How the energy transition is reshaping finance

We are experiencing an era of change, a shift in our energy production and consumption patterns. This shift, commonly referred to as the energy transition, represents a move from fossil fuels toward renewable energy sources. It is a global phenomenon driven by climate change concerns, technological advancements, and policy changes. The energy transition is redefining not just the energy industry but various other sectors too.

The energy transition holds considerable implications for the finance sector. As the global energy sector undergoes this transformation, it is influencing investment strategies, risk management, lending patterns, asset valuation, and more. The finance sector, with its pivotal role in the economy, is at the heart of this metamorphosis.

In this article, we explore the impacts of the energy transition on the finance sector and how finance professionals are adapting to these changes.

Understanding the implications of the energy transition for the finance sector

The energy transition is not merely a change in the energy mix; it is a structural transformation with profound implications for the finance sector. Financial institutions are recognizing the risks and opportunities that this transition brings. They are increasingly conscious of the environmental and social risks associated with their financial activities, particularly those tied to fossil fuels.

Conversely, the energy transition is also unveiling a plethora of investment opportunities in renewable energy, energy efficiency, and other clean technologies. It is driving financial innovation, leading to new financial products and services that cater to the needs of the green economy.

Moreover, the energy transition is reshaping regulatory frameworks. Central banks, financial regulators, and standard-setting bodies are integrating climate change considerations into their mandates. They are developing sustainability standards, disclosure requirements, and stress testing frameworks that account for climate-related financial risks.

[The impact of the energy transition on finance professionals]

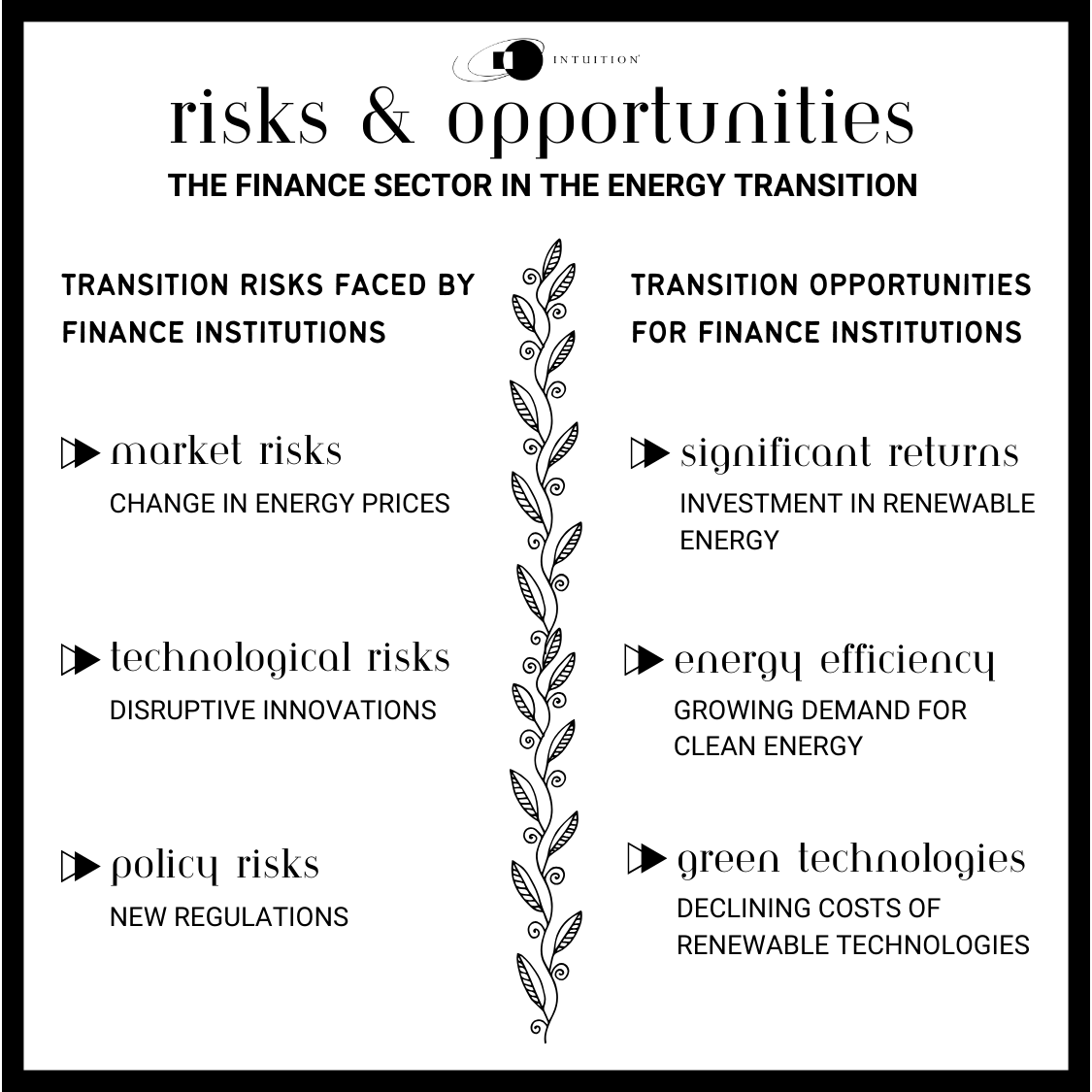

Risks and opportunities

The energy transition is a double-edged sword for the finance sector, presenting both risks and opportunities. On the one hand, financial institutions face substantial transition risks. These include market risks due to changes in energy prices, technology risks from disruptive innovations, and policy risks from new regulations.

On the other hand, the energy transition also offers considerable opportunities for investment in renewable energy, energy efficiency, and other green technologies. These investments can generate significant returns, particularly given the growing demand for clean energy and the declining costs of renewable technologies.

Furthermore, the energy transition is opening up new avenues for financial innovation. Green bonds, climate-themed funds, sustainable loans, and other green financial products are gaining traction. These instruments are not only profitable but also help financial institutions meet their sustainability targets and enhance their reputation.

[Energy transition: How finance professionals can overcome challenges]

The impact of the energy transition on major finance sectors

The energy transition is leaving its mark on various segments of the finance sector. Take, for instance, the banking sector. Banks are reassessing their lending policies to account for the risks associated with fossil fuel investments. They are also exploring opportunities in green lending and renewable energy financing.

The insurance industry is another case in point. Insurers are factoring in the risks of climate change and the energy transition into their underwriting and pricing decisions. They are also developing innovative insurance solutions for renewable energy projects.

Moreover, the asset management industry is experiencing a surge in demand for sustainable investments. Asset managers are incorporating environmental, social, and governance (ESG) factors into their investment decisions. They are launching green funds and other sustainable investment products to cater to this demand.

How financial institutions are adapting

Financial institutions are not just passive observers of the energy transition; they are active participants. They are adapting to this transition in several ways. Firstly, they are integrating climate risks into their risk management frameworks. They are conducting scenario analyses and stress tests to assess their exposure to these risks.

Secondly, financial institutions are seizing the investment opportunities that the energy transition presents. They are increasing their investments in renewable energy, energy efficiency, and other green technologies. They are also developing new financial products and services that cater to the green economy.

Thirdly, financial institutions are enhancing their sustainability disclosures. They are providing more detailed and consistent information about their climate-related financial risks and their contribution to the energy transition.

Investment trends

The energy transition is influencing investment trends in the finance sector. There is a growing appetite for sustainable investments. Investors are increasingly factoring in ESG considerations into their investment decisions. They are investing in green bonds, climate-themed funds, and other sustainable assets.

Moreover, investors are divesting from fossil fuels and investing in renewable energy. They are recognizing the financial and reputational risks associated with fossil fuel investments.

Additionally, impact investing is on the rise. Investors are seeking investments that not only generate financial returns but also have a positive social or environmental impact. This trend is particularly evident in the energy sector, where investments in renewable energy and energy efficiency can contribute to climate change mitigation.

The role of green finance

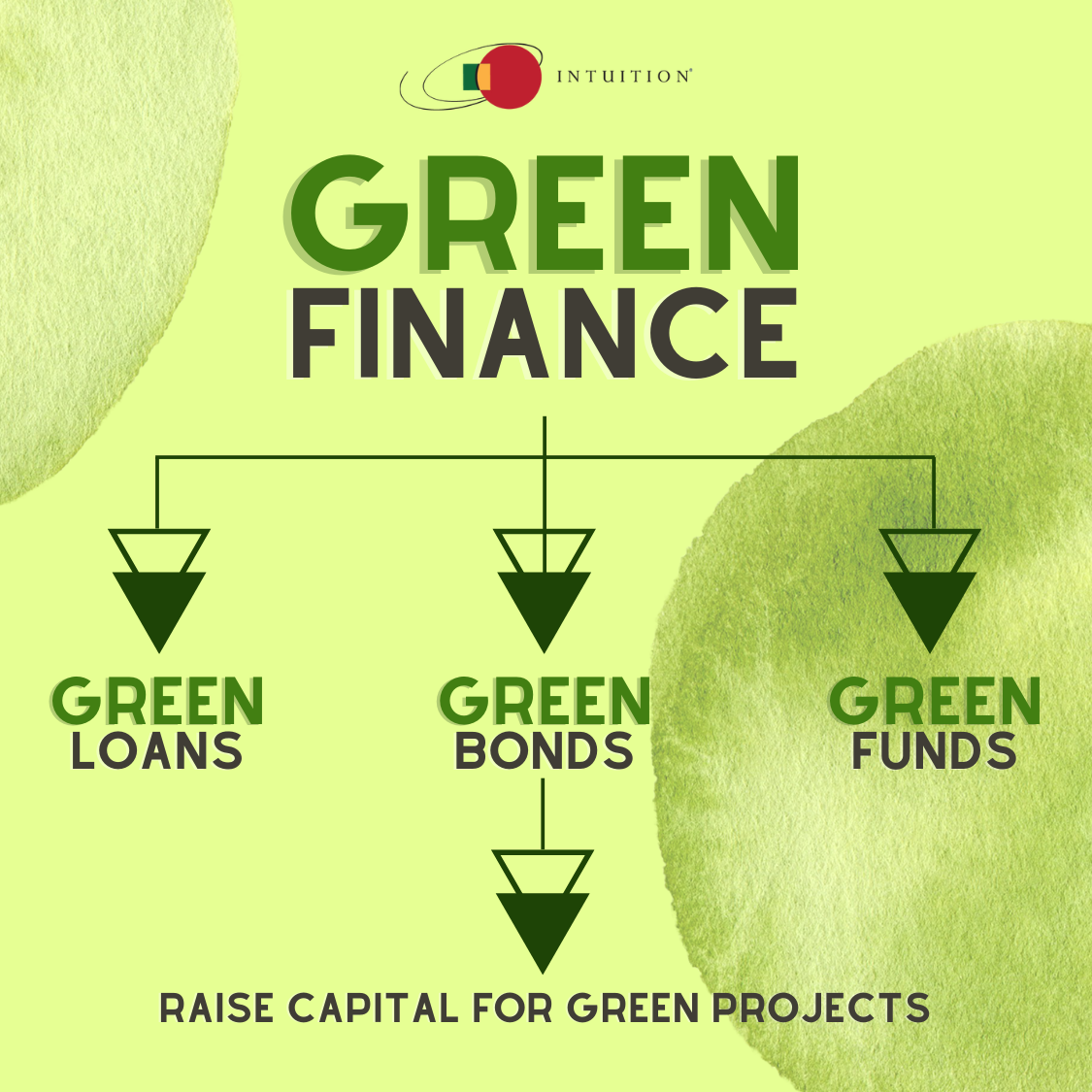

Green finance is playing a pivotal role in the energy transition. It is mobilizing the financial resources needed for this transition. Green finance encompasses a range of financial instruments, including green bonds, green loans, and green funds.

Green bonds, in particular, have seen exponential growth. They are a popular tool for raising capital for green projects, including renewable energy projects, energy efficiency projects, and green buildings.

Moreover, green finance is promoting transparency in the finance sector. It is encouraging financial institutions to disclose their environmental impact and their contribution to the energy transition.

Future predictions

Looking ahead, the energy transition is set to continue reshaping the finance sector. Climate change considerations will become an integral part of financial decision-making. Financial institutions will increasingly incorporate climate risks into their risk management frameworks and investment strategies.

Green finance will gain further momentum. The demand for green financial products and services will grow, driven by investors’ growing awareness of climate change and their desire for sustainable investments.

Moreover, regulatory pressure will intensify. Financial regulators will tighten sustainability standards and disclosure requirements. They will also promote stress testing for climate-related financial risks.

Strategies for financial professionals

As a financial professional, how can you navigate the energy transition? Firstly, educate yourself about the energy transition and its implications for the finance sector. Understand the potential risks and opportunities associated with the transition.

Secondly, integrate climate change considerations into your financial decisions. Assess the climate risks of your investments and loans. Explore the investment opportunities in renewable energy, energy efficiency, and other green technologies.

Thirdly, enhance your sustainability disclosures. Provide clear and consistent information about your climate-related financial risks and your contribution to the energy transition.

Conclusion: Embracing the changes in the finance sector due to the energy transition

The energy transition is a transformative process that is reshaping the finance sector. It presents both risks and opportunities. It is driving financial innovation and regulatory change. As finance professionals, we need to understand these changes and adapt accordingly.

Embracing the energy transition is not just about mitigating risks; it is about seizing opportunities. It is about contributing to a sustainable future and creating value for our stakeholders. It is time to embrace the changes in the finance sector due to the energy transition and use our financial expertise to facilitate this transition and build a greener economy.