The Future is “Fintegration”: FinTechs & Traditional Firms Are Joining Forces

The line between FinTech firms and traditional financial institutions is blurring as the latter embrace new technology. Partnerships and mergers between traditional institutions and FinTech startups are increasingly common, and many incumbent firms are licensing and adopting the tools developed by innovators. As more institutions integrate artificial intelligence (AI), blockchain, and other technologies into their digital operations, the financial firms of the future will increasingly be a hybrid of the old and the new.

Financial technology (FinTech) firms have had a dramatic impact on the financial landscape. New competitors in trading and brokerage, financial planning, payments, and other areas have introduced novel products and processes, challenging traditional firms to make their services more convenient, cost-effective, and user-friendly. Despite their initial promise, however, many FinTech firms have struggled to capture meaningful market share.

Consider, for example, financial planning. When robo-advisors – software programs that provide personalized wealth management services to users through a digital interface – launched in 2008, they sent a shudder through the industry. By 2016, KPMG was predicting that robo-advisors would have assets under management (AUM) of over $2 trillion by 2020.

However, the anticipated robo-advisor boom failed to materialize. By 2020, Backend Benchmarking estimated that robo-advisors’ global AUM was only $630 billion, a tiny fraction of the global total and far short of expectations.

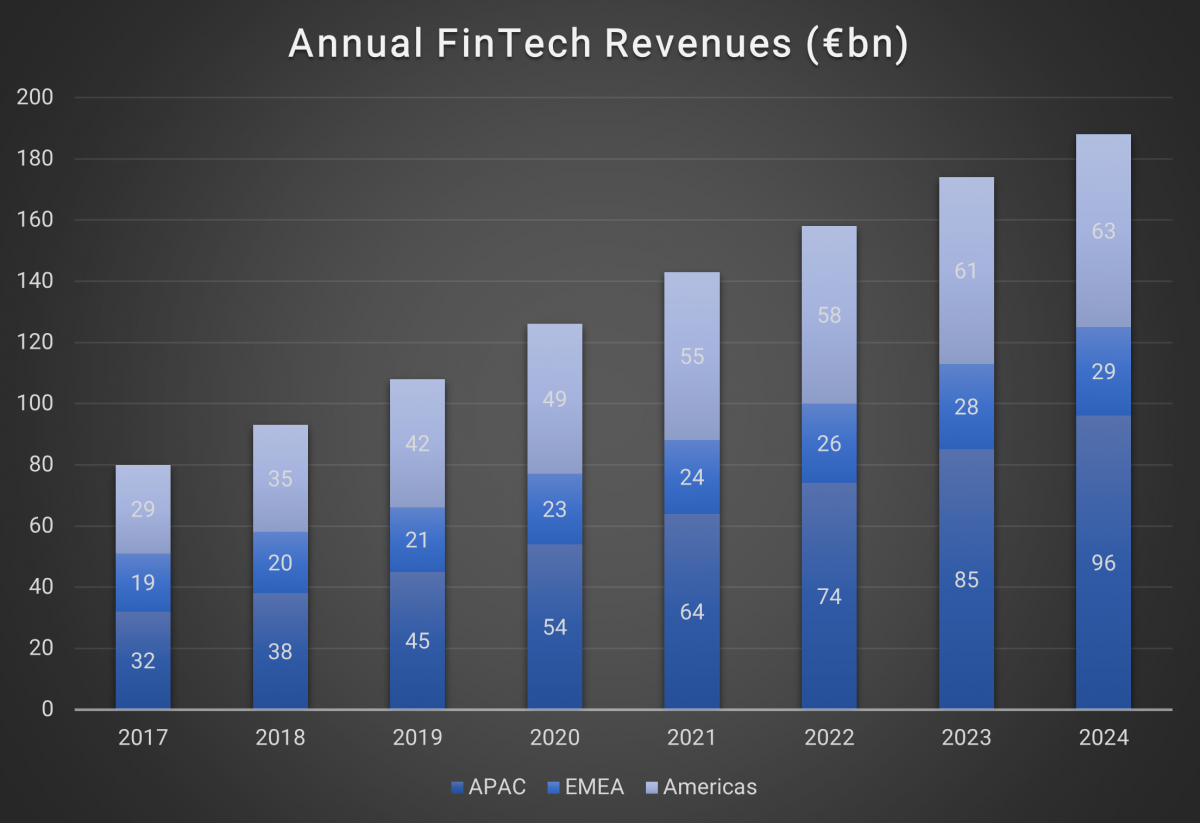

This example illustrates a common theme among FinTech firms – while they develop appealing products and generate rapid growth (see chart below), they often fail to capture as much of the market as anticipated.

Deloitte. FinTech: On The Brink Of Further Disruption. December 2020. Actual figures up to 2018, subsequent figures are projections based on data from Mordor Intelligence.

The reasons for this can be complex, but one core factor is the response of incumbents.

Incumbent wealth management firms, for example, hurried to streamline their operations, lower costs, and improve their digital footprint in a bid to stave off the competition from robo-advisors. Many of them built their own robo-advisors or licensed the technology for use within their existing operations as a support to their human advisory workforce.

These actions helped improve traditional firms’ offerings and – combined with consumers’ reluctance to switch providers and strong preference for established and trusted financial firms – meant that incumbents were able to retain and grow their market share despite the entrance of new robo competitors.

A similar pattern has repeated itself in other industries, such as brokerage where incumbents have responded to no-fee trading apps like Robinhood by adjusting their pricing and providing user-friendly apps.

Integration not competition

All this points the way to the likely future of finance – “fintegration” or the integration of FinTech firms and their technologies into the day-to-day operations and businesses of traditional firms.

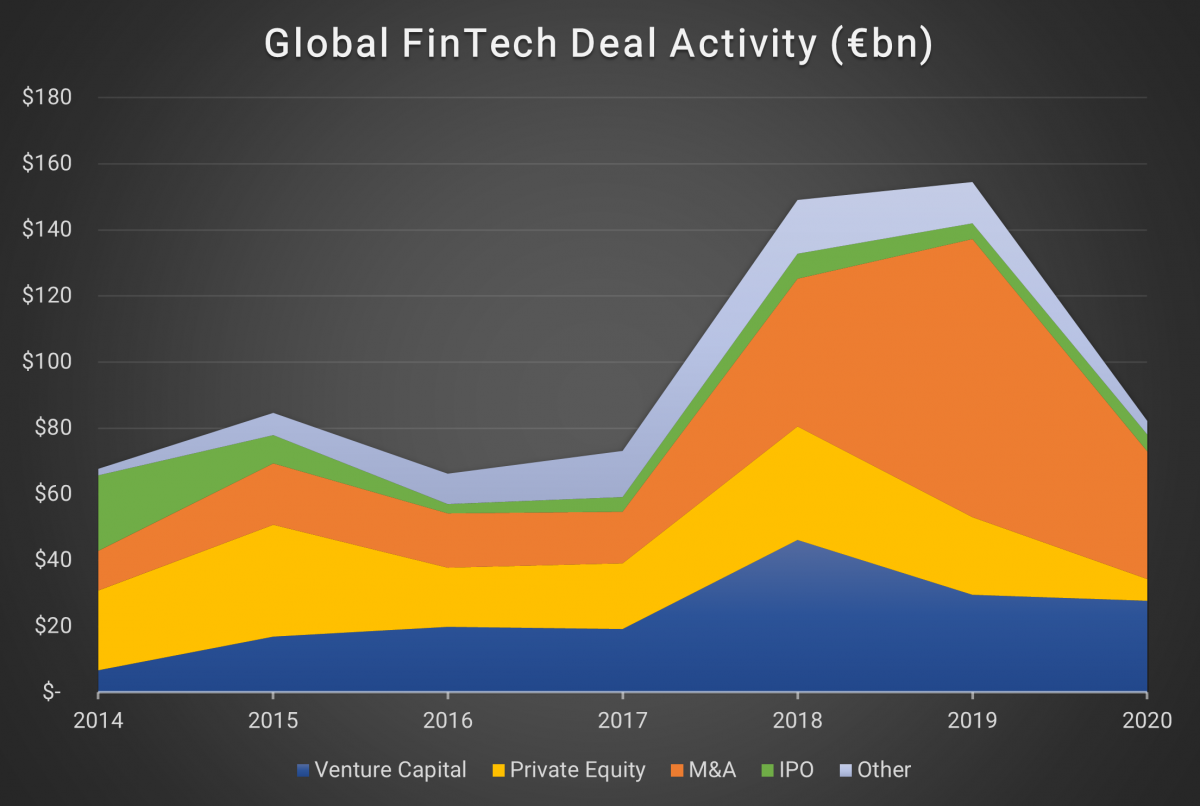

A growing range of technologies incubated and developed by outsider FinTech startups – from blockchain to artificial intelligence (AI) – are being adopted and used by traditional financial institutions. At the same time, deal activity is rising as these firms selectively acquire or join forces with FinTech firms whose technologies complement their core business (although 2020 saw a dip in activity in the face of the global pandemic).

Deloitte. FinTech: On The Brink Of Further Disruption. December 2020. 2020 data as of Q3.

In the future, then, the distinction between staid traditional firms and innovative FinTech startups may vanish as the financial industry moves toward the full and deep integration of technology in all its various operations.

Intuition Know-How has a number of tutorials that are relevant to FinTech:

- Blockchain – Primer

- Crypto Assets

- AI & Machine Learning (ML) – Primer

- AI Applications – RPA in Trade Processing

- AI Applications – Internet of Things (IoT)

- AI Applications – Robo-Advice

- AI Applications – Credit Risk

- AI Applications – Fraud & Compliance

- AI Applications – Wealth & Asset Management

- Payments – An Introduction

- PSD2 & Open Banking

- Digital Money & Mobile Payments