Stage III and IV of the trade lifecycle: Clearing & settlement

After a trade is executed, there are a number of activities that must take place before the trade can be considered complete.

The purpose of these activities is to clear and settle the trade, and they must take place regardless of whether the trade was executed on:

- An exchange such as the New York Stock Exchange

- An OTC market such as the interest rate swap market

- Or an off-exchange market such as a dark pool

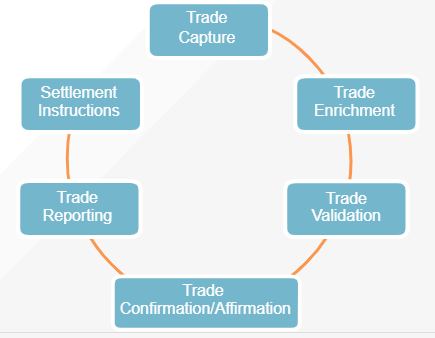

The first step in the process following trade execution is the booking and capture of the trade details by the front office, who then pass the details to the operations team for processing.

Operations enriches the trade with further details necessary for settlement, before performing trade validation checks to ensure that the gathered information is complete and accurate.

Once internal validation is complete, the trade details must be agreed with all participants in the trade.

Trade reporting is another vital step that must be completed, especially from a regulatory point of view.

When the trade has been captured, enriched, validated, agreed, and reported, the final step before settlement is the preparation of settlement instructions.

Once settlement instructions have been sent, the trade is in a position to be settled.

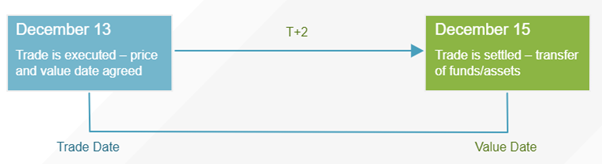

Trade dates versus value dates

When two counterparties agree to execute a trade, the transfer of funds (cash)/securities does not take place immediately. Instead, it takes place at some future point in time.

The date on which the trade is executed is known as the trade date, while the date on which settlement (the transfer of funds/securities) is scheduled to take place is known as the value date. For example, the value date may be scheduled two business days following the trade date. If so, the value date is referred to as T+2.

Clearing versus settlement

The term “settlement” refers to the completion of the agreed-upon transaction. Settlement is supposed to take place on the value date, but if a problem arises the actual settlement date may differ from the value date.

Before settlement can take place, the counterparties to a trade and their brokers/agents must determine and verify the exact details of the transaction and prepare for settlement. This process is known as “clearing” and requires careful:

- Recording of information related to the trade

- Validation of the trade information

- Confirmation of trade details

- Preparation of settlement instructions

Hence, clearing refers to activities that prepare a trade for settlement, and takes place post-trade execution and pre-trade settlement.

Trade clearing

Trade clearing refers to the activities that take place post-trade execution and pre-settlement.

Before settlement can take place, the counterparties to the trade and their agents must determine and verify the exact details of the transaction and prepare for settlement. The main steps involved are:

Trade capture

Once the front office executes a trade, it records data related to the trade – a process known as trade capture – and submits this as a “trade ticket” or “deal ticket” to the operations (back office) unit. Alternatively, trade details may be fed automatically from the electronic execution/trading platform into the trade capture system. Ultimately, the trade ticket will include all details related to the trade. Initially, however, the front office may only provide basic information such as security type and price.

Trade enrichment

The front office may submit just basic trade details. Operations then engage in trade enrichment, which is the process of applying additional information to a trade that is necessary for downstream processing.

Trade validation

Following enrichment, and before communicating with other entities in relation to a trade, it is prudent to perform a final check of the details. This process is known as trade validation and its purpose is to:

- Check whether the gathered information in relation to any trades is complete and accurate

- Implement protocols, known as exception handling, through which to address those trades that have been flagged as potentially problematic

The next step is to engage in a process to verify that the participants in the trade are in agreement with its terms, called trade confirmation.

Trade confirmation

Trade confirmation is the process through which trade details are verified and agreed between the direct participants to the trade. For example, an institution engages in trade confirmation when it verifies the terms of a trade with the counterparty with whom it has directly traded.

Trade affirmation

Trade affirmation is the process through which the trade details are verified and agreed between the direct and indirect participants to the trade. For example, an institution engages in trade affirmation when it verifies the terms of the trade with a fund manager client for whom it was acting when it executed the trade.

Trade reporting

Trade reporting refers to the reporting of transactions using an approved reporting mechanism. Reporting may take place automatically once a trade is executed on an exchange or may be a requirement that participants in the trade must satisfy.

Settlement instructions

Once a trade has been captured, enriched, validated, agreed, and reported, the final step before settlement is the preparation of settlement instructions.

Settlement instructions are instructions that are sent to the relevant clearinghouse or CCP stipulating how trade settlement should take place.

Trade settlement

Trade settlement refers to the completion of the agreed-upon transaction. Two methods through which settlement can take place are:

- Delivery versus payment (DVP)

- Free-of-payment (FOP)

Delivery-versus-payment (DVP)

DVP refers to settlement whereby securities are only delivered if payment is made and payment is only made if securities are delivered. In other words, the transfer of securities and payment for those securities occurs simultaneously.

Free-of-payment (FOP)

FOP refers to settlement whereby the delivery of the securities and payment of funds take place separately. It requires one or both counterparties to a trade to release securities/payment before confirmation of receipt.

DVP removes principal risk, while FOP does not. Principal risk is the risk that a party to a transaction that has fulfilled its obligations may not receive promised funds or securities from the counterparty. Because DVP removes principal risk, regulators recommend DVP settlement.