previous standards and technology when it comes to digital banking. The question for incumbent banks today is how far to invest in emulating these innovators through internal means or whether collaboration is the most efficient option.

Intuition Know-How has a number of tutorials relevant to the content of this article:

- Information Technology in Business

- IT Systems & Architecture

- APIs

- FinTech – An Introduction

- Digital Banking – An Introduction

- Open Banking & Open Finance

- BaaS & BaaP

- Embedded Finance

- PSD2 & Open Banking