Understanding the Dynamics of Recession

Around the world, many economies are either in recession or heading toward one as a result of the inflation crisis and the associated policy response from monetary authorities. But what exactly is a “recession,” what happens during it, how long does it last, and how does it end?

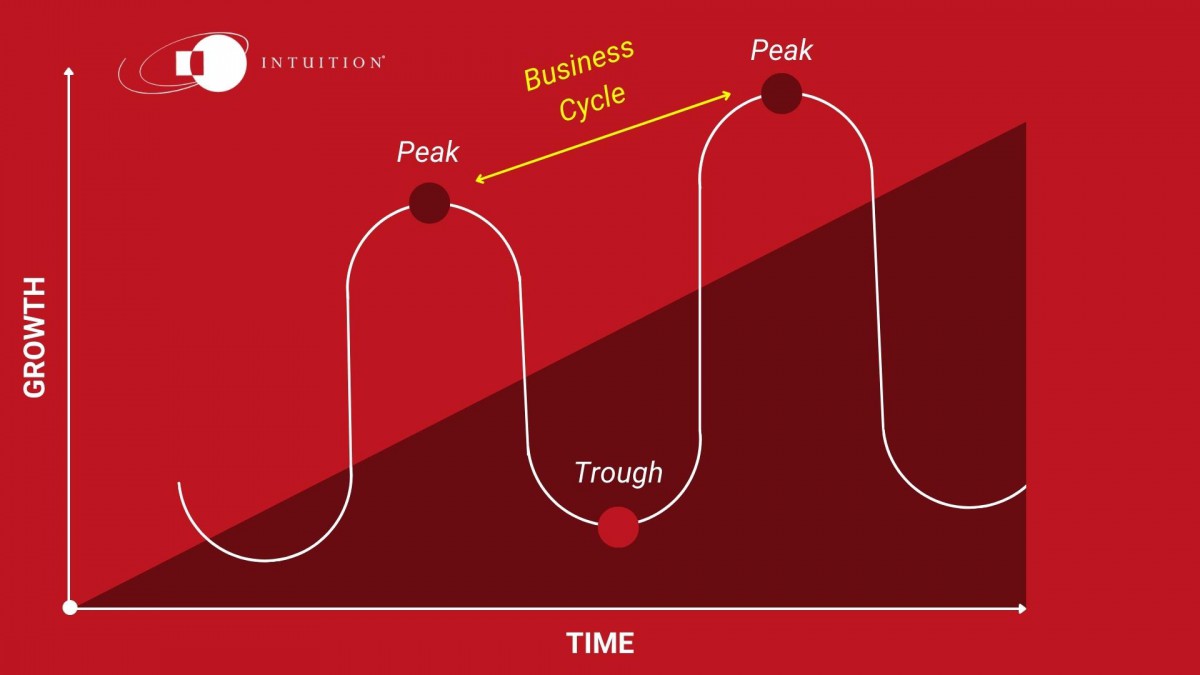

The trajectory of global economic growth is inevitably positive over the long term – driven by population growth and productivity improvements. But this is not a continuous phenomenon. The economy performs in cycles with periods of expansion and contraction. Where the contraction is sufficiently severe and prolonged, we have what is termed a recession.

Business Cycle

There is no universal definition of a recession but typically an economy is said to be in recession where it has seen two consecutive quarters of negative growth in real GDP.

Right now the word ‘recession’ is trending heavily in the financial media as the global economy struggles with the impact of central bank policies to curb inflation, principally through the raising of interest rates.

Features of a Recession

Definitions of recessions vary but every recession has its own individual features. So, while recessions (and subsequent recoveries) are often marked by certain typical dynamics, they are by no means uniform. Back in 1990, the recession that began that year was marked by high unemployment and the post recession period was notable for weak demand for labor – the so-called jobless recovery. The 2001 recession saw severe stock market declines, most spectacularly in the case of the bursting of the dotcom bubble. Recovery in the case of the 2008 global financial crisis (GFC) was long and slow and badly affected a depressed housing market. The pandemic recession of 2020 was a singular event that was particularly sharp and severe although recovery proved relatively swift.

Causes of Recession

And the causes of recessions are similarly diverse, although they can be divided roughly into demand-side and supply-related factors.

Demand-side economists believe that short-term changes in demand can affect the supply of goods and services. Negative economic sentiment may cause people to save rather than spend. A decline in home prices may cause people to feel less wealthy, leading to a reduction in spending which causes demand to fall. This has a knock-on effect on companies who will sell less, causing them to lower production and cut jobs. This reduces household income, which further lowers demand, resulting in a recession.

Recessions may also be caused by short-term supply problems. For example, a rise in the cost of oil raises companies’ costs and discourages production as margins suffer. This again means job cuts and less money for suppliers. In turn, income in the economy is reduced which reduces overall demand, leading to a recession.

Recessions and Asset Prices

The prospect and reality of a recession also has major implications for asset prices, notably equities. In general, slowdowns and recessions depress asset prices but the effect is not spread equally. Some sectors are more sensitive to economic conditions than others. Those that respond to the different phases of the economic cycle are known as cyclical stocks, sectors such as consumer discretionary, while the stocks that are less affected by the cycle are known as defensive stocks, sectors such as consumer staples and utilities. The performance of defensive stocks will respond less to changes in the cycle and therefore are preferred in a recessionary phase.

Recession and Central Bank Policy

The current momentum toward recession has several causes but the great accelerator has been central bank policies to combat a surge in inflation worldwide. Put simply, central banks are looking to reduce overall demand and hence they have increased interest rates rapidly from what were historically low levels – so-called interest rate normalization. This causes credit to contract and puts pressure on company margins, leading to increased business failures and an even greater slowdown in the economy.

The effects of this policy have been compounded by the ending of the era of quantitative easing (QE) where central banks worldwide in the aftermath of the GFC engaged in massive purchases of securities to increase the money supply, keep interest rates low, and stave off recession.

While inflation is the notable factor in the current recessionary phase, it has less in common with other high-inflation recessions such as those post-World War II and the Korean War recession in 1953. It has more in common with the stagflation recession of 1981 – stagflation being the phenomenon of economic contraction combined with high inflation.

This poses particular problems for policymakers as they struggle to contain inflation while understanding that measures in that regard may well deepen the recessionary trend.

The worst of all possible scenarios arises when monetary and interest rate policy comes into conflict with fiscal policy. This is the scenario that played out in October 2022 when the UK government announced a raft of unfunded tax cuts – a measure that directly contradicted the Bank of England’s anti-inflation program of quantitative tightening (QT) and interest rate hikes. The effect was to undermine market confidence in the UK Exchequer, which placed immediate pressure on sterling.

This fall in the value of sterling would normally exacerbate inflationary pressures by making imported goods more expensive, and so the BoE was forced to accelerate its rate-hiking, in turn increasing recessionary fears.

Now that economies around the world begin to tip into the recessionary phase, the question is how long this phase can be expected to last? Every recession is different but, according to the US National Bureau of Economic Research (NBER), the average U.S. recession lasted about 17 months in the period from 1854 to 2020. Post-World War II, from 1945 to 2020, the average recession lasted about 10 months.

At that point all eyes will be on indicators of recovery, when a return to positive growth, looser monetary policies, increased production and company profits will announce the end of the recession.